A broker/dealer, in the traditional sense, is a regulated entity that trades securities on behalf of customers and for its own accounts. But, that regulatory definition increasingly is not a reflection of the business of investments and financial advice as it happens in the real world.

As the nature of what advisors do has evolved, IBDs have evolved as well, with many creating new affiliation models beyond the traditional brokerage business and following advisors into the rapidly growing fee-only registered investment advisor space.

They have to. Financially, the percentage of a traditional registered rep’s production from commission-based products that goes to the firm is on the decline, and as older clients begin to pull money from those accounts in retirement, that trend will only accelerate.

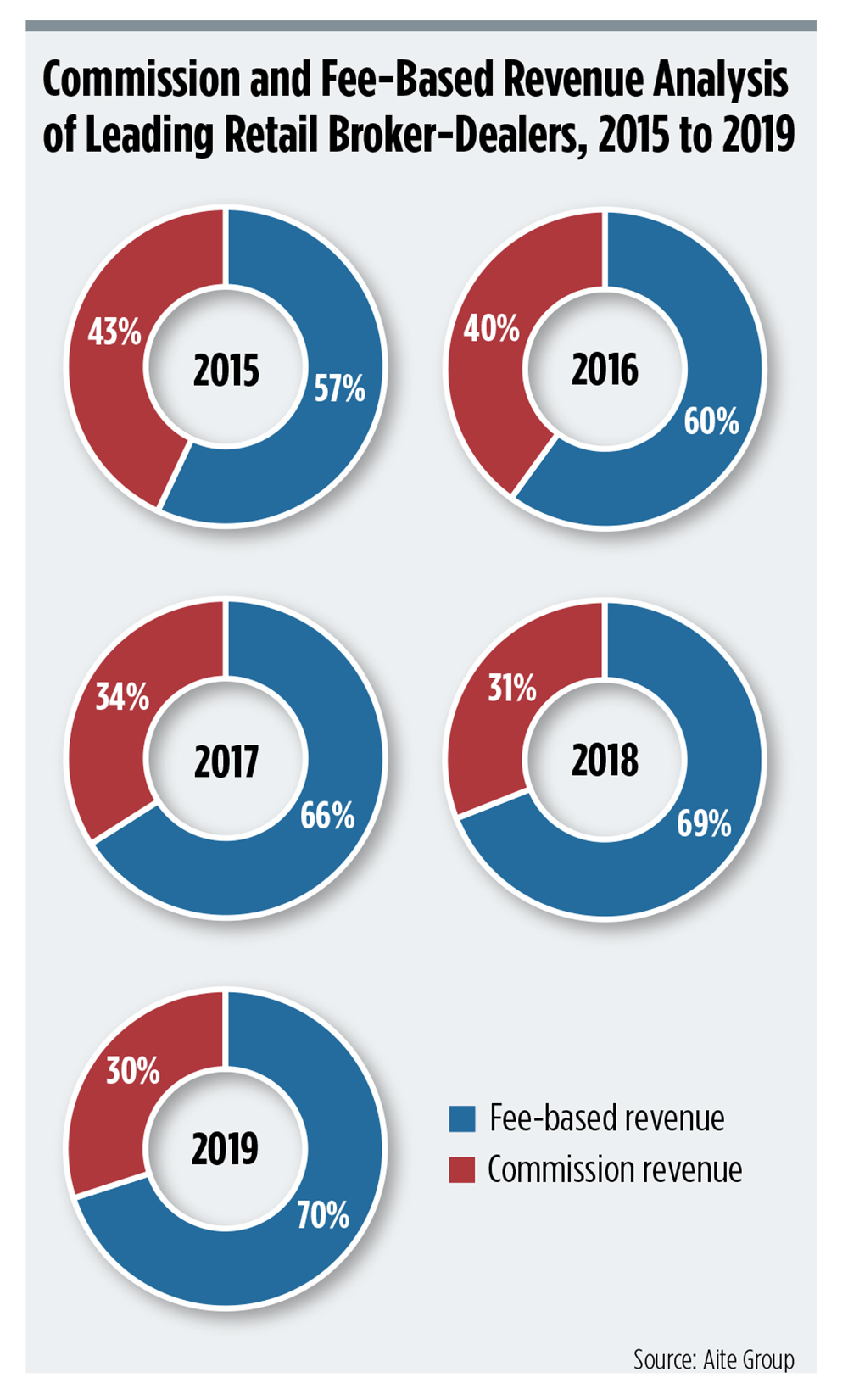

Industry assets continue to shift toward advisory. The share of fee-based revenue at leading retail broker/dealers has grown from 57% in 2015 to 70% in 2019, according to an Aite Group report. Commission-based revenue accounted for just 30% as of 2019.

Even at the wirehouses, fee-based assets are growing at a fast pace. At Merrill Lynch, fee-based assets surpassed the 50% mark of total client assets for the first time in 2019, the highest of any wirehouse firm, according to Aite.

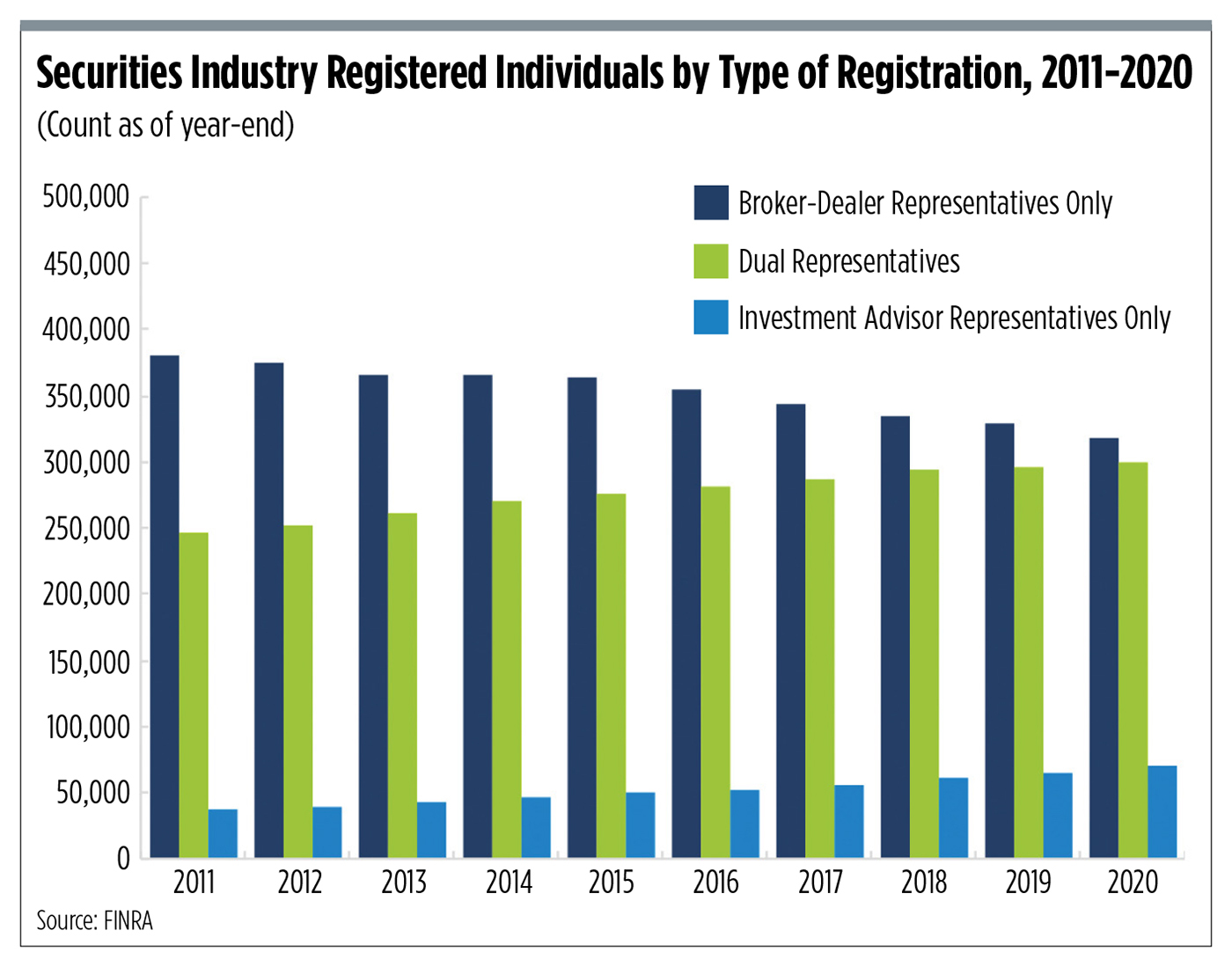

The number of dual registrants—FINRA-registered reps who are also investment advisor representatives of RIAs—has steadily risen since 2008, according to FINRA data. At year-end 2020, there were 299,613 dual registrants, up from 295,677 at the end of 2019. Meanwhile, the number of broker/dealer-only representatives is on the decline.

Add to that a shrinking overall pool of advisors—a 2020 report by Cerulli Associates estimates that more than one-third of advisors will retire in the next decade—which leaves a gaping hole in the market for advisors and competition among firms that service them.

“The market’s consolidating, so they become a valuable commodity,” says Dennis Gallant, senior analyst at Aite Group. “That brokerage mentality underestimated the opportunity in advisory and the growth of the advisory side of the business, and that’s transformed all these firms.”

Some think this could signal the end of the traditional IBD business model, leaving the firms to find ways to map their operations to changing demand, or slowly drift off into irrelevance.

“I think it’s the end of the independent broker/dealer,” says Tim Welsh, president, CEO and founder of Nexus Strategy. “They are turning themselves into technology and service/support platforms. Commissions are going to zero, and they’re not going to go up. They know their revenues need to change, just like the advisors need to change.”

“And Schwab and Fidelity have been eating their lunch for the last 30 years—taking their advisors, taking their business.”

As Advisors Evolve, So Do Firms

LPL Financial, the largest IBD in the nation, has been front and center in adapting to the trends.

While LPL has custodied assets for RIAs since 2008, it was largely to support the fledgling hybrid advisory business of its registered reps. But the firm recently unveiled its pure-play custodial service for fee-only RIAs.

Rich Steinmeier, managing director, divisional president, business development at LPL, says the firm started looking more intentionally at serving fee-only RIAs after hearing from a number of LPL advisors who dropped their FINRA licenses.

“Their refrain was, ‘Man, we really love working with you, but some of the things that you do today are probably not aligned with the evolution of how a custodian should support us,’” he says.

The idea behind LPL’s pure-play custody strategy is to offer RIAs a more high-touch, “white-glove approach,” the firm says, bringing back what the custodian used to be a decade ago.

And for the first time, the firm will support advisors on LPL’s own corporate RIA who don’t have any brokerage affiliation, says Marc Cohen, executive vice president of advisor business at LPL. The firm opened that option up to give advisors more flexibility in how they want to affiliate and allow fee-only advisors to outsource their risk management and compliance to LPL.

In April 2020, LPL launched its premium affiliation model, Strategic Wealth Services, for advisors coming out of wirehouse and regional firms, aimed at taking some of the more entrepreneurial tasks involved in starting and running a practice off advisors’ shoulders. That model was initially launched under the corporate RIA, but Steinmeier says he expects the firm to eventually make it available to advisors who are running their own RIAs.

LPL also announced its first foray into the W-2 affiliation model when it closed on its acquisition of Allen & Co., a Lakeland, Fla.–based broker/dealer and RIA with 30 advisors and $3 billion in assets under management, in 2019. Since then, the firm has been building out the business channel and in August officially made it available to the market with the opening of an office space in Boston.

“We had a number of advisors saying, ‘I love independence; I love running my own practice. I love having this freedom, but I’d like to not have the obligation of trying to figure out payroll and not trying to figure out take-down space,” Steinmeier says. “And my staff, I want to manage the staff, but I don’t want to have the responsibility from a human capital perspective.”

Raymond James has long had different affiliation models, what it calls “AdvisorChoice.” Advisors can join as a traditional employee under Raymond James & Associates, an employee under Alex. Brown, an independent employee, an independent contractor under Raymond James Financial Services, an independent RIA under its custodian or a bank and credit union advisor.

The firm has been building out its services for fee-only RIAs, recently combining its Investment Advisors Division and Custody & Clearing Division into the new RIA & Custody Services Division. In 2019, the firm brought on Greg Bruce, who spent 21 years at Schwab, to lead that division and build out a full-service custodial offering.

“We expect all our affiliation options to see growth, but given changes that are occurring in the profession, with a higher percentage of advisors electing to be fee-only and moving to an independent RIA, given some of the growth in some of these RIA consolidator organizations, we thought it was wise to make sure we enhanced our offerings in this space, supporting the independent RIAs, so that we can be more competitive than we have been historically,” says Scott Curtis, president of Raymond James’ private client group. “So as much as we had an offering historically, we weren’t as competitive in terms of our capabilities, the resources, the professionals who are part of the division—now under Greg’s leadership.”

Bruce says Raymond James is different from other custodians because it offers the type of services, like bank and trust services, investment banking and capital markets opportunities, that those advisors are used to having at their old firms.

“A lot of competitors have connectivity to those types of offerings, but that would involve separate contracts, new pricing schedules and a technology interface,” Bruce says. “We can create a more seamless experience.”

Additionally, the firm does not have a retail advice offering competing with advisors.

Wells Fargo also has expanded its affiliation options over the years, and today that includes its traditional wirehouse model, independent broker/dealer, digital direct channel, Private Bank, retail bank branches and clearing business.

In early 2019, the bank announced it would begin providing custody services to fee-only RIAs under its First Clearing subsidiary, led by John Peluso. The firm partnered with TradePMR to provide middle-office support to independent RIAs that choose the custodial service.

That channel now has 21 RIAs and over $8 billion in client assets, Peluso says. So far, all those RIAs have joined internally from Wells Fargo Advisors, but the firm is actively recruiting externally.

The firm is making all the capabilities and services within Wells Fargo available to the RIAs on the platform, including banking services, lending, the trust platform, advice and planning services, and its investment solutions.

Commonwealth Financial Network, another traditional IBD, has been supporting fee-only advisors since 2013. In 2018, the firm created a dedicated RIA servicing group, and later hired Matthew Chisholm, former head of practice management and consulting at Fidelity, to lead its newly combined RIA services and practice management unit.

Chisholm says the firm now has about 70 fee-only firms operating either their own RIAs or Commonwealth’s corporate RIA. It custodies with Fidelity, and about 70% of the firm’s total assets are fee-based.

Chisholm is working on building out the firm’s Business Consulting Services across the IBD’s affiliations, providing a so-called “soft landing” for employee advisors as they transition into owning and running a business as an independent.

The firm also has a more-formalized succession planning and M&A capability, where advisors can get access to capital to use for succession or growth through acquisitions.

LPL's Rich Steinmeier

“As we continue to come to market with some of these more enhanced services, as well as some of these liquidity options, we definitely expect to see more demand,” Chisholm says. “We’re not necessarily expecting to land billion-dollar RIAs by any stretch, but there’s a lot of disruption in the market. We certainly think that there’s an opportunity there for an advisor at the right point in their career and their trajectory that would benefit from the scale and support of a Commonwealth, but also has a well-established RIA that they can continue to either invest in and/or get network value out of by being affiliated with us.”

He says Commonwealth considered an employee model and that there’s appetite among older advisors looking for an exit strategy and a longer-term retirement plan. But the firm is not at that point yet; many of its affiliated advisor firms have captive W-2 models, so advisors have the option to tuck into those. “If a W-2 model has enough demand for it, we certainly will respond to it appropriately.”

Other IBDs also have expanded their affiliation models, including Kestra, which launched Kestra Private Wealth, a division that helps wirehouse advisors go independent, a couple years ago.

In 2019, Cetera Financial acquired the assets of Foresters Financial’s brokerage and advisory business, which has seeded the firm’s employee channel. The firm also has an RIA-only capability.

Thrivent Financial, the Midwest-based not-for-profit financial services organization, branched out from its legacy insurance broker/dealer to launch a hybrid independent advisor platform in late 2019: Thrivent Advisor Network, which is growing and attracting top talent from the industry.

This is by no means a comprehensive look at new affiliation models. In fact, there are firms outside of the IBD construct that are getting innovative with their offerings.

Is This the Death of the IBD?

Many IBD executives agree that “IBD” is an antiquated term that no longer describes their business model.

“That moniker of IBD was one that we wore with pride for north of two decades, and I think it was one that really was relevant and worked,” LPL’s Steinmeier says. “As we looked at the evolution of the marketplace, what we saw was advisors starting to really run practices that expanded beyond just us being able to serve them as an IBD and a hybrid.”

“The lines continue to blur between the traditional channels of wirehouse versus IBD versus RIA,” Commonwealth’s Chisholm says. “We’re basically a national RIA on many measures. I think tech platforms, it’s all just in my mind kind of what I think of as the independent advisory platforms or the independent advisory channel. And so that I think is a better descriptor of what we’re doing and who we are in the marketplace.”

At the same time, he doesn’t see commission products going away completely; these products are so entrenched in many advisors’ books of business, and the compensation model does make sense for a large number of existing clients’ portfolios. The growth of fee-based products that were traditionally available only on a commission basis—annuities and the like—will accelerate the decline of commissions.

“Nonetheless, unless there’s a regulatory change in the framework, I don’t see how it can be abandoned altogether,” he says.

That trailing 12-month commission revenue still accounts for a significant amount of broker/dealers’ revenues, and these firms are by no means encouraging reps to give up their securities licenses, says Larry Roth, founder and managing partner of RLR Strategic Partners.

“If I’m affiliated with LPL, as an example, and I have $100,000 a year in trails, LPL is processing those commissions, paying me—call it 90%, they’re keeping 10%. In the aggregate, that’s a lot of money in terms of revenue, so they’re not going to want to throw that away,” Roth says. “But what’ll happen is, same thing that happens now when advisors retire. Smaller accounts, traditional accounts—could be variable annuities or 40 Act funds with trails—those just stay with the b/d, and the b/d services them with a sales desk. That’s what’s happening right now.”

Roth says it’s likely a defensive move by these b/ds, but a smart way to keep the advisors on their platforms.

“I think what they’re saying is, ‘If your plan over time is to exit, give up your FINRA license and be a pure RIA, do that here, and if you have accounts that you leave behind, we’ll service them,’” Roth says. “Those that are smaller clients, or clients that don’t really need to be in a fee environment—say that $100,000 or $200,000 account that’s just on autopilot, the idea is, leave those at the b/d.”

Aite’s Gallant says that while the trend overall is good for advisors, providing them with more choices on how they want to work, it can also be dizzying for those trying to navigate those options.

“How do you choose the right firm, and the right affiliation and how does that align with your business model?” Gallant asks. “Firms really have to then, not only create these affiliations, but really promote and target them to the advisors. It’s already hard making apples to apples comparisons across brokerage firms; these varied affiliation models just add to it.”