In August, a bit of digital art—a picture of a rock, no less—sold for 400 Ethereum, or just about $1.3 million. That same month, a digital image of an ape with lasers shooting out of his eyes sold for $11.7 million at Sotheby’s, the 277-year-old auction house. And a Chromie Squiggle, a computer-generated image of a short, squiggly line, sold for $2.44 million.

All are nonfungible tokens, or NFTs. Perhaps you’ve heard of them. Like other tokens, NFTs use the same blockchain principles employed in cryptocurrency to program and record transactions and “ownership” of a digital asset. By tokenizing an asset—assigning it a unique string of code—and memorializing that code in a decentralized ledger, the “ownership” of the asset becomes a discrete thing that can be bought and sold. And while the above examples may sound ridiculous and highly speculative, there are signals that NFTs are going to change the way investment management and advice works.

To be sure, most advisors won’t touch cryptocurrencies—let alone NFTs. Yet, executives in the cryptocurrency and NFT space argue that this growing source of wealth—as well as the tech-enabled medium of exchange that makes that wealth possible—should not be ignored.

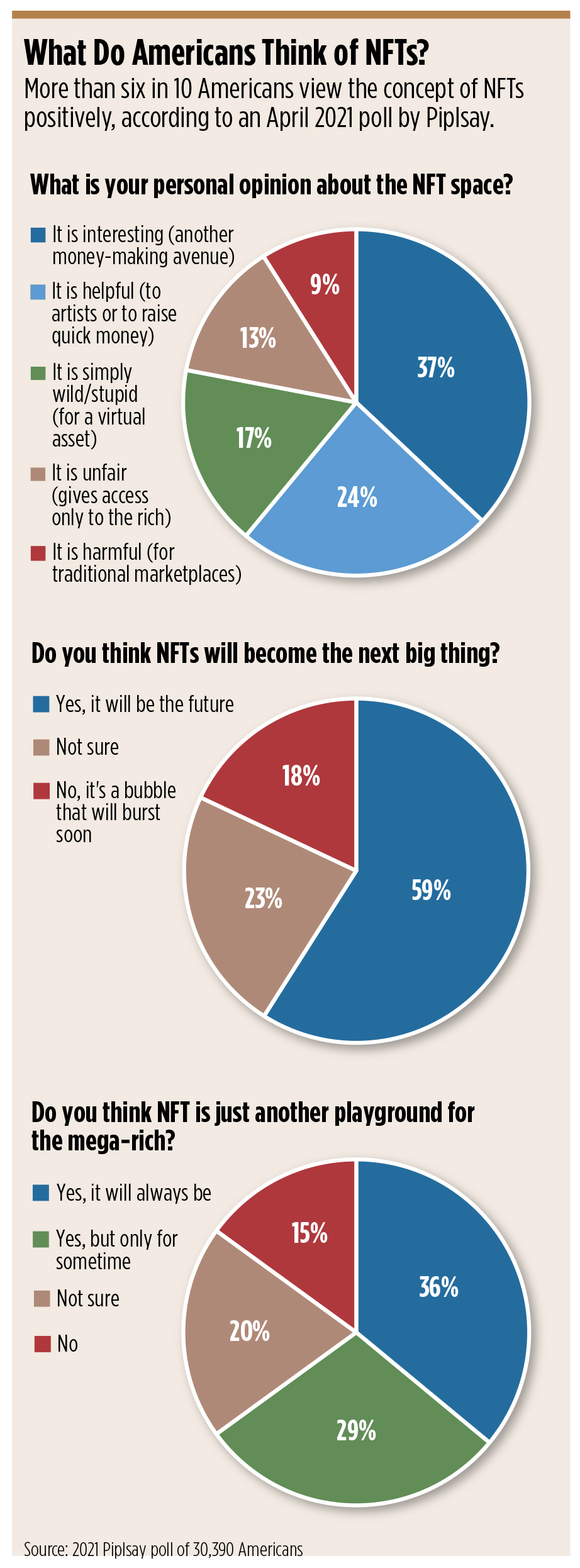

Less than 10% of wealth managers have any sort of cryptoassets as part of their practice, according to Kathryn Harrison, founder and CEO of Magpie, a fintech firm beta-testing a platform that lets advisors pull in and track a client’s NFT data and performance. Yet 49% of millennials own cryptocurrencies, according to a Piplsay survey, and nearly half of millionaire millennials own NFTs, according to a separate survey by CNBC and the Spectrem Group.

“We see NFTs as a path to get increased share of wallet for advisors, retain existing clients and bring on new ones,” says Harrison. “I think that most normal, non-crypto-focused people kind of think that [NFTs are] this hyped digital art phenomenon. And that is certainly the case today. But there are so many use cases for NFTs that we are just starting to unlock.”

“There are 68 million Coinbase accounts, and chances are most advisors’ clients already own crypto. And if they bought it two years ago, it’s up 10 times. So it could be hundreds of thousands, could be millions of dollars that’s currently being held away,” says Matt Hougan, chief investment officer at Bitwise. “The same thing is true of NFTs. There aren’t as many NFT users as there are crypto owners, but there are more than you would think.”

But NFTs carry even greater implications for advisors than Bitcoin in the long term, Hougan says, as they are the expression of digital property rights in a time when almost everything can be digitized.

“NFTs fit so squarely into one of my favorite investing patterns that I’ve seen time and time again, which is that they look completely goofy at first blush and a lot of people dismiss them as ridiculous,” Hougan says. “But at the same time, they’re so much more important, and there’s so much more potential than almost anyone gives them credit for.”

NFTs Today

The investment case in the current crop of digital art NFTs can be split into two categories, Hougan says. The first includes digital avatars, social symbols and online communities with names like CryptoPunks or Bored Ape Yacht Club, where trading in NFTs is as much a social activity as an investment.

“These are social signaling mechanisms, and as goofy as it may seem to have a Bored Ape on your Twitter profile, it’s equally goofy to have a $50,000 Birkin bag, and yet we don’t raise any questions about that,” Hougan says. “People have been using money to signal socially to the world for decades. And the fact that they want to do it digitally online is not surprising.”

The second category is what Hougan and others see as a legitimate class of artists creating “incredible” digital art that has long-term cultural value, like Tyler Hobbs’ “Fidenza” works or Damien Hirst’s “The Currency” collection.

Currently, there are limited ways for advisors to invest in such NFTs on behalf of their clients. There’s no regulatory framework for advisors to do so themselves without taking custody of the assets.

Currently, there are limited ways for advisors to invest in such NFTs on behalf of their clients. There’s no regulatory framework for advisors to do so themselves without taking custody of the assets.

The few options available for accredited investors include Galaxy Digital’s NFT venture fund, custodied at Gemini, and Wave Financial Group’s NFT fund, structured as a three-year closed-end fund.

Defiance recently launched the first exchange traded fund focused on NFTs: the Defiance Digital Revolution ETF (NFTZ). But it does not directly hold NFTs; it provides thematic exposure to the NFT, blockchain and cryptocurrency markets with publicly traded equities.

Ric Edelman, founder of the Digital Assets Council of Financial Professionals (DACFP) and a believer in the future of cryptocurrencies and digital markets, says he has done due diligence on several existing or nascent NFT funds and declined them all. With one, the general partner was anonymous, referred to only by his online handle. “For all I know it was a teenager playing with his computer in a bedroom and who very well may be a very smart buyer of NFTs, but we need to see the established financial services industry engaging in the space,” Edelman says.

Edelman, whose DACFP has started to incorporate NFT education into the curriculum for its Certificate in Blockchain and Digital Assets, expects to see mutual funds and ETFs come into the NFT market, but it will take a while.

“Once the crypto community begins to realize the opportunities of attracting the advisory marketplace, it will create products and services to cater to it,” Edelman says. “It’s beginning to do so. And it won’t be long before there are products offered by reputable organizations providing an adult approach to this asset class that will represent an appropriate vehicle for risk capital.”

Harrison’s Magpie has been beta-testing a software-as-a-service platform that allows advisors to view the cryptoassets and NFT assets of their clients and track and monitor their performance. Harrison says she’s trying to partner with some of the larger aggregation platforms in the industry, such as Black Diamond, to pull that data into those platforms. Magpie also includes a discovery engine, so that an advisor can see what NFT investments may be interesting to the client based on their preferences.

“I just saw a massive black hole in the market for financial advisors and wealth management,” Harrison says. “Just being able to say, ‘OK, we can see your NFT portfolio. This is what you’re holding; this is what it’s worth,’ is a huge step forward for most advisors.”

Gemini, a regulated, crypto-native exchange and custodian, also owns Nifty Gateway, a platform for buying and selling NFTs. Dave Abner, global head of business development at Gemini, would not say whether the company is working on an NFT offering for advisors.

Marc Nichols, product director at Arbor Digital, a division of Arbor Capital, a traditional RIA, says his firm uses Gemini to custody its digital asset separately managed account strategy. He’s hopeful Gemini will provide access to an NFT marketplace for advisors in the future but says that’s likely two years away.

While Nichols can’t currently give clients direct access to NFTs, he can provide exposure to NFTs via proxy. For instance, Arbor Digital invests client portfolios in “metaverse” tokens usable in digital environments like Decentraland and The Sandbox, a gaming platform that allows users to build a virtual world with NFTs. “[Clients] now don’t feel that need to FOMO in, which is hugely beneficial from a behavioral standpoint for our clients,” Nichols says. For many NFT collectors, their investments in the space are becoming more than just gambling money; it’s turning into real wealth, he says.

“You’re getting these kids or these investors who maybe threw in $5,000 or a thousand bucks, and next thing you know, two years, six months, whatever the time frame is, they all of a sudden have $400,000, $1 million,” Nichols says. It’s an advisor’s fiduciary duty to help these clients, he says. “Hey, you’ve built this. Now it’s our job to help you protect it.”

“[NFT collectors] are going to be coming more and more to the advisory space for help in understanding what they should do and how this impacts their portfolio,” Gemini’s Abner says. “If you have an entire portfolio, and 1% of your assets are in crypto, that’s one thing. But if all of a sudden that 1% becomes outsized, you start to need to rethink your wealth management plans.”

NFTs in the Future

While the current iteration of NFTs presents some opportunities, many say the real transformative power of the underlying technology is yet to be realized.

Almost anything, in theory, can be “tokenized,” which is the process of replacing sensitive data with unique identification symbols. This could be applied to assets that need protection and identification rights, such as the deed to a house, exotic cars, rare wine, employment contracts or royalties—and eases the way for these assets to be exchanged. The streaming royalties of a recording artist, for instance, could become investible. Even securities could be tokenized and traded outside of traditional channels.

Dan Eyre, CEO of Bitria, a digital asset SMA and turnkey asset management platform for advisors, says he’s most intrigued by the possibilities in real estate. Propy, a real estate transaction platform on the blockchain, sold the world’s first real estate–backed NFT when TechCrunch founder Michael Arrington sold his apartment in Kyiv, Ukraine, on the platform.

Eyre believes that as more assets, including physical ones, get “tokenized,” advisors will have a bigger window into a client’s financial life, allowing them to take a more holistic approach to managing their wealth.

“The broader opportunity is really just for advisors and asset managers to finally get that holistic picture where they can manage those assets the same way that they would manage any others,” Eyre says. “I could see a world down the line where (real) property can be exchanged or traded for other liquid assets, which is something that’s very difficult to do today.”

Edelman expects NFTs will mean an investor goes from having 15 to 20 asset classes to having over 20,000, and that will mean advisors have an opportunity to differentiate themselves as experts in an investible niche. “Advisors will have the opportunity to craft personalized portfolios for clients in a way never before conceived,” he says.

Many companies in the crypto space are realizing the importance of advisors as the gatekeepers. Consider Digital Currency Group, the parent company of some of the biggest names in the crypto space, including asset manager Grayscale Investments. DCG is currently hiring financial advisors for its new wealth management division aimed at crypto millionaires, according to published reports. (The company declined to comment on the new unit, which is in stealth mode.)

Eyre says advisors need to ask themselves whether they’re open to a redefinition of what it means for something to have value.

“It’s not easily understood by a lot of advisors because they’re looking at it and they’re saying, ‘How could this fully digital property, how could it have value?’” Eyre says. “But it’s not that big of a leap. How does software have value? It’s not tangible, it doesn’t have anything physical, but it helps you do things in a digital world that you otherwise would not be able to do. I think that we’re just seeing that play out.”