It may seem odd that we devote so much space in this issue to nonfungible tokens.

But consider these statistics from DappRadar, a firm that tracks the NFT market. Trading in NFTs reached $22 billion in 2021, up from $100 million in 2020. The market capitalization of the top 100 NFTs ever issued was $16.7 billion, an amazing number considering that few investors even knew what an NFT was just a year ago.

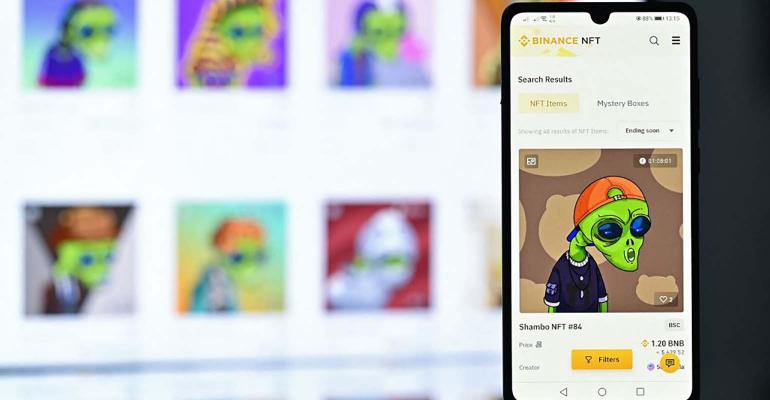

It’s doubtful that many advisors participate in the space, with good reason—it’s pure speculative fervor. So why bother with it? Because it’s possible that the NFT market points the way to a future in which investments will expand beyond our quaint idea of being simply a claim on future financial earnings or interest payments. Consider the ease with which heretofore illiquid markets will open to everyday investors: Real estate, sports teams, royalties, etc. ... That’s not to mention the new Web 3.0 markets around games, community affiliations and virtual environments.

But I’m not sure current investors in the space are betting on the long term. The past year has shown investors view the markets—all markets, digital, crypto and traditional—as a huge casino, where bets are only on which direction a price will go, and that direction was often up.

Records broke in almost every investable asset you can imagine: As the value of NFTs skyrocketed, so did that of physical collectibles. A Mickey Mantle baseball card—printed on paper in 1952—sold for $5.2 million, breaking a record in the collectible card market that was set only five months prior.

Venture capitalists poured $30 billion into all things crypto in 2021, more than all previous years combined. “We’ve got financial services, art, gaming as a subcategory of NFTs, Web 3.0, decentralized social media, play-to-earn—all of that made investors think ‘we don’t have enough exposure,”’ Spencer Bogart, general partner at San Francisco–based Blockchain Capital LLC, told Bloomberg.

User accounts at Coinbase—the self-directed brokerage platform for cryptocurrencies—shot to 56 million. Almost 9 million users are active traders, making more than one transaction a month.

Yet, there are hints the balloon may be deflating. The market value of Robinhood, the home of the new retail investor on the front lines of “disrupting” traditional Wall Street, with its army of meme-stock traders, is down 77% from its 52-week high. Coinbase, seen by many credible institutions as the best way to play the cryptocurrency markets with picks and shovels instead of digital gold, has fallen 40%. And it should be no surprise that over half of the NFTs on the largest platform, OpenSea, sell for next to nothing, and in some cases cost the creators more in fees and charges than they’ll ever earn.

Cryptocurrencies and Web 3.0 may be real game-changers. But right now, too many promoters are more than willing to take your very real, fiat currency to bring you into the club. Someone will be left holding the bag—let’s hope it’s not your clients.

David Armstrong

Editor-In-Chief