The ranking Democrat in the U.S. House of Representatives Capital Markets Subcommittee said the Labor Department should clarify parts of its new iteration of a fiduciary rule, including whether certain recommendations and discussions fell under that compliance structure.

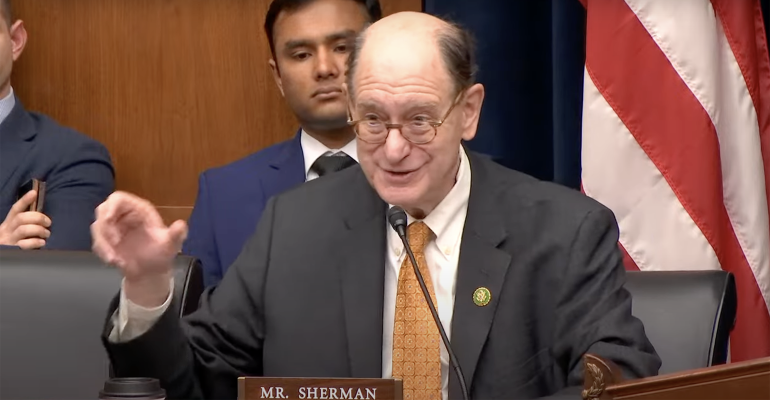

“The fact is we need to improve this regulation, but we need a regulation in this space,” U.S. Rep. Brad Sherman (D-Calif.) said during the Wednesday morning hearing. “A lot of what’s in the preamble (of the rule) needs to be as legally binding as what’s in the rule.”

The Capital Markets Subcommittee, which is part of the House’s Financial Services Committee, called the hearing to examine the DOL’s newest version of amending the fiduciary definition, which was unveiled last fall and recently wrapped up its public comment period.

Sherman argued the DOL should clarify that so-called “choose me” discussions, when an advisor is trying to convince a client to take them on as their advisor, does not have to fall under the standard, nor does the rule deal with proxy advice or discussions about charitable donations with funds from an IRA.

Sherman also decried that the regulation of the space was split between three different committees of Congress and three different governmental agencies (the DOL, the Securities and Exchange Commission and the Treasury Department).

“We see an incredible balkanization of regulations designed to protect investors,” he said.

President Joe Biden announced the new rule on Halloween last year, framing it as his administration’s latest attack against “junk fees” in different industries. It marked the DOL’s newest attempt to revise the definition of “fiduciary” for advisors recommending retirement products. Several previous administrations had proposed their own fiduciary revamps, including an Obama-era rule overturned by the Fifth Circuit Court of Appeals.

Sherman’s advice to the DOL largely echoes recommendations included in the Investment Adviser Association’s comment letter about the rule, including requests for clarification about preliminary hiring conversations.

The letter was submitted Jan. 2, the final date of the Labor Department’s comment period. Numerous industry-related organizations, from broker/dealear advocates like the Securities Industry Financial Markets Association to investor reps like the Consumer Federation of America, also weighed in prior to the deadline.

Most of the hearing witnesses had previously spoken out against the DOL’s rule, including representatives for the Insured Retirement Institute and American Council for Life Insurers (who stressed that the rule was beyond saving and should be withdrawn).

Finseca CEO Marc Cadin, a critic of the rule, also testified, arguing it would make it “impossible” for thousands of advisors to do their jobs.

“Yes, millions of Americans will be left less financially secure,” he said. “If adopted, it will take the country in exactly the wrong direction, as we already face a $7 trillion gap in retirement savings.”

But Kamila Elliott, the CEO of the Atlanta-based firm Collective Wealth Partners, argued moderate-income retirees will gain access to advice if the rule is passed. Elliott was also the Chair of the CFP Board in 2022, and said its adherence to fiduciary guidelines, as well as her firm’s fiduciary mandate, showed you can succeed when recommending retirement products under the standard (Elliott’s firm focuses on middle-to-high income clients, offering various fee models and no minimum account balances).

“The wealthy receive financial advice that is best for them, and those with moderate incomes should be treated the same,” she said.

Elliott noted that Reg BI applied solely to securities recommendations, and also argued for including one-time advice under fiduciary protections, as the new rule intends to do (the previous “five-part test” specified that a recommendation only fell under fiduciary mandates if it was delivered in the midst of an “ongoing” advisor/client relationship).

“For many Americans, they don’t have a financial advisor they can access on a routine or consistent basis. Many Americans reach out to an advisor during a key life event,” like leaving an employer or a death in the family, Elliott said. “That removal of one-time advice does a lot of harm to clients.”

The Labor Department is expected to release a final version of the rule later this year.