George Nichols III is a trailblazer. He was Kentucky’s first Black insurance commissioner, the first Black president of the National Association of Insurance Commissioners and the first Black person elected to New York Life’s executive management committee.

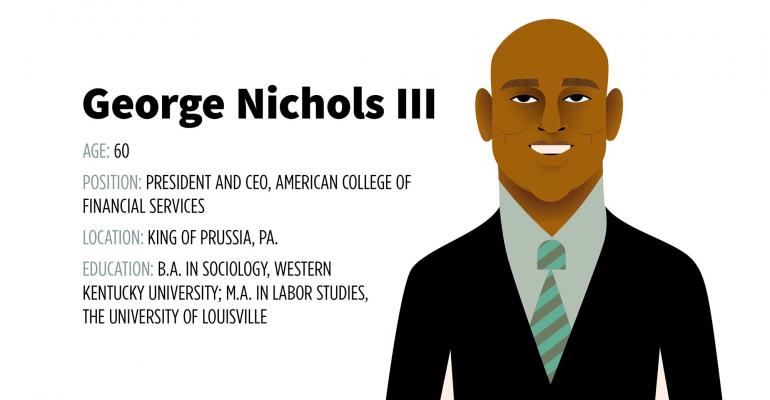

So it can be particularly disheartening for him to see how far America still has to go in leveling the playing field for all. As the first Black president and CEO of the American College of Financial Services, a 93-year-old institution and advisory education and accreditation program born out of The Wharton School, Nichols recently outlined an aggressive yet practical plan to put more Black Americans on a path to upward mobility and wealth creation, and set out a commitment to double the number of Black advisors by 2027. Nichols believes the plan could eventually apply to any group that has traditionally been on the outskirts of financial institutions.

Growing up in segregated Kentucky drove a desire to improve the financial knowledge of Black Americans, he said.

“I learned what most Blacks learn, which was hard work and an income—that’s it,” he said. “That income allows you to pay your bills. You take care of your family. You put a little money in church. If you’ve got some left, you put a little in savings. We were never taught about wealth. We were never taught to invest.”

While the U.S. population becomes more diverse, minorities—especially African Americans—continue to be grossly underrepresented in financial services. For years, many financial services firms have had diversity and inclusion initiatives, but they still aren’t moving the needle. Blacks account for just 6.9% of personal financial advisors, according to 2019 data from the Bureau of Labor Statistics.

“What happens a lot of times is, there’s a crisis, people write a check: ‘I did my part, and I hope it works. It didn’t work, but I did my part.’ That’s not what we want. Let’s make sure we understand it, and let’s measure it so we can find out if it was really that way.”

He wants to make sure any plan was sustainable, meaning companies could make money from it. “As [Blacks] create wealth, guess what? That’s a new client for you, for you to expand your business,” he said.

Nichols’ plan includes four steps, the first being collective impact, where he calls on all sectors of the financial services industry—insurance, banking, asset management, alternatives and brokerage—to promote racial equality and financial well-being.

The second part is to develop financial literacy programs for Black women, who face significant challenges. The college will partner with the industry to curate and modify content currently produced by financial literacy programs.

“Unfortunately, there’s a large percentage of single parent homes. Of those single parent homes, 89% are run by women.”

The third part would create a development program for Black professionals who are on the cusp of going into senior management and executive roles. Participating professionals would be paired with a white senior executive colleague for mentorship in their role and career progression at the company.

The fourth part of the plan is to recruit and develop more Black advisors.

“We should have more Black advisors that are in the communities that are served, to help them understand how to do upward mobility and wealth creation,” Nichols said. “This is an age-old issue.”

The college will offer a template for Black advisors to create their own study groups. The organization also wants to execute on a massive effort for financial services firms and trade organizations to recruit top white advisors to serve as mentors.

“This, to us, is addressing a systemic problem that has gone on for way too long, systemic racism, the institutional barriers that exist,” Nichols said. “I’ve never been so exhausted and emotionally drained than I have been in the last several months, since May. And yet, I’ve never been so hopeful because I really do believe that people are listening and hearing. We may have listened in the past, but I’m not sure we heard.”