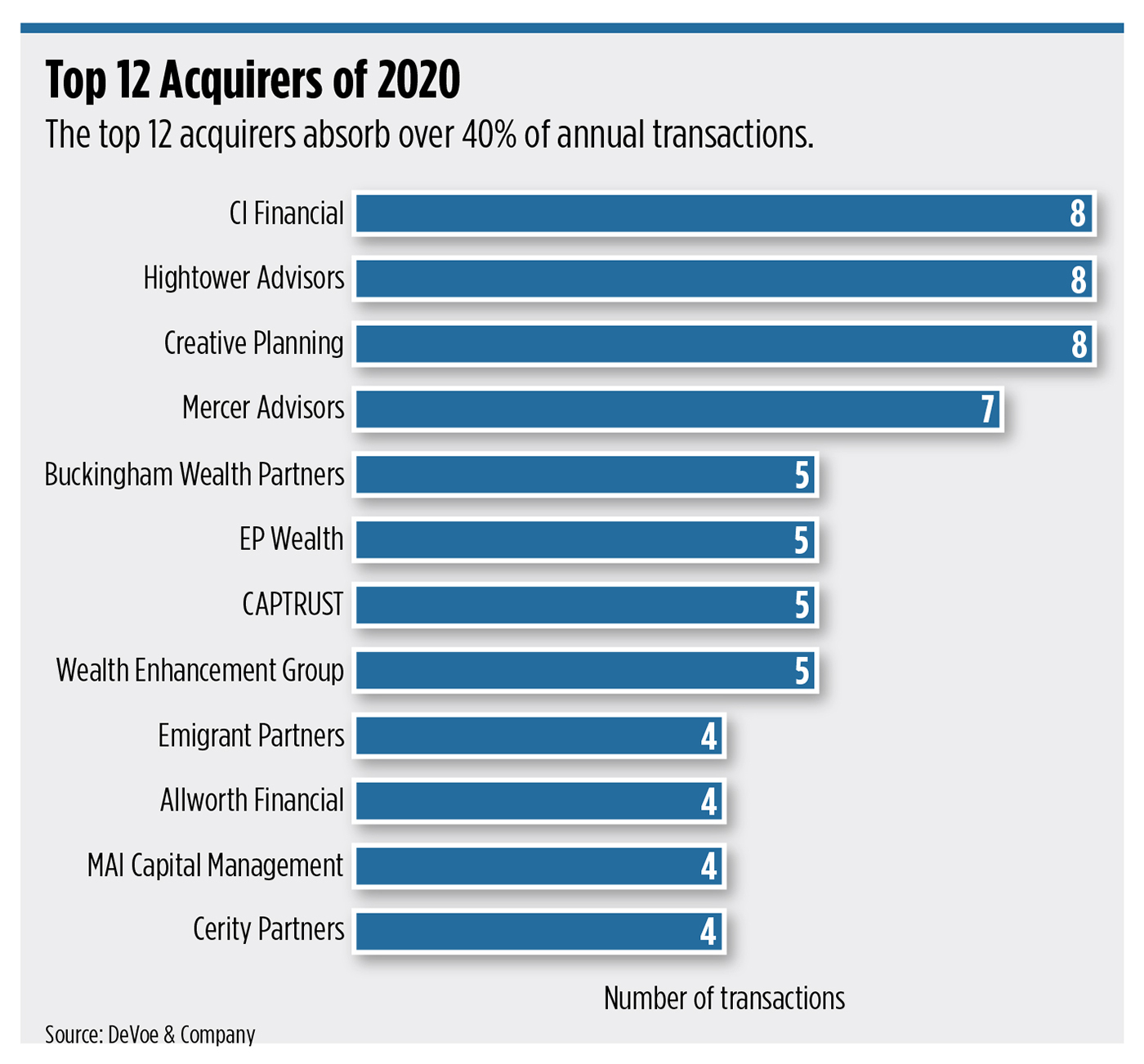

Fresh off a run of acquisitions that closed in the final month of 2020, Mercer Advisors Vice Chairman Dave Barton expected 2021’s M&A activity in the space to exceed 2020, which he called a “banner year” for deals.

Mercer’s seven December acquisitions, including firms in Arizona and the state of Washington, netted the company a combined total of almost $3.9 billion in additional assets under management, and the firm will now be serving more than 3,200 new clients.

In an interview with WealthManagement.com, Barton said the deals bolstered Mercer’s scale in its efforts to be viewed as “the first national homogenous family office.” Barton believed that RIA executives nearing retirement age who were assessing the industry’s ongoing consolidation were increasingly reaching points where they’d need to join a partner with scale or create their own. Even for those not nearing retirement age, the crowded and competitive market is making owners ask how they’ll compete against local, regional and national RIAs.

“These are hard questions that sellers are now asking themselves and have been asking for the past couple of years,” he said. “‘Can I compete with a Mercer that is a de facto family office and can offer a panoply of services under one roof? I can’t afford to build that and I can’t afford to compete with it.’”

Many of Mercer’s end-of-year deals had their origins in the spring, near the onset of the COVID-19 pandemic and the March stock market crash that had many investors fearing the start of a protracted bear market. Barton said the drop made firms reassess their standing and future, arguing the sobering reality of a potential long-term downturn meant “fence-sitting” firms were jumping off them.

“It turned out to be one of the shortest bear markets, if not the shortest, but no one knew that in March or April,” he said. “The fear of an extended bear market for people who were already thinking about selling their company meant they’d have to wait another two or three years to get back to the AUM level and revenue level that they were at before. So, the moment the market started to rebound, they jumped at the chance.

Neither the amount of Mercer’s deals last year or the fact that many of them closed in the last quarter were surprising to John Eubanks, a vice president at Park Sutton Advisors, who described Mercer as one of the space’s most active national acquirers. Like Barton, Eubanks expected 2021 would see continued growth, and said the pandemic and its effects in 2020 belied the fact that the year was a continuation, rather than an aberration.

“Honestly, I think while there was some surprise that the year ended the way it did after the slowdown, if you look at the full year ... it was really just another normal year,” he said. “It’s just the majority of those transactions got packed into the second part of the year, rather than spread throughout the year.”

Eubanks noted that two of Mercer’s late-year acquisitions were in the Atlanta market, including Kays Financial Advisory, an $800 million fee-only firm. With Mercer already running one office in the city before these deals, Eubanks estimated the firm could have $2 billion in assets in the Atlanta metro area alone. Those acquisitions illustrated Mercer’s efforts to build density in locations by seeking additional firms in markets where they’re already located, Barton said.

“We’ve been in Georgia prior to those two acquisitions for 10-plus years, but we see the Southeast as a location and area that is poised for rapid growth, and we wanted to scale up on a local basis there,” he said. “If we buy a firm near an existing location, it’s much better for us and the new partner, because they have a colleague next door.”

After a period of co-branding to ensure clients understand that the original firm teams remain in place, the acquired firms do transition into becoming Mercer branch offices, which Barton says puts them in a different position than Focus Financial. When he evaluated possible acquisitions, Barton said his red flags include high client defection and attrition, high staff turnover, along with low growth, as well as pending lawsuits and SEC complaints.

Overall, Mercer’s 2020 acquisitions totaled 13 for the year; in total, the Denver-based company manages about $27 billion in total assets for about 16,500 clients, with about 525 employees throughout more than 45 locations. Barton said several more announcements were likely in the first quarter of this year, as well.

“M&A and the consolidation of the RIA space will continue, and the velocity of that consolidation will also continue,” he said. “And frankly, it’s a good market for sellers to sell.”