Many registered investment advisors who came out of the wirehouse world will tell you they left the big Wall Street firms so they could gain independence and more autonomy over running their own business. Many will cite their desire to provide unbiased, fiduciary advice to their clients, without conflicts of interest or pressure to sell proprietary products. It also doesn’t hurt that for many, the financial payoff can be larger in the independent space.

So the 220 advisors who sold their practices over the past 14 years to follow Joe Duran’s vision of what financial advice should be for clients will find themselves, in a sense, right back where they started, with Goldman Sachs announcing its acquisition of the national wealth management firm Thursday for $750 million in cash.

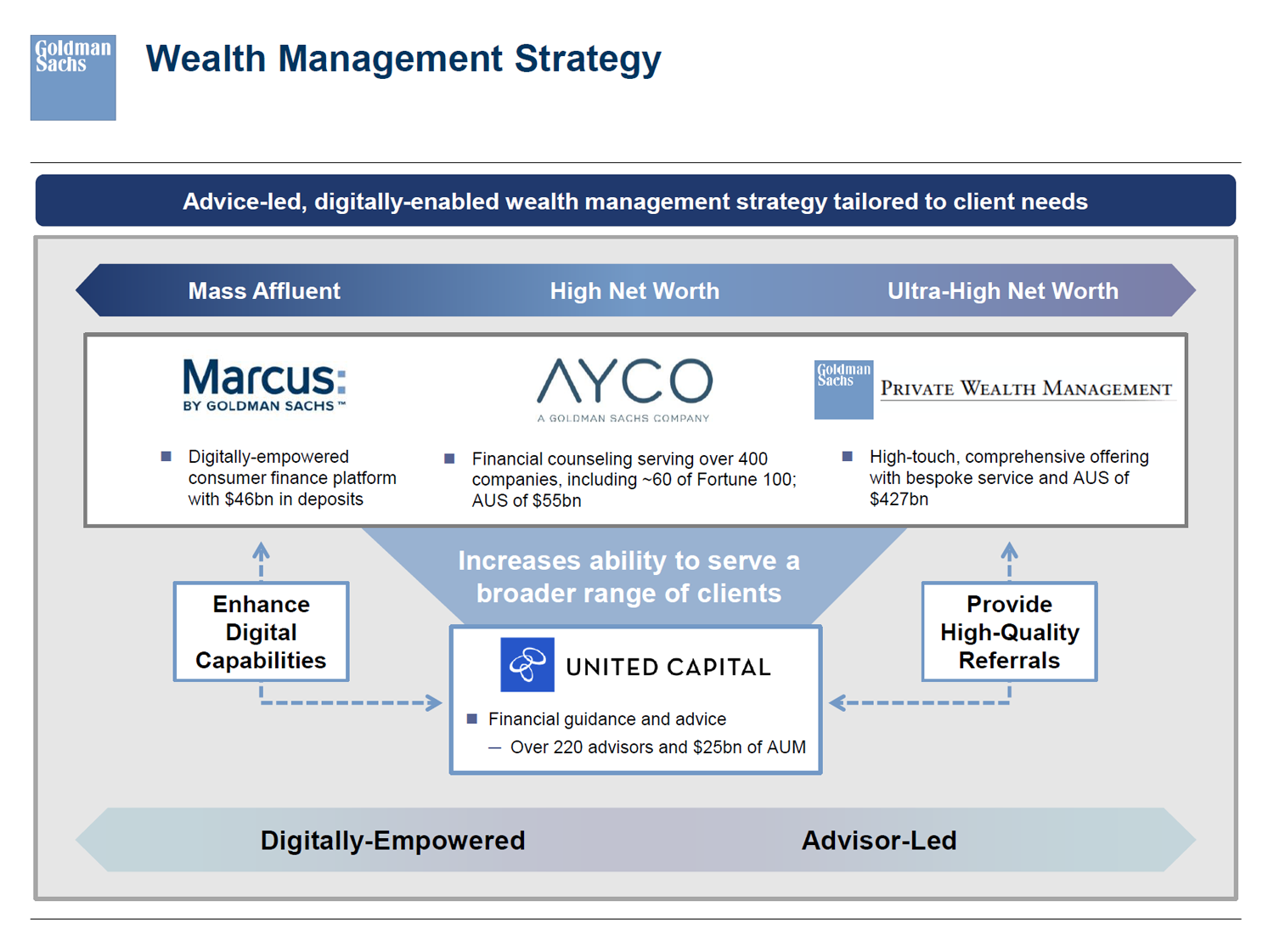

In annoucing the deal, Goldman says it will use United Capital to add financial planning offerings to its client base in private wealth and Ayco, an RIA the firm purchased in 2003. Collectively, those entities have some $500 billion in assets under supervision, mostly for high-net-worth families and corporate executives.

Goldman, traditionally known for its asset management, investment banking and capital markets desks, has been keen on tapping into the retail wealth management market for some time, looking for the right opportunity, industry observers told WealthManagment.com. In fact, when Fiduciary Network was in a similar sale process last summer, Goldman was a very interested buyer, according to a person close to the RIA M&A space with knowledge of the bank’s activities.

Goldman, this person said, was most interested in using Fiduciary Network as an incubator to test distribution of its investment management products. Distribution is becoming more difficult for asset management firms and product sponsors, especially through the RIA channel, the fastest-growing business model in wealth management.

“They want to know how advisors think in the independent space, because the old (distribution) strategy of making appointments, knocking on doors and so on, it’s just not working,” the source said. Goldman’s acquisition of United Capital would give it deeper insight into how independent advisories operate, their investment processes and how to create products to meet their needs, the source added.

“They’re spending a lot of time at the highest levels thinking about how to break free of their capital markets business and their trading business and their investment banking business,” the source said.

And Goldman’s investment management business has been struggling, observers say. In the first quarter of this year, its investment management net revenues declined 12% from the year-ago period and 9% sequentially. But assets under supervision were up $79 billion, $20 billion of that total being net inflows primarily to fixed income assets.

It’s possible Goldman will take FinLife Partners, United Capital’s white-label technology platform that it licenses to outside advisory firms, and combine it with their bank product and personal lending suite to create a hybrid advice model, leading with technology but providing advisors on-demand, similar to what Schwab and Vanguard have done.

Peter Nesvold, managing director of Silver Lane Advisors, a subsidiary of Raymond James, said it would be counterintuitive for Goldman to make a product distribution play immediately, especially after paying a large sum to buy a business with a certain business model.

“However, it does seem like a longer-term temptation—one that has proven irresistible to other firms,” he said.

A likelier near-term play, Nesvold said, is to diversify Goldman’s business away from the ultra-high-net-worth market toward the mass affluent, where United Capital has a strong foothold.

“We’ve seen Goldman make similar, mass-market moves in other segments, including developing its first-ever credit card, making a deeper dive into ETFs through S&P’s Investment Advisory Services, buying into multiple robo advisor platforms and even pushing into retail banking,” Nesvold said. “Looking ahead 10 years, Goldman might look more like a J.P. Morgan.”

United Capital CEO Joe Duran said he was not worried about Goldman looking at his advisors as a distribution strategy. He said he was reassured by how the bank handled its acquisition of Ayco as a model for how they might integrate United Capital.

“They were incredibly careful about ensuring that the culture and vision of that group (Ayco) was not in any way harmed,” Duran said, in an interview with WealthManagement.com. “In fact it was enhanced because of their relationship with Goldman. And that was a big factor in our decision-making.”

While some private equity firms were in the running to invest in United Capital, he didn’t consider any other strategic acquirers seriously.

He said Goldman’s intention in buying United Capital is to go after clients with $1 million to $15 million in investable assets, and his RIA serves that market.

When Duran started United Capital 14 years ago, the idea was to change how financial advice was delivered to clients. But now, he says, size matters.

“I realized that even though we’re big, there are limitations to what we can get done,” Duran said. “And Goldman is a brand that is incredibly prestigious that has no real penetration in the market that we serve. They have a need to fill, which was to get to this particular segment of the market using a scalable, proven platform. We bring that to the table, but they also bring a set of clients that need our services.”

For now, the United Capital name will remain, as will Duran and his team.

Goldman has said it plans to launch a joint credit card with Apple later this year and that it is working on an automated investment solution, or robo advisor, to be part of its online consumer bank, Marcus.

Marcus currently offers only loans and high-yield savings accounts, but that will eventually change. Research analysts at Morgan Stanley said in a note they think checking accounts are coming after Chief Financial Officer Stephen Scherr mentioned improving the functionality of the bank’s deposit offering would make clients stickier. Across both the U.S. and U.K., Marcus has $46 billion of online retail deposits, and the bank estimates there are over $4 trillion in consumer deposits in the U.S. who are potential customers, Scherr said during the bank’s first quarter earnings presentation.

But Marcus is being built to serve as a broad platform with different products and “wealth management will be a key component,” Scherr said.

Goldman will be in a position to develop its mass-affluent services, then introduce those customers to wealth management.

“We have a leading wealth management franchise, driven by our preeminent Private Wealth Management and Ayco offerings, which will serve as a cornerstone of our business as we execute on our long-term strategy to offer clients solutions across the wealth spectrum,” said David M. Solomon, chairman and CEO of Goldman Sachs, in a press release announcing the deal. “United Capital will help accelerate this strategy by broadening our reach, allowing more clients to access the intellectual capital and investment capabilities of Goldman Sachs.”

United Capital and FinLIfe could help service Goldman’s new mass-affluent customers that might not be a fit for its existing wealth management businesses. Goldman Sachs Private Wealth Management and Ayco, an RIA the bank acquired in 2003, cater to the ultra-high-net-worth client.

After Goldman’s first quarter earnings, Oppenheimer analysts Chris Kotowski and Owen Lau said in a note that the bank seems to have “made their peace with the fact that they will forever live with the regulatory burdens of being a bank holding company and so they might as well get some more utility out of the bank charter.”

Marcus and the effort to grow wealth management are not going to drive Goldman’s performance in a meaningful way in the near future, according to the note.

“To be sure, Marcus will continue to grow, and there will be new products like corporate cash management. However, for the time being, these are still the after-school science projects done for extra credit. The midterm and final exams as well as the term paper will all be in the traditional disciplines.”

But many mass-affluent and high-net-worth clients chose the independent advisor model “because they simply no longer trust the largest financial institutions following the financial crisis,” Nesvold said.

“Ultimately, it will be up to Goldman Sachs to convince the advisors why this change is good for clients—because if it isn’t good for clients, it will be difficult to retain many advisors as their contractual obligations roll off.”

“What ends up making it an allure or a fit is the fact that United Capital has built these replicable processes for serving the client, which are valuable, and they’ve led to a lot of growth,” said Dan Seivert, CEO and managing partner at Echelon Partners in Manhattan Beach, Calif.

But United Capital has had its challenges with employee turnover and advisor unrest, Seivert added.

“Advisors and teams that joined the firm through dealmaking often signed agreements that keep them on board. Any new buyer will want to ensure these contracts remain in place and/or improve the employee satisfaction and working conditions. Doing so will reduce turnover as a result of the deal, and the opposite is also true.”

Valuation

Goldman will pay $750 million in cash. Some reported a valuation of 17 to 18 times EBITDA. But Echelon Partners values the firm at nearly $800 million, with an EBITDA multiple of 14.6.

Echelon estimates the FinLife platform, while a smaller piece of the package, might put upward pressure on the overall valuation multiple. Reports suggest that FinLife has an estimated $13 billion in proprietary assets on the platform, which would yield more than $50 million in revenue and $15 million in profit (EBTIDA) for similar platforms. At an estimated 15 times EBITDA, FinLife could be worth one third to one quarter of the total valuation or amount paid by Goldman, according to Echelon.

United Capital’s $24 billion in AUM, at an estimated fee of .73%, brings in $175 million in revenue, but at a lower margin, earns $38.5 million. Echelon calculates just a 14 times EBITDA multiple on that part of the business, for a value of $540 million.

Seivert says the valuation is in line with other deals in the wealthtech space, such as Hellman & Friedman's acquisition of Financial Engines, which it merged with Edelman Financial Services, NorthStar Financial Services Group’s deal to buy FTJ FundChoice and Envestnet’s purchase of PIEtech, parent company of MoneyGuidePro. Envestnet announced plans to purchase PIEtech in March for $500 million, roughly 16 times adjusted EBITDA for the first year of ownership.

United Capital, after all, is a play on financial account aggregation as well as a wealthtech portal, with its FinLife Partners tech platform.

As far as RIAs go, it is a healthy valuation, said David DeVoe, founder and managing director of DeVoe & Company. But the strategic power, or synergies, from a partner like Goldman could rationalize that higher valuation.

“The growth that a firm must yield to justify a 14 or 15 times multiple of cash flow is pretty steep. To move beyond that would require either extremely high expectations or strategic power.”

Nesvold said he’s seen similar multiples for hyper-growth platforms.

“What’s more important than United Capital’s stand-alone EBITDA is what the deliverable EBITDA might be if certain back-office and other operating functions were consolidated with Ayco or other parts of Goldman Sachs.”

Commenting on the purchase price, Duran said his firm has little outstanding debt, so almost all of it was equity value. Every shareholder, he said, is getting cash proceeds higher than when they joined the firm, and every advisor is getting the same share price as other investors in the firm.

“We’ll be making a lot of millionaires thanks to this transaction,” he said. “I’m really happy to have delivered on my promise to all of these folks who sold their businesses to us, to all the clients, the tens of thousands of client who trusted us.”

Duran came to this country with almost nothing, having grown up in the war-torn Republic of Rhodesia (now known as Zimbabwe), an orphaned state in southern Africa and a colonial legacy of the British Empire struggling, violently, with a system of white-minority rule and racial segregation. Horror stories of families being murdered in their homes by black nationalists were common.

“I kiss the ground of this amazing country, and what’s possible if you do good things and work really hard,” he said.

Editor's Note: This story was updated at 3:20 p.m. eastern time.