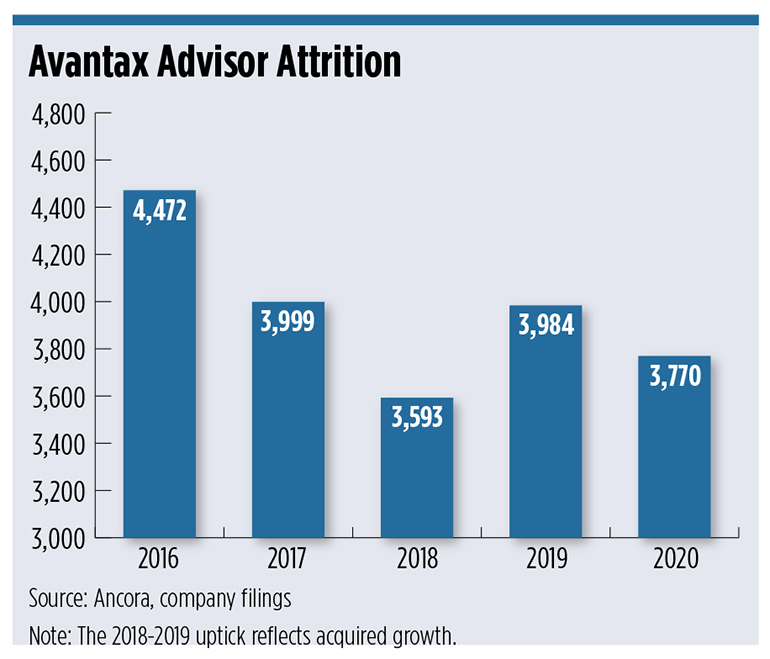

Last month, RIA and investor Ancora started a public proxy battle with executives of Blucora, the parent company of Avantax Wealth Management, the tax-centric broker/dealer created from the acquisitions of HD Vest and 1st Global. Ancora argues Blucora is mismanaging Avantax, resulting in a net loss of 100 advisors over the previous year and over 700 advisors over the past five years.

Former advisors of the b/d, all of whom left in the past 12 months, paint a picture of two different firms—one before the acquisition of HD Vest, and one afterward. It provides a cautionary tale for what happens when a company outside the industry buys a broker/dealer.

Blucora started out as a technology company in the dot-com era; first called Infospace, a content provider to websites and an early search engine, the firm went through many iterations before buying the online tax preparation company TaxAct in 2012 and changing its name to Blucora; technology for tax professionals became the main business, and a move to the broker/dealer space with tax-centric firms became the opportunity.

H.D. Vest was founded in the mid-1980s by CPA Herb D. Vest, the son of a West Texas refinery worker. Long-time advisors said the firm had a family feel, with direct access to Roger Ochs, who was the CEO when it was sold to Blucora in 2015. The technology was not great, but the firm’s back-office service made up for that, with short wait times on the phone and knowledgeable support people who wouldn’t hesitate to spend hours helping an advisor with an issue.

“When I initially joined HD Vest, it was really nice. You knew the people you were talking to; you could call up the CEO, and he would chat with you,” said Josh Ingram, a former Avantax advisor in Bishop, Calif. “You felt like family. You were listened to. Your opinion was considered.”

“Blucora overstretched themselves or thought that they could come in and make all these changes and make it a highly profitable asset for them,” he said. “But what they didn’t realize is they destroyed their relationship with their true client in the process.”

“I remember when H.D. Vest was H.D. Vest, and you felt like you were part of a family,” said another former Avantax advisor, who declined to be named. “You knew they had your best interest, and they were truly fighting for the client. I think once it became more of an acquisition and a business model, there was a switch from ‘How can we keep our culture?’ to ‘How can we make money?’”

“Now you call in and you can’t find anybody that knows any more than you do, and truly they’re giving half the wrong information.”

In an interview with WealthManagement.com, Avantax President Todd Mackay said the firm’s financial advisors are his top priority, and they do have direct access to him and his leadership team.

“Not a day goes by when I don't speak with one or many of our financial professionals, gain insights from their feedback, discuss strategic growth opportunities, or discuss their long-term goals and how we can truly make them a reality,” he said.

He says Avantax has built a community of like-minded professionals who share best practices and encourage each other to grow through chapter programs, regional communities and national conferences, which will start back this year.

Mackay also says the firm regularly seeks feedback from advisors, through an advisor council, a group of reps that meet with senior management on a consistent basis, as well as product process or technology councils, where advisors provide input on strategic programs, pricing incentives and technology designs.

Avantax President Todd Mackay

Jonathan Foster, president and CEO of Angeles Wealth Management and a personal shareholder of Blucora, recently issued an open letter in support of Mackay and the existing board of directors.

“I have known Todd Mackay, the President of the Avantax Wealth Management division of Blucora, since we worked together at E-Trade, and he is the right person to run the advisory business,” Foster wrote. “CPAs are incredibly tax-sensitive, so the branding/messaging around Avantax as an after-tax focused investment platform is strategically sound and a very smart move. It will attract more CPAs, and they will be able to market the services because they really believe in the after-tax focus.”

Four advisors currently affiliated with the firm, who were made available through Avantax, said they had a different experience than those who had left. These advisors said they felt the firm had supportive management and back-office service teams, a much-improved tech stack and competitive payout, compared with other b/ds. For the firms that left, many of those improvements may have been too late.

Declining Service

According to former Avantax advisors who spoke with WealthManagement.com, the first thing to go was the service levels.

Ingram said he had to wait on hold for an hour typically, to get through to the service desk. He also had customer service logs that wouldn’t be addressed for months.

Another advisor, whose team was supposed to get a “premium” level of service, said he experienced similar wait times.

“When you actually would get ahold of somebody, it was somebody who had no idea—and this was even pre-COVID—no idea what’s going on,” he said. “I probably had more knowledge regarding our back-office than they did.”

Another former Avantax advisor in the Northeast Ohio area, who also declined to be named, said he had to wait a day and half to get a call back from a service team member, and experienced long wait times when he decided to stay on the phone.

Yet another advisor who left, who also declined to be named, said the firm never processed paperwork for a client when Avantax changed its brokerage platform. He sent in the paperwork for the client, who had a sizable account, but the firm still hadn’t processed it after three or four months.

“It just gave me a black eye with my client, like ‘He doesn’t know what he’s doing.’ Appearances, to me, mean more to me than money,” he said.

To be sure, Mackay says the firm has increased the number of home-office support staff to the highest level in the history of the organization, and the firm has invested in teams focused exclusively on the technology product experience, something new to Avantax.

The firm also added an advisor ambassador group, a team of home-office professionals that will be dedicated to serving the brokerage’s top teams. Mike Kobs, a longtime Avantax advisor who founded MRK Financial Solutions, has been hired to lead that group.

According to an internal survey conducted by Avantax, advisor satisfaction with its service and operation support is up 27% year over year, with satisfaction across all its departments up 16% from a year ago.

The firm and current advisors say wait times for service calls are improving.

Stanley Warner III, one of Avantax’s current advisors and president of Warner Finance in Tamaqua, Pa., says his team typically gets a response to questions from the back-office within a day. He also points to the fact that Avantax’s advisor homepage lists current customer service wait times, and it’s usually under five minutes. The longest he’s ever seen it at was 10 minutes.

A company spokesman said wait times for service calls on some days are less than 30 seconds.

‘The Biggest Bomb’

Last year, Avantax imposed a $60 annual fee on advisors for mutual funds held directly at the fund companies versus in brokerage accounts or separately management accounts. Ancora primarily blames that “ill-conceived initiative” for the brokerage’s attrition problems, according to a 73-page investor presentation. Ancora Chairman and CEO Fred DiSanto says if he’s elected to Blucora’s board on April 21, his first move would be to cease and desist that annual charge.

Ancora President Fred DiSanto

One advisor team, who declined to be named, said they heard about the charge on a firmwide teleconference regarding the future of advisory business. And despite the fact that directly held mutual funds made up a significant portion of their $150 million in AUM business, the firm hadn’t notified them prior to the teleconference.

“At the end of that, they dropped the biggest bomb on us that they possibly could’ve,” one of the team’s advisors said. “They said, by the way, ‘Anybody who has directly held mutual fund business, we’re going to charge those advisors $60 per year, per account.’ At that point we probably had over 2,500 accounts.”

Had they stayed and not converted those assets over to advisory, the team estimates it would have cost them an extra $60,000 a year in fees to the broker/dealer.

The team called into the firm “fiery mad,” the advisor said, and threatened to leave, but the firm would not budge on the policy.

Another advisor said it would have cost him $12,000 a year, had he stayed. “We’re in the business for our clients; we’re not in the business to make money for our broker. That’s kind of how I viewed it.”

Ingram said he bought a book of business from another advisor who passed away, and it was primarily older clients in mutual funds held directly.

“Here I bought a business. It was valued at X. Now it’s worth less because of this fee,” he said.

Mackay defended the directly held mutual fund fee. “Our pricing model is designed, like many others in the industry, to incentivize growth and let our financial professionals reach their goals while serving their clients,” Mackay said. “We marry that pricing approach with innovative products and investment solutions. Many of those products are things that other broker/dealers don't provide that gives value back to both the financial professional and the end client.”

He points to the firm’s new brokerage IRA with zero custodial fees for low-balance accounts, as an example. The firm will be showcasing this year a new proprietary portal for clients and advisors, featuring a single sign-on capability and streamlined processes. It will roll out an enhanced compensation system for compensation reporting and management, as well as a new account opening process across all of its platforms. And Avantax also plans to introduce a new deferred compensation plan for its advisors, “to help them plan for their own financial future in a tax-efficient way.”

Deanna LaRue, another Avantax advisor and president of TimeWise Financial in Woodstock, Ga., said she has always leaned more toward advisory, so she had few direct-to-fund assets. Yet, the move helped her to seek out those clients.

“It’s a change, and nobody likes a change,” she said. “But it kind of lit a fire under me to now go and find these people and find out, ‘OK, are you a liability on my book and you won’t even answer my calls?’ For me, it was almost like having more accountability to make that happen.”

John Lammers, managing partner of business development at MRK Financial Solutions in Plymouth, Minn., said his firm, a current Avantax affiliate with about $750 million in client assets, has 90% of its assets in advisory, so the $60 fee had minimal impact on its business.

“That being said, if you're a Main Street advisor and you have all of your assets held direct to funds, that's going to be challenging to make that change,” Lammers said. “I still think at the end of the day it’s a better deal for your clients. You can do a better job for your clients if it’s all under one roof.”

But other things have brought advisors’ costs up, such as requiring they use certain errors and omissions insurance and an email clone system, without the ability to shop the street for lower quotes on those. One advisor said his technology fee increased from $50 a month at one point to $125 a month by the time he left.

“What it seemed to me is, they were passing the compliance buck off on us, and saying, ‘OK, if you guys don’t do this, you’re just on your own.’ And that’s not what you pay a broker/dealer to do,” said one advisor.

Another advisor said the straw that broke the proverbial camel’s back was when Avantax wanted to monitor all of his emails, even those from his CPA practice, which often include very sensitive client information, such as Social Security numbers.

“I said, ‘If you’re going to make me have you look at every email, then I’m leaving,’” he said.

“Now I got to go tell my client, ‘Hey, Mr. and Mrs. Client, a third party’s going to be looking at every email you send me.’ The first thing my client is going to say is, ‘What did you do wrong?’”

On the E&O insurance, Mackay says the firm reviews the providers, policies and premiums several times a year to make sure they’re aligned with industry standards. The firm does allow for exceptions when there’s ample coverage held away.

Payout Changes

Advisors also said the firm adjusted the brackets for overall payout after the acquisitions, causing their payouts to drop by 1 to 2 percentage points. Ingram, for instance, said his payout declined from 88% to 86% under the new compensation plan. Now at LPL, he’s making 90% on brokerage business and 92.5% on advisory assets.

The advisor from the $150 million team said his payout increased from 87% at Avantax to 90% at his new b/d, and the fees are comparable.

The firm did change the payout grid under its previous leadership team in 2019. But Mackay said the only recent change under current management was to the administration fee on the advisory pricing grid, which he says positively impacted 95% of its advisor force.

LaRue said that when the firms merged, her payout increased by about $2,000 a year.

“It took a while because they had to blend what 1st Global was used to and what HD Vest was used to, and try to make everybody happy,” LaRue said. “And I remember being a little nervous about that because you hear rumors that this is what they’ve got. It didn’t impact me in a negative way.”

David Strother, an advisor with Darnall Sikes Wealth Partners, an Avantax affiliate with just under $1 billion in client assets, said his payout was somewhere in the 80–89% range previously, and now it’s in the mid-90% range.

At the end of 2019 and into 2020, Strother’s firm shopped around to see what other broker/dealers had to offer, and they realized it would be more financially attractive to stay at Avantax versus moving to another firm.

“At the end of the day, when we looked at what our alternatives are in the investment community outside of Avantax, and what is our arrangement inside Avantax, we realized we were more competitive with Avantax than we would be with other people that were suitors for us,” he said.

Management Changes

Ingram said that after Blucora combined H.D. Vest and 1st Global and rebranded as Avantax, there were a lot of upper management changes occurring rapidly, a red flag in his view.

“Somebody was hired on to fill this management position, and then two weeks later they were gone,” he said. “When you have a turnover every week or every two weeks in upper management for two months or three months—that’s concerning. That’s a lot of writing on the wall that something’s not right. And as an advisor, you’re already experiencing all these customer issues and the fact that they just didn’t listen to you.”

Enrique Vasquez, the former head of Cetera’s tax-focused b/d and one of WealthManagement.com's Ten to Watch in 2020, was brought in to lead the brokerage in the summer 2019. Less than a year later, in April 2020, Mackay took over his duties as president.

“What I've told our employees and our community of financial professionals is that the time for change has passed,” Mackay said. “We're now in a time of progress for Avantax. I have an incredibly strong and committed senior leadership team, that has among my direct reports on average, 15 years of tenure within our business.”

Lammers said if you look at the past five years, there has been a lot of management turnover, but he believes Mackay has assembled a good team at this point.

“And to some extent, I feel a little bit sorry for this group that's there right now, because they are sorting that out and are reestablishing some stability. I think they've done a really good job with that in a really difficult environment.”

Advisor Attrition

While Ancora estimates the broker/dealer suffered a net loss of 100 advisors over the past 12 months, Mackay says it recruited 210 new advisors to the firm in 2020. Just last week, the firm brought on Legacy Capital Advisors, an Atlanta-based team with $126 million in client assets, from LPL Financial. And this week, the firm recruited Maestro Wealth Advisors, a Winston-Salem, N.C., practice with more than $133 million, from World Equity Group.

“Having access to the tax professionals within the Avantax network is a key competitive advantage for us,” said Chris Kirkland, managing director of Legacy Capital Advisors, in a statement. “This allows us to open up new growth avenues with a stronger platform and a one-stop-shop for clients. Our firm’s strong growth is due to the personalized nature of our client relationships, but we knew we needed a more focused partner, and because we weren’t getting the personal approach we wanted from our prior broker-dealer, we started looking for a partner who would really know us, what makes us different and what’s important to us.”

An investor presentation filed by Blucora says, “Some attrition among financial professionals is natural, healthy for the business and expected.”

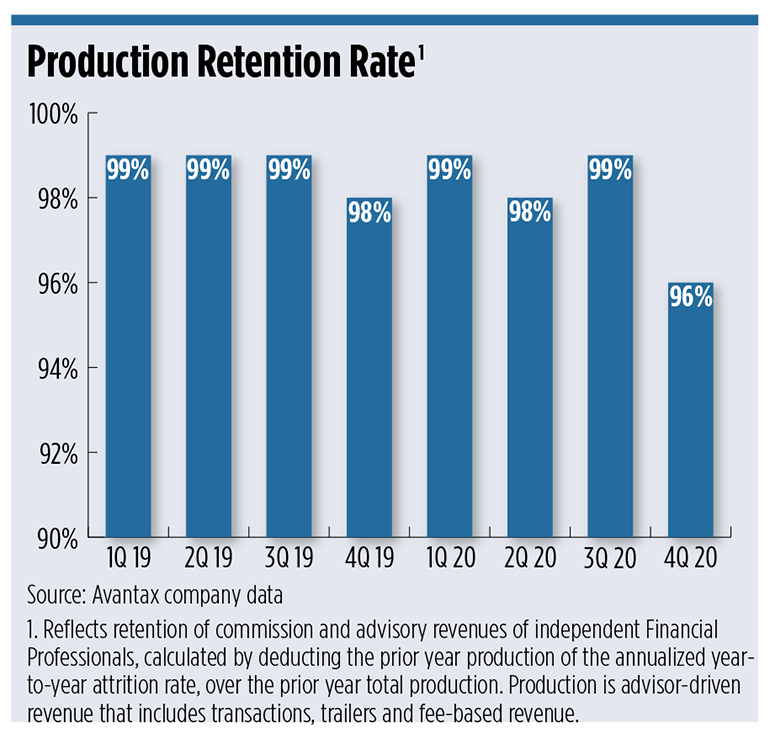

The attrition is driven in part, the company says, by its own efforts to cull inactive and less productive reps. Mackay points to the fact that the b/d’s production retention rate has remained at or near 99% since the beginning of 2019. It dipped to 96% in the fourth quarter 2020. (See chart, below.)

The company also points to post-acquisition attrition, which can run at 10–20% of financial advisors associated with acquired firms, the deck said.

Some of that attrition is also due to tax professionals who added wealth management services and then later decided to drop it to focus only on tax planning.

The attrition could also be attributed to CPAs retiring from the business and transferring their assets to another financial professional. That reduces head count, but not assets, Blucora said.

“We've attracted, over the last year, financial professionals from across the industry that have chosen to affiliate with us,” Mackay said. “The reason they come to Avantax is simple—I’ve heard this from countless firms over the last year—is that we offer what other firms don't. That is that unique community of like-minded financial professionals that share ideas and share in the passion of serving their clients across both tax and financial planning. They also come to us for a unique ability to have direct access to senior management that they're not getting it at their current firms, and unique opportunities to grow their practices, both organically and inorganically.”