Advisors grappling with the coronavirus pandemic have changed how they relate not just to their clients but to each other as well.

Advisors in independent practices, much like doctors and lawyers, have always worked in some degree of professional isolation, even before COVID-19 put an end to in-person gatherings of like-minded peers. Many advisors join professional communities or organizations to find peer support, advice on running their practices and the latest professional developments.

Traditionally, those communities have taken the shape of professionally managed, large-scale membership-based organizations like the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA). Educational opportunities for public-facing credentials are available from organizations like the Investments and Wealth Institute (IWI).

Each of these groups has evolved over the course of the past year in different ways, but all face the challenge—with varying levels of success—of remaining relevant in a time when advisors can easily, and often more cheaply, find community and support networks online, in digital-only study groups like the recently launched Advisors Growth Community or through a vibrant community of peers gathered via social media.

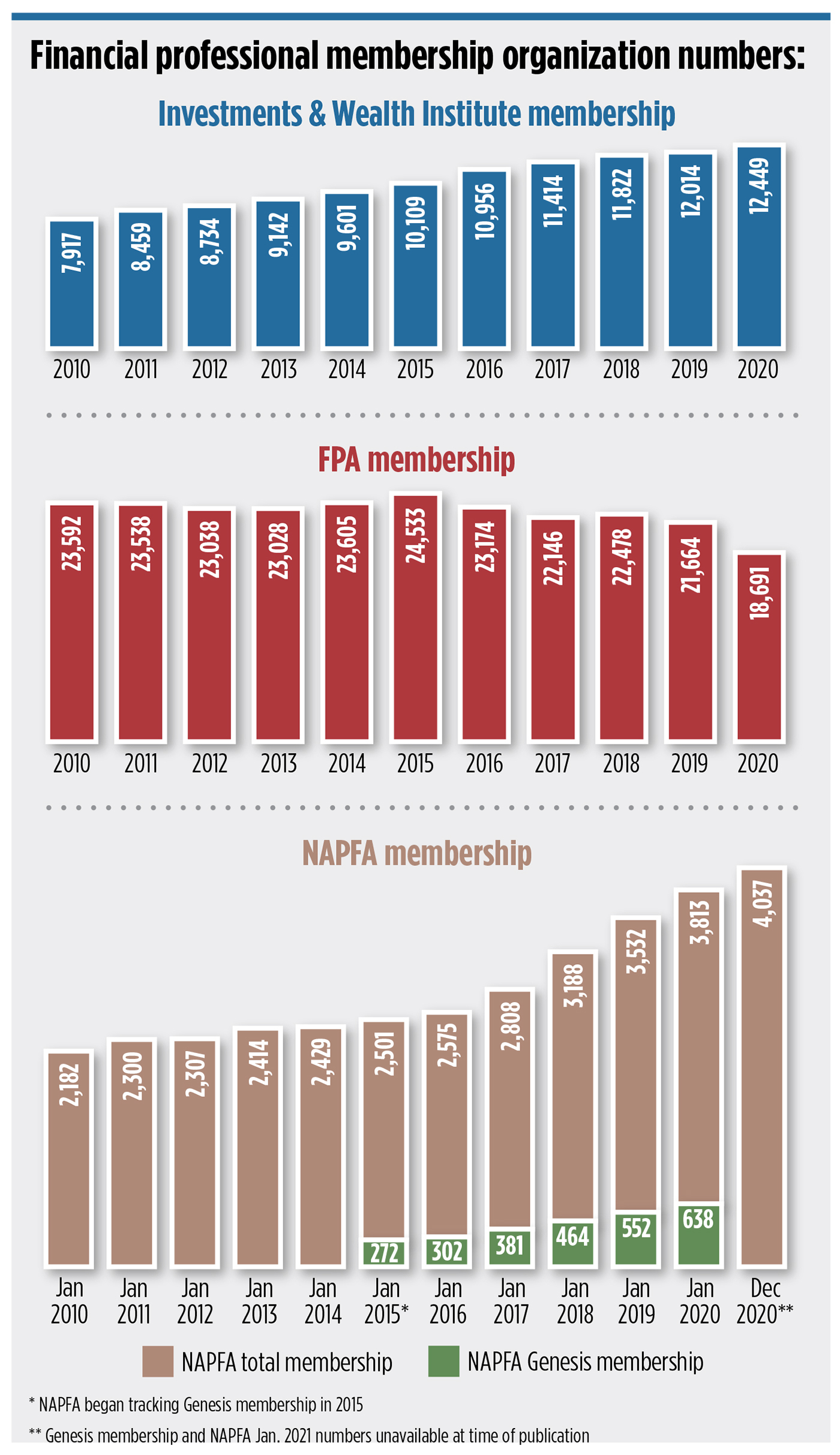

In the past year, NAPFA and IWI have grown their memberships, while FPA lost members. All three organizations’ 2020 membership figures were in-line with their long-term trends over the past decade. While all three vary in their missions, constituencies and goals, each of them seeks to provide a community of professional peers with support, education and resources meant to build better firms and better serve their clients. Here is how each has fared over the past year:

FPA Membership Woes

As the largest group of the three, FPA is arguably a bellwether for the impact of the pandemic on financial professional membership organizations. FPA lost 2,973 members from 2019 to 2020. But that decline in membership started long before the pandemic struck. In fact, in the past decade, the FPA has seen only three years of growth.

Some critics point to an effort to consolidate all of FPA’s valued regional chapters into one national group—perhaps a financially motivated effort that nonetheless threatened to remove what many valued in the organization: a local group of peers.

In May, just after the pandemic hit, FPA CEO Lauren Schadle parted ways with the organization, and the $350,000 position. Some critics contend conflict with the board over the direction of the association led to the departure.

It’s a case of muddled value, according to Patrick Mahoney, the former head of the IEEE who was recently named CEO of the organization. “We need to do a better job of conveying our value to members,” he said. “It’s been a slow decline and it’s not going to be fixed overnight.”

Mixed in the muddle are continuing education credits, chapters and subchapters, and advocacy. While the FPA once had the corner on the market for all three, advisors tend to cite only the community aspect of FPA when it comes to meeting their professional needs.

“You have to understand that the soul of the organization is at the chapter level,” explained Mahoney, who predicted overall membership growth in 2021. While “one or two” chapters have discussed merging with larger, regional chapters, he said no local chapters closed last year.

“Overall, the FPA community is just extremely robust,” said Daniel Yerger, president and CCO of My Wealth Planners, in Longmont, Colo. The NexGen platform, a subset of the FPA built for professionals who are newer to financial planning, is growing, and the online community is active, he added.

But the organization’s value was impacted by the pandemic, he said. The “hallway magic” of meeting other advisors at an in-person conference couldn’t be replicated by the group’s virtual events.

Jake Morris, founder of Fun Financial, in Rhinebeck, N.Y., was one of the nearly 3,000 former FPA members who decided not to renew his membership in 2020. While he capitalized on the four years he spent as a member and found value in the networking events put on by the New York City chapter, he decided the membership fee to be “a little bit cost prohibitive this year.”

The cost, which starts at $375 plus local chapter fees, per year, for a single CFP member, became even more of an obstacle when factoring in the virtual nature of networking during the pandemic.

“The experience really has changed a lot,” he said of virtual networking. “It’s like listening to a record, but there’s a lot of fuzz on needle. It’s still there but not as good as it could be.”

Others are confused by the FPA’s vision. “I feel like FPA is a sales and marketing organization,” said Todd Pouliot, founder of Gateway Financial in Northfield Center, Ohio. A member of NAPFA, Pouliot looks forward to daily exchanges of information on the organization’s forums and the visibility afforded by the group’s directory.

The FPA will continue to struggle with growing its membership unless the organization changes, said Michael Kitces, co-founder of XY Planning Network. XYPN members are extended a NAPFA membership as part of their dues.

That’s because the FPA is no longer a major provider of CE credits and it’s mixed its advocacy message—two of the major draws for the group, he said.

“Professional education providers are getting ripped upside down with the ability of advisors to get CE credits online,” Kitces explained.

Then, when the FPA had an opportunity to fight the SEC's Regulation Best Interest last year, it let XYPN lead the charge—later filing an amicus brief siding with XYPN. It drew criticism for the decision to wait for XYPN to take the reins.

“The FPA’s core issue is that they haven’t been clear about who it is that they want to serve,” added Kitces. “It’s hard to grow membership when you don’t know who you’re for.”

The FPA’s current president, Skip Schweiss, acknowledged that the firm needs to lead through advocacy, citing a planned push for defining Reg BI and the use of the term “financial planner.”

The organization is also banking on its chapter structure to help it pull out of its 2020 tailspin.

A return to more normal post-pandemic circumstances, coupled with a strong NexGen community that’s active in universities and among younger demographics, will help the organization grow in the years to come, Mahoney predicted.

The Ballast of Credentialing

While the FPA has suffered attrition, the IWI has seen a decade of growth, even as the organization adapted to 2020’s all-virtual mandate. IWI saw its membership growth increase by 435 members from 2019 to 2020.

The organization benefits from its professional development heritage (it issues the CIMA credentials), but the group’s head start on remote learning was what allowed it to face the challenge of the pandemic without skipping a beat, according to CEO Sean Walters.

“We could have seen bigger growth, but in general, growth slowed and didn’t stall,” he said. Online learning was already an option before the pandemic, so maintaining the organization’s inertia was a matter of switching the in-person learners to a virtual system. While many opted to move into the virtual system, there were members “who were frustrated and took the year off because they didn’t want to do online learning,” he said.

To add to the group’s resilience, the CIMA structure has a built-in community, said Walters. Cohorts participate in the certification as a group, forming peer-to-peer bonds as part of the learning experience.

Located in Denver, IWI found its advocacy mission to be eased, to some extent, by the pandemic. Since the pandemic, Walters has held meetings with four of the five SEC commissioners, he said, where he discussed the definition of accredited investor, among other topics. “It would have been really difficult for a non-DC-located organization to do that,” he explained. He cautioned, however, that access doesn’t necessarily mean better advocacy. It was, however, an avenue opened by the pandemic.

Access to lawmakers and regulators isn’t the only change in store at the IWI. Traditionally seen as focused on professional development, the organization is planning to launch a new professional networking platform, called The Hive, in March. The platform will support the sharing of best practices and content, as well as facilitating the formation of study groups, according to Walters.

Small, but Growing

Like IWI, NAPFA has seen a decade of steady membership growth, which has become more pronounced in the past three years, organizers contend. As a smaller organization, its advocates say it benefits from a tighter focus. The group’s "Find an Advisor" tool helps market its advisors to the public, and that helps with growth efforts, organizers say.

NAPFA grew by 281 members from January 2019 to January 2020. It’s association with XYPN, which is now approaching 1,400 members, has helped the group, as well.

The group’s focus on fiduciaries and fee-only advisors has strengthened NAPFA’s appeal, said CEO Geoffrey Brown, the group’s full-time executive manager. The group’s association with XYPN has contributed to growth, “but not necessarily more than the other segments we target through our new member acquisition efforts,” he said. “XYPN has been great at giving planners that are new to this channel a starting point.”

NAPFA’s Find an Advisor platform is a major draw for the organization, said Travis Tracy, founder of Fortitude Financial Planning, in Durham, N.C. The level of experience in the NAPFA membership is an advantage of the organization, but he noted the social media presence of NAPFA seemed eclipsed by both FPA and XYPN.

For John Bovard, founder of Incline Wealth Advisors, in Cincinnati, a NAPFA membership is useful for CE credits and its forums. But its networking appeal has suffered in a virtual environment, he said.

“I never knew when the meetings were going to be,” he said. “There wasn’t really any structure to it.” Furthermore, there were few opportunities for guidance from NAPFA in specific areas of expertise, like marketing or sales, he said.

Yerger also found the smaller organization to be enigmatic. “I’ve struggled to find value in NAPFA,” he said. “While their find-an-advisor tool is very active in some geographic regions, their programs of webinars, conferences, and local ‘study groups’ are difficult to navigate.”

“I often liken the experience to circling a castle with a moat and no bridge,” he explained. “There’s value in there somewhere; they just make it incredibly difficult to access.”

Kitces praised NAPFA’s focus and its reputation but acknowledged that FPA has an advantage in numbers. With a large head count, FPA is able to build local chapters that serve as touchstones for advisors spread across the country. Although NAPFA is growing, it doesn’t have the member numbers to provide that type of service.

The Future of Membership Organizations

The pandemic accelerated trends in membership organizations, big and small, that were already underway. All three organizations have reacted to the realities of remote work and virtual conferences. Online learning modules are now ubiquitous, and videoconferencing is a must.

Yet some advisors find more value in groups with a narrow, but deeper focus. Tracy joined the Association for African American Advisors (AAAA) last month, to meet more Black professionals in the industry. Alajahwon Ridgeway, owner of A.B. Ridgeway Wealth Management, in Lafayette, La., said he valued the community he found in Kingdom Advisors, a professional organization for advisors who want to combine their Christian faith and finances.

The question remains how the traditional large-scale professional organizations can fare after the pandemic recedes. Some advisors are skeptical they can at all, when social media and virtual connections are taking on ever greater importance.

“Traditional memberships will eventually go by the wayside,” predicted Incline Wealth Advisors’ Bovard. “They’ll eventually be done.”