Carefull, a service and application for monitoring and protecting the finances and personal data of loved ones, this week announced a partnership with Cetera Financial Group, which provides the firm’s advisors approved access to use the technology.

The application was created for the estimated 45 million caregivers of those 55 and over who are in need of help in preventing elder fraud, financial mistakes and identity theft.

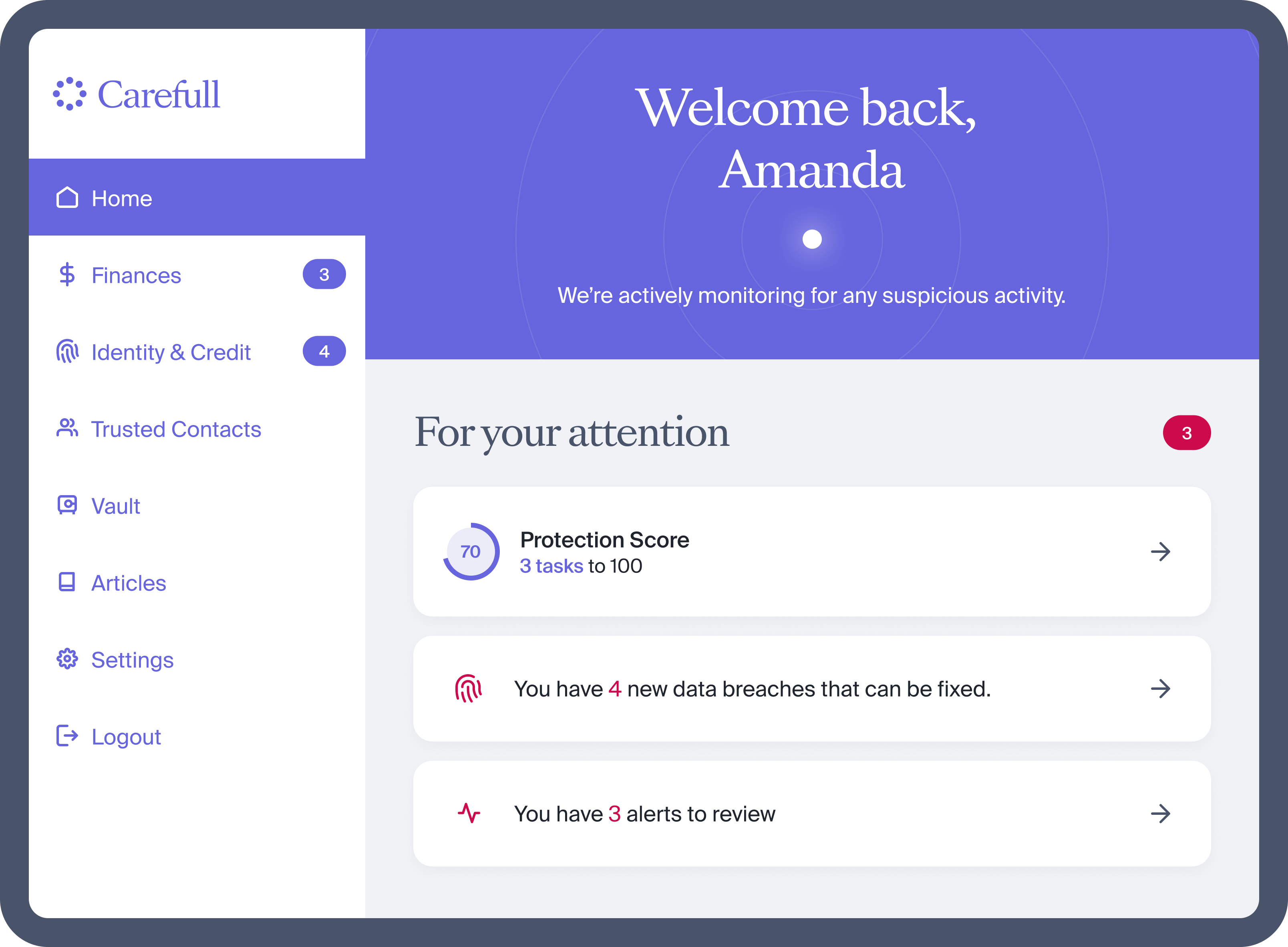

First introduced in February 2021, Carefull has continued to add features and combines transaction data (using account aggregation through Plaid) and financial behavior monitoring, family communication and even educational content into one place.

Through analytics and machine learning on the application’s back end, any suspicious transactions or behaviors, whether a large unexpected payment, a provider that is new or unknown to caregivers or bills being paid twice, (among other things being watched for) are tagged and an alert is sent to the “circle of care.” The network can then securely discuss and decide the actual danger or lack thereof in the activity.

To start, the client themselves or a close designated family member would set up the Carefull account by securely entering financial or other account credentials, and invite a selected group of caregivers into the circle of care. Those added to the circle have view-only access to alerts and warnings and cannot access the accounts themselves through Carefull.

The cost for Cetera advisors is $125 a month ($1,500 per seat for an annual subscription), which allows an advisor to add up to 100 users. Special rates are also available for adding teams are available as well according to co-founder Todd Rovak.

Non-Cetera advisors interested in the application or sharing it with clients can find much more information on the Carefull website including pricing for individuals as well as helpful FAQs and other content including how to have the sometimes difficult discussions around getting help as we age.

This is not the first big partnership for Carefull, which announced a similar one with Nationwide Insurance in March.

Catchlight Integrates with Wealthbox

The prospect analysis and lead-conversion provider Catchlight already had an integration with the popular CRM provider Redtail (now part of Orion). This week, the startup announced its integration with another popular CRM: Wealthbox.

The lead-evaluation tool was born out of the Fidelity Labs startup incubator and remains a subsidiary of the firm. The tool uses data gleaned from five public or publicly available for-profit databases to help determine which leads have a greater likelihood of becoming full-fledged clients. The technology even applies a Catchlight Score of one to 100 to prfioritize leads for advisors and help determine the likelihood of their becoming a client.

With the new integration, Catchlight synchronizes prospects and data in Wealthbox that it brings in from external databases to enrich profiles with financial attributes that range from estimated investable assets, income range, other financial holdings as well as personal interests and hobbies.

During a recent demo and interview, Daniel Gilmartin, who heads up marketing at Catchlight, said the application is ultimately about helping advisors take data insights and convert them into actions.

“It is about helping them decide who to call and what to pitch next and it will work as easily for a multi-billion AUM RIA as a $10 million AUM solo practitioner,” he said.

Advisors using the Wealthbox platform that want to learn more can join an upcoming webinar.

Redtail Imaging Gets a New Interface and Other Features

Orion’s Redtail Technology, the popular client relationship management application for advisors, announced major enhancements to its Imaging product, which provides compliant document storage. Among the improvements are additional capabilities across operating systems, as well as new licensing options and a new user interface.

Firms can now upload and download files in bulk directly from the web-based imaging application without the need for bridge software, which was required in the past.

The upgrade now provides for full compatibility for macOS users, as well as an archive feature that allows users to restore deleted files.

In terms of licensing options, the new entry-level offering provides up to 200GB of storage while the enterprise license has expanded to up to 1TB of storage. A free trial is now available for Redtail Imaging too.

TIFIN AMP Announced

On Tuesday TIFIN announced AMP, a proprietary and integrated platform that combines and helps manage the marketing, data science and sales enablement assets for asset management firms and help remove distribution friction.

AMP, which is short for asset management platform, is an “interconnected AI-powered software as a service platform that integrates data from marketing and awareness activities, CRM information and other data feeds, to generate actionable signals to fuel lead generation, qualification, nurturing and optimization in a firm’s sales efforts,” according to a statement.

“By consolidating intelligence from marketing, practice management, and CRM data, we are able to provide asset management firms real-time precision in the impact of their distribution efforts and help them uncover new insights and opportunities,” said Jack Swift, TIFIN’s president and chief revenue officer, in the statement.

TIFIN has evolved from its roots as a startup incubator and holding company with more than a dozen businesses and has morphed and combined several of those into TIFIN Wealth, a platform for advisors, wealth managers, and other intermediaries that combines several tools and features. It also operates Magnifi, an intelligent search-powered marketplace for investments, among other offerings.

The firm has had its ups and downs this year, having announced the close of its $109 million Series D funding round in May, followed by belt-tightening in June that included laying off 10% of its staff, mostly in sales, and asking top executives to take pay cuts.

If the name AMP sounds familiar to some advisors, it could be because Fidelity rolled out a product they called AMP back in 2019, which stands for automated managed platform and was co-developed with eMoney.