For the past five months, prospect analysis and lead-conversion provider Catchlight Insights has been operating with a small group of wealth management firms, helping their advisors prioritize client leads in a way that is meant to make cold-calling and emailing more efficient. The 30-employee, Boston-based firm is a fully owned subsidiary of FMR and still within the startup ecosystem of Fidelity Labs. While the startup is planning a general debut of its capabilities in May, WealthManagement.com got an early look.

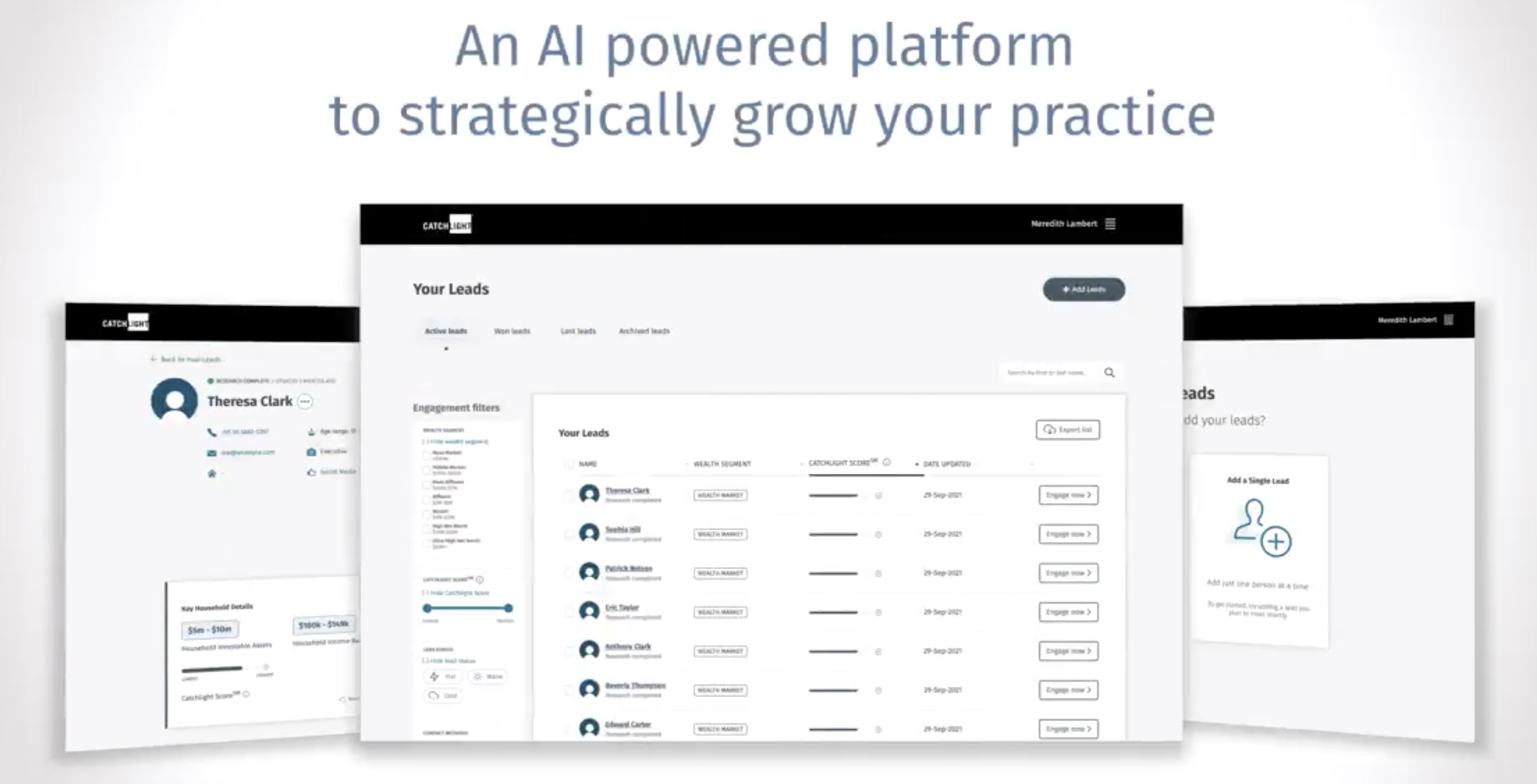

Catchlight is a lead-evaluation tool, which uses data gleaned from five public or publicly available for-profit databases to help advisors determine which of their leads have a greater likelihood of becoming full-fledged clients. The tool assigns up to 1,000 attributes for each record in its system and has data on more than 255 million U.S. consumers.

By combining client attributes with the firm’s algorithms and advisors’ own success rates at converting a lead to a paying client, Catchlight ingests information on leads and ranks the leads by the likelihood the advisor will be able to convert the lead to a client, as well as providing attributes on each lead so that an advisor can tailor his or her sales pitch.

Lead generation is often likened to a funnel: Large numbers of potential clients are sourced through vendors selling advisors lists of potential clients, or even by advisors harvesting contact information from the readers or viewers of their own newsletters or podcasts. Advisors are then left to evaluate the raw leads—narrowing the funnel—through methods like cold-calling, searches on LinkedIn, or sometimes just their own intuition. If all goes to plan, an advisor walks away with a few new clients at the end of the process.

The firm did not indicate how many actual leads it has converted and did not provide the number of clients it has.

“When advisors analyze all their leads, they typically see a 2% to 3% conversion rate over time,” said Wilbur Swan, Catchlight CEO, referring to the firm’s own collection and analysis of advisor lead conversion data. “Our propensity model produces results with a two to three times improvement, leading to an improved conversion rate of 4% to 9%.”

One of the first advisors to use Catchlight is Aaron Marks, founding partner and chief strategy officer at Amplius Wealth Advisors, in Blue Bell, Pa. His firm, which joined Dynasty Financial Partners’ network last year, has $941 million in assets under management, according to its most recent regulatory filing.

Amplius uses a number of lead-generation techniques, from social media posts to lead-generation vendor Zoe Financial, according to Marks. It’s in the process of launching its own podcast, which will be cross-linked to YouTube, providing another source of leads.

Once they have a number of potential new clients, advisors at the firm use LinkedIn and ZoomInfo searches to narrow down lists of potential clients, said Marks, before engaging with leads via cold calls, emails or direct messages on social media sites.

Over the past few months, Marks has begun using Catchlight to rank leads by their potential to turn into new clients, as well as pulling lead insights from the tool to fine-tune his pitch. Using the tool, he’s seen his lead conversion rate go from an estimated one to two new clients per 100 potential clients to three to six new clients per 100 potential clients.

It’s also the first time Marks, who previously used SmartAsset’s lead-generation service, has had a tool that ranks leads, he said.

Catchlight isn’t without its manual processes, however. Advisors who don’t use Redtail will need to input their leads into the tool either one at a time or as a bulk upload via a spreadsheet. Redtail has an integration with Catchlight, but other CRM providers, such as Salesforce (used by Marks), are yet to be integrated. Access to the tool costs $150 per month per seat, with discounts for annual subscriptions.

Overall, Catchlight is worth the monthly fee, said Marks, even though it isn’t integrated with his CRM. “This takes work on my part, but not a lot of work. If I source the names and screen them through Catchlight, it gives me better outcomes. That's how I view it,” he said.

Besides better integrations, Marks said he would like to see Catchlight expand into the top of the lead-generation funnel, or for firms like Zoe Financial to provide rankings like those provided by Catchlight. Increased applicability of the tools in his lead-generation funnel would allow Marks to consolidate his marketing tech stack, he said.

To be sure, advisor-focused firms are already gunning for more functionality. Aidentified aims to provide prospecting and relationship intelligence for the independent advisor channel. Broadridge and SmartAsset also advertise their ability to whittle down big prospect lists into manageable “hot” leads for advisors.

But Catchlight wouldn’t exist if its competitors were complete solutions. “Advisors have always been frustrated with the quality of leads and prospecting isn’t a fun process,” said Dennis Gallant, a strategic advisor for Aite-Novarica's wealth management division, who is familiar with the tool but hasn’t seen it in action. “I could see a lot of advisors seeing [Catchlight] as really valuable.”

Advisors have grown soft in their prospecting and new client development abilities over the past decade, lulled into complacency by a bull market, he wrote last year, in a report called “Top 10 Trends in Wealth Management, 2021: The Future Is Now.”

“In a post-pandemic marketplace, the frequency of engaging new clients and prospects virtually will continue to rise,” according to the report. “Virtual and hybrid prospecting will require the deployment of new skills, tools and technology.”

One of Catchlight’s differentiators is its scale, said Gallant. Its “algorithm-based process” provides an analytical replacement for advisor standbys like LinkedIn, internet searches and advisor intuition.

“The data is more available now than it has been in the past, so it's not like the ability to deliver this was something that's been around for 10 years."

“This is fairly new as far as the capability and analysis," he said. “There’s definitely a need in the marketplace."