Carefull, a first-of-its-kind web application for monitoring the day-to-day financial safety of the elderly, announced Wednesday a pilot program with insurance carrier Nationwide to raise awareness of elder abuse and highlight the tool's ability to prevent it.

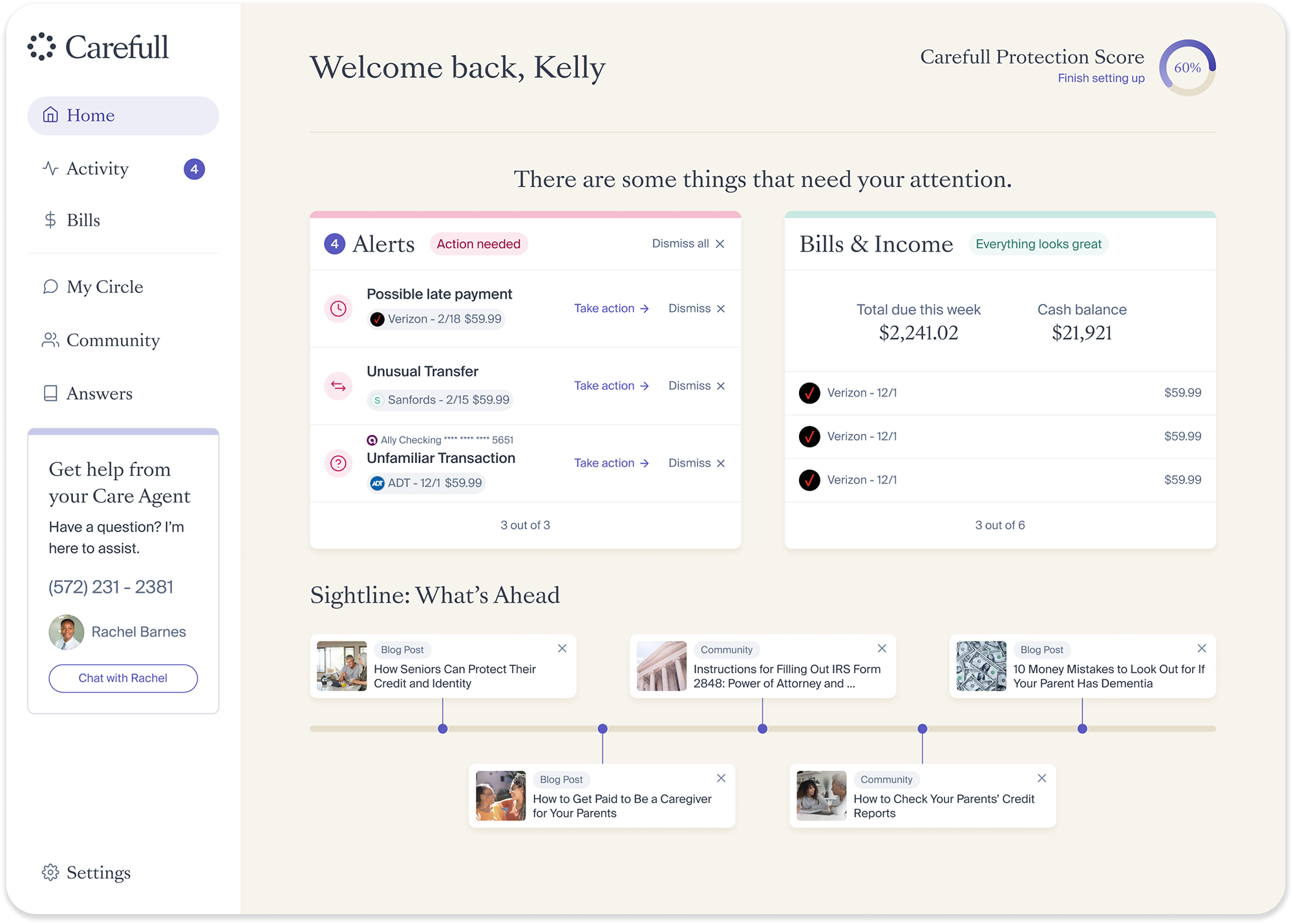

The Carefull application monitors checking, savings and credit card accounts for more than 30 data points that may be "red flags" older adults have fallen victim to elder financial abuse. These include late or missed payments, changes in spending behavior or other unusual banking activity, like recurring cash transfers or charitable contributions that have not been properly vetted.

During setup, the seniors involved select family members and caregivers to be in their “circle of care” to receive notifications if any suspected issues are detected by the application.

In the Nationwide partnership, the carrier is sharing Carefull educational content from within its web environment, as well as directing those interested in the application to the startup’s site where they can sign up for the service.

The Carefull dashboard that consumers see.

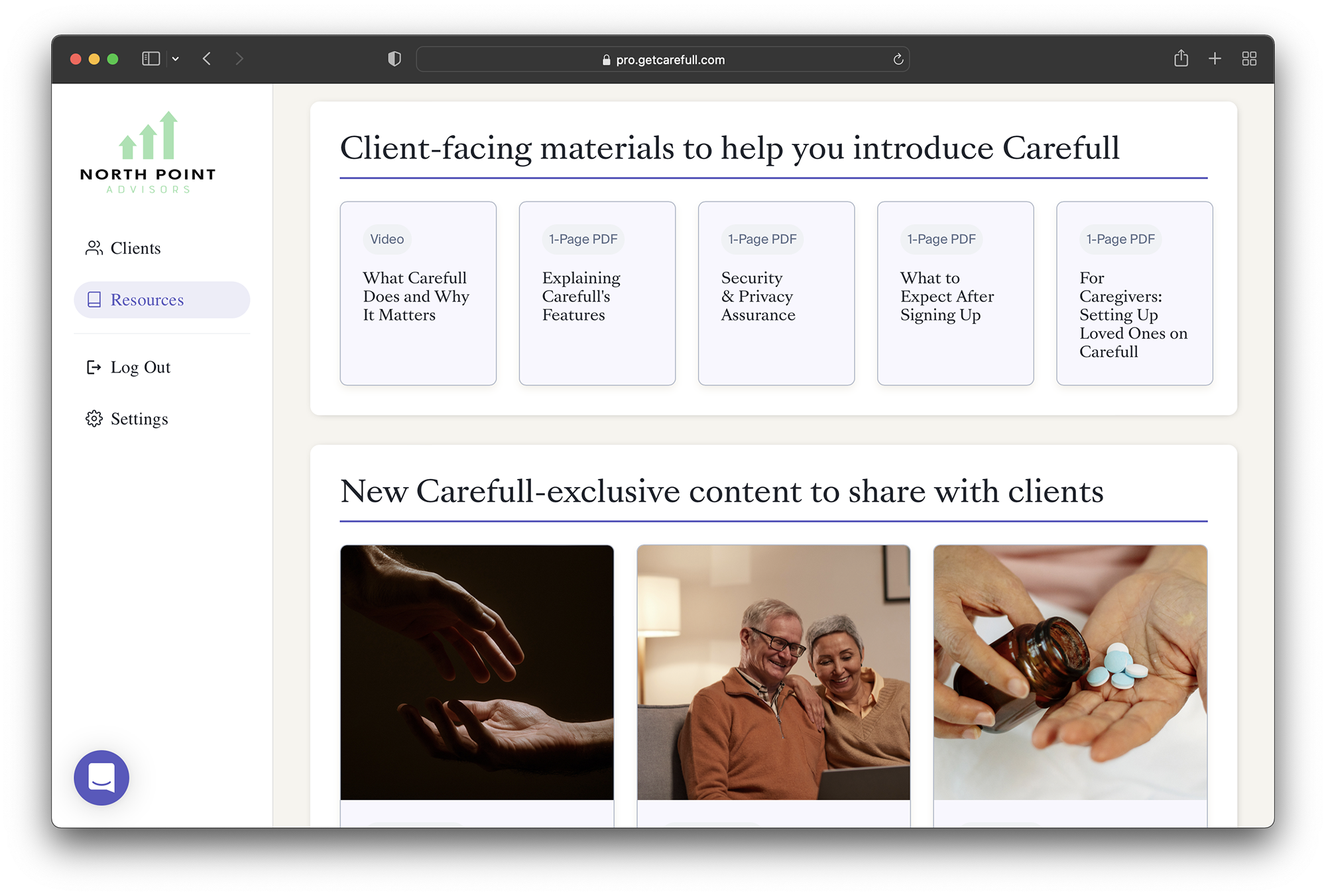

Separately, Carefull co-founder Todd Rovak said that the company rolled out a “Pro” offering specifically for financial advisors late last year.

Advisors can invite clients to use Carefull under their own brands, and manage and monitor notifications on all clients through a unified dashboard. The dashboard, he said, can help advisors know when to check in with clients and possibly intervene to stop any fraudulent activity. Advisors can also send clients content from Carefull's "Take Care" site, with information on preventing financial fraud.

“We have been very fortunate that (account aggregation) is something they have been doing manually for a long time and this helps fill a gap to help them hold onto clients or add clients in terms of the next generation,” said Rovak.

“It represents high impact with a minimum amount of additional work,” he said, noting that the application on average aggregates 4.2 accounts—generally banking accounts as opposed to the brokerage accounts that advisors are accustomed to in their own day-to-day aggregation—and usually across multiple institutions.

And the need has never been greater for tools to assist caregivers. According to the 2020 Caregiving in the U.S. study conducted by AARP (the latest available), 42 million Americans serve as an unpaid caregiver to someone older than 50 years of age. That equals one in five Americans serving in the role, usually for a friend or family member, most often an aging parent (or both parents).

While total estimates of annual losses due to elder fraud in the U.S. are all over the map, ranging from significantly less than $10 billion to more than $100 billion, most suspect it is vastly underreported due either to embarrassment or lack of discovery.

Rovak says the app helps users detect unusual patterns in banking activity. “What some advisors will probably see is systematic drain where a family member, possibly a new spouse, has been living off this person, or taking advantage."

Andrew Blass, president of Atlantic Private Wealth, a Chapel Hill, N.C.–based registered investment advisory with $650 million in assets under management, has been using the nonadvisor version of the Carefull application for some time and recently began beta testing the Pro version with a handful of clients.

While interest in the application often starts with seniors and concerned caregivers, Blass said it has been clients that approach him with concerns about a parent that have adopted the tool.

Blass saw the benefit of the app in his own personal use, when it flagged three checks that were cashed simultaneously from a home cleaning service. Turns out the service simply cashed the legitimate checks all at once, but Blass said he never would have noticed that pattern on his own.

“The use case there became clear to me,” he said. “This is a very real, real, problem, and this is a very elegant way—probably one of many in the future—that will potentially be very helpful.”

The advisor screen on Carefull

Blass said he had no plans to charge clients for the service.

“If it is something useful and can help the client it should be part of the standard service we are offering,” he said. Though there may be issues of having too many clients in the program; the volume of flags being raised on the platform would require some new thinking around workflows, he said.

Pricing is straightforward: Advisors can share the general application with clients at the retail cost of $119 per year. With the professional version, advisors get the unified dashboard and Carefull-generated content for a flat per-seat fee per year, right-sized to their practice size, which ranges from $1,300 to $2,000 annually per seat depending on features and practice size.