“The fundamental challenge for marketing solutions for advisors is that the overwhelming majority of advisors are really, really bad marketers.”

That frank assessment of financial advisors comes not from an outsider but from XY Planning Network’s co-founder, Michael Kitces.

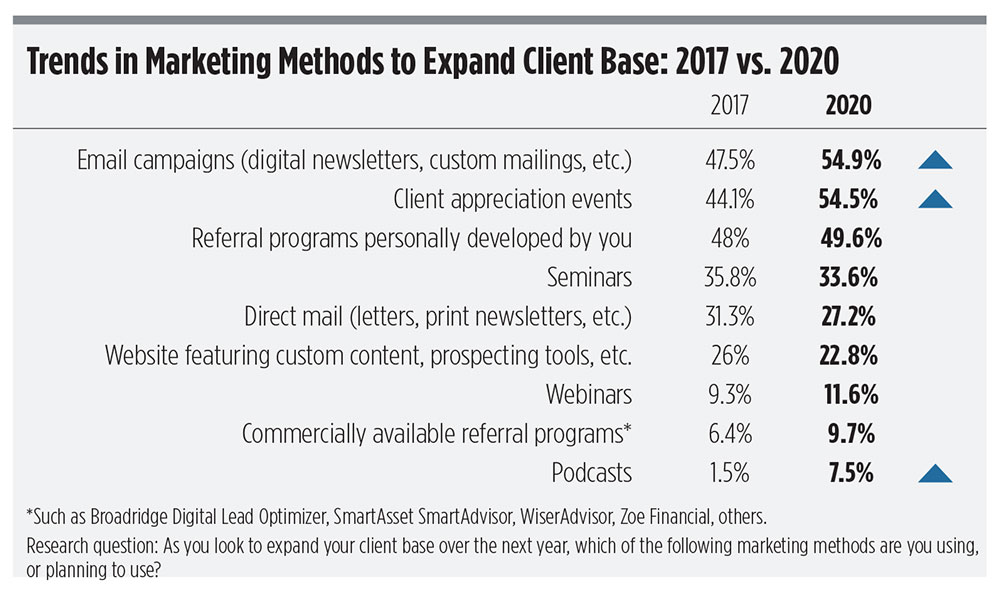

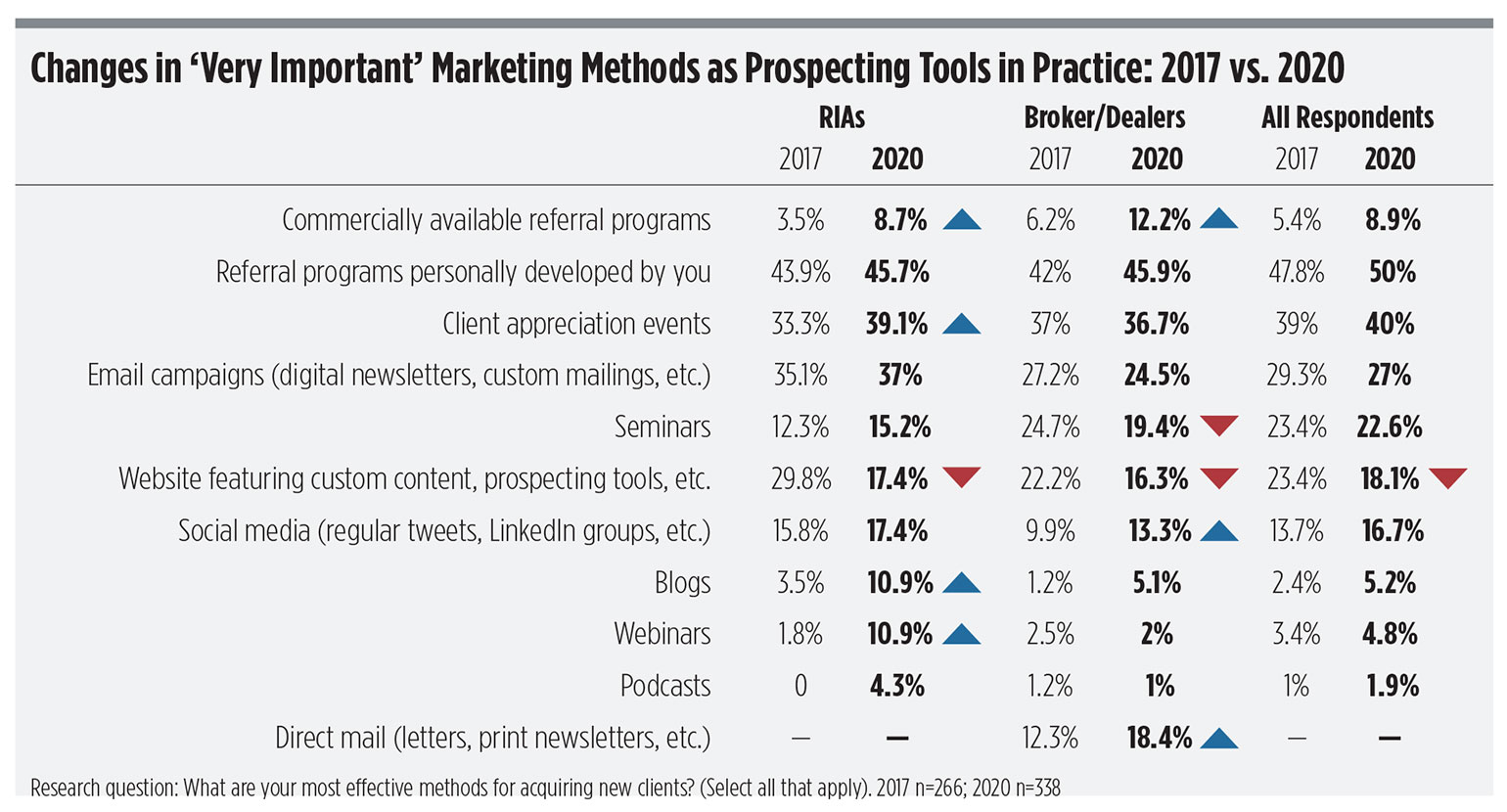

That outlook is even bleaker considering the plethora of digital marketing tools and services available to advisors. There are services promising “hot” leads and online directories for advisors to join. Retirement planning calculators litter the pages of financial news sites, gobbling up prospects’ personal information and spitting it out at the advisors’ feet. The exhibitor halls of industry events and conferences are crowded with reps selling email campaigns and intelligence on where the clients with the most assets live or work.

But all the tools in the world won’t help someone who won’t pay for a tool, doesn’t know how to use it, or can’t even tell the difference between one tool and the next.

“We’re relatively good salespeople,” Kitces explained. “We can prospect and find people and get in front of them and get them to do business with us. But if you look at most of the industry benchmarking studies, typical advisory firms spend no more than 2% of their revenue on marketing. A lot of other industries do 5% to 10% or more.”

A Broadridge survey of 406 financial advisors found that even among big “growth-focused” firms, less than a quarter spent 7% or more of their revenue on marketing. Among the advisors not focused on growth, less than one in 10 advisors spent that amount.

Despite providing tools like custom campaign landing pages, targeted online ads and educational content, Broadridge is vague when it comes to defining which advisors actually benefit from their marketing tools.

“We oftentimes will work first with RIAs and IBDs who tend to be more easily able to adopt new offerings,” said Kevin Darlington, product development lead at Broadridge Advisor Solutions. “That said, we are working with several very large firms on systematically offering [digital lead-generation services] to their advisors as well.”

He later added, without providing names or head counts, that his firm tends to work with registered investment advisors and “smaller” broker/dealers, stating that the “close working relationship between the advisors and their compliance departments” is the reason, in part, that those firms tend to adopt Broadridge digital lead-generation services.

Broadridge’s “Digital Lead Optimizer” costs advisors $1,899 a month, in addition to a one-time setup fee of $1,500. The firm provides advisors with approximately 15 to 35 “qualified leads” per month, said Darlington.

Advisors are wise to do their due diligence and take some of these overly generalized marketers with a grain of salt, said Mike Van Kempen, COO of fintech firm U-Nest and former director of growth for consumer-oriented digital investing firm Acorns. He spent nearly five years at Acorns, guiding the company through the opening of millions of new accounts.

With the company in hypergrowth mode, adding investing features and some 200,000 accounts per month, at-scale marketing was vital for the startup. While marketing for fintech startup firms and independent advisors might appear different on the surface, the lessons learned by Van Kempen apply.

Flat fees for leads tend to produce bad results, he said. “I’ve been burned quite a few times going down that path.” More often than not, information sold as “hot” leads ends up being bad or doesn’t convert into a true client further into the marketing funnel, he said.

A better solution is to pay on a per-lead-conversion basis or require a vendor to provide a minimum number of leads, he said. By establishing their demands upfront, customers are more likely to squeeze positive results from their marketing vendors. Plus, it makes analyzing results that much easier. “I like to have full visibility into where our marketing dollars are going,” he explained.

For advisors considering a marketing plan, Van Kempen recommended starting with an analytical understanding of their own marketing funnel and picking up a tool like Amplitude Analytics or Branch to measure returns on marketing dollars. Where a lead is coming from and where it drops out of the funnel, if it does, is critical information to have, he said.

Furthermore, don’t be afraid to start small and ask for a reference. A trial marketing run gave Van Kempen flexibility and a better idea of what to expect in a larger marketing campaign. It also allowed him to endure only the occasional lemon, steering clear of groves of lemon trees.

Being prepared to handle a new lead is also crucial. It may seem counterintuitive that an advisor running a marketing campaign would be slow on the draw when reaching out to a prospect, but AJ Smith, vice president of content and financial education at SmartAsset, has seen that scenario play out all too often.

“Advisors who are most successful on our platform are excited and ready for leads,” she said. “They’re going to reach out quickly and be ready to help. A high-intent customer is a different customer.” Some advisors are caught off guard when a lead comes in who has done some research and is looking for answers to specific questions.

The firm generates leads through an online process using devices like calculators and widgets that ferret out client details, like their assets or where they’re located.

“This is meeting people where they are,” she said.

Part of the lead-generation service offered by SmartAsset, called SmartAdvisor, includes an account manager who can help prepare advisors with suggestions on best practice for interacting with leads.

RIAs are the biggest customer segment for the firm, and advisors are charged based on the number and type of leads they’re looking for. The firm has a 5% to 10% conversion rate, she said.

For advisors using the service on a month-to-month basis, the firm charges anywhere from $25 to $240 per lead (depending on the size of the assets brought by a client). Smith said the price-per-lead is less expensive for firms operating under a longer-term contract but wouldn’t provide specifics.

Each lead generation provider tends to have its own prerequisites for advisor customers. SmartAsset requires advisors to be registered with the SEC or a state regulatory body and have no disciplinary disclosures within the past 10 years. Another firm, WiserAdvisor, requires its advisors to have at least five years’ advising experience before they can work with the marketer. They must also be fee-based.

Since 2011, WiserAdvisor has focused on providing turnkey leads for financial advisors using paid search terms and geography, said CEO Rishi Bharathan, eschewing calculators and downloadable materials to lure in the prospects.

It’s an approach that catches leads further into the marketing funnel, he said, adding that advisors close around 10% of the firm’s leads. “I’ve never spoken to a financial advisor that’s not been able to close somebody that’s been in front of them,” he explained. “The problem they have is getting that person in front of them.”

WiserAdvisor charges an annual membership fee that ranges from $1,000 to $2,500 and then another fee on each lead, ranging from $40 to $300, depending on the size of the client assets and the client’s location. “We fully expect that that first year’s revenue will more than cover the cost of the service,” said Bharathan. “The reason that our service, or any credible online lead-gen service, makes a lot of sense is the lifetime value of that client. Most consumers are not switching financial advisors every couple of years.”

Despite the plethora of tools and models, however, teaching advisors how to market remains a challenge. “Because advisors are so weak at marketing, giving them better marketing tools often doesn’t help,” said Kitces. “They can’t effectively use them because they don’t build a whole marketing funnel.”

Today’s “second generation” of marketing tools—like Snappy Kraken, which runs websites and digital marketing campaigns for advisors—might be a better solution, he said, because they don’t just generate a list of prospect names but basically do much of the marketing on behalf of the advisors themselves.

The best advisor-focused marketing tools build the funnel from the top to bottom, with content provision, social media, email campaigns and even the creation of webpages, he explained. “Advisors really need help with the whole process from end to end,” he said. “It’s less marketing technology and more marketing outsourcing to a provider that happens to use their own good technology to execute the process.”

As more and more advisors choose to join or run independent firms, standing out from a crowd becomes all the more vital. Marketers know this. Advisors, it seems, are still figuring it out.