Envestnet is acquiring the estate and legacy planning technology of Apprise Labs. Terms of the deal were not disclosed.

The deal, announced Tuesday, will close with Edmond Walters as the sole stakeholder in Apprise Labs, with Envestnet and Envestnet MoneyGuide's Tony Leal dropping out of the joint venture.

Meanwhile MoneyGuide will be adding detailed cash flow reporting, estate and legacy planning, trust modeling and inheritance fairness planning technology from Apprise to its financial planning offerings. The new planning services will be called Wealth Studios and will be encapsulated within MoneyGuide.

Apprise Labs took the advising world by surprise in early 2019, with former competitors teaming up to make MoneyGuidePro’s goal-based planning more competitive with the estate planning offered by eMoney Advisor and Advicent’s NaviPlan. At its launch, it was billed as a “scenario where everyone wins,” according to Leal, then co-CEO and CTO of PIETech, which owned MoneyGuidePro before it was acquired by Envestnet later that year. One consultant called it “the perfect storm of vendors.”

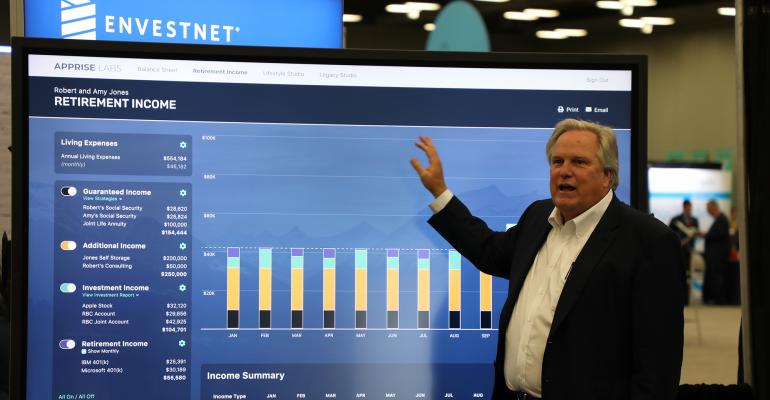

Officially, Apprise Labs announced it was open for business in April 2020. But the tool was built to impress in an in-person setting, with advisor presentations on jumbo touch-screen TVs where clients and advisors would sit together in an office. Apprise Labs had apparently signed a major broker/dealer in the first part of 2020, but it was never named and the tech provider wasn’t even mentioned when Envestnet launched its Trust Services Exchange last month.

Now that Envestnet has acquired the Apprise Labs tech, the only place to utilize the estate planning developed by Walters will be through MoneyGuide Wealth Studios. The technology will debut with beta testers in June and be fully deployed by the end of the year.

By bookending goals-based MoneyGuide with cash-flow-based Finance Logix and the Apprise Labs tech acquisition, Envestnet will focus on bridging the two different financial planning styles—and engines—into one, said Leal, now president of Envestnet | MoneyGuide. He wants the zealots on both sides of the planning spectrum to be fully satisfied with the planning available at Envestnet.

“We're going to offer both, but it'll be one simulation engine,” he said. “From an efficiency and scale standpoint, why carry two around?”

Reconciling the results from two calculation engines could cause headaches for advisors on Envestnet’s platform, according to competitors.

“If [advisors] have different calculations engines running in these two applications, how do you reconcile a significant disparity when a client graduates from one application class to the next?” asked Anthony Stich, COO at Advicent. “Which engine wins out in the end when it comes to the calculations?”

Indeed, there’s a fundamental difference when it comes to calculations between cash-flow and goals-based planners: Which comes first? Does cash flow planning lead to goals-based planning, or should goals-based planning produce the planning outline that’s later fine-tuned by cash-flow-based planning? Envestnet wants to make the question a moot point, by providing the best planning experience for both styles, but advisors will ultimately crown the victor.

Digital estate planning software developer Vanilla, led by Steve Lockshin, is also taking notice of Envestnet’s announcement. “We welcome all players into the complex estate planning arena,” he said. “Advisors are woefully behind in providing complete estate planning analysis for clients of all sizes. Competition, collaboration, and adoption are all important when it comes to best serving clients.”

The deal raises questions of leadership and cooperation, as well. While Walters is now the sole stakeholder in Apprise, the working relationship between Apprise and Envestnet will remain unchanged, said Leal. “The relationship was created to create this,” he said, referencing the technology underpinning Wealth Studios.

“We've worked the same way we did before and after the transaction. He’s still who I look to for guidance and creativity in the estate realm,” he said. “We’re talking about the future feature set.”

“We found that the MoneyGuide, Envestnet, Apprise relationship really, really works well,” he added. “We just changed the ownership structure, but the working relationship is exactly as it was before the transaction.”

Over the past year, the sometimes-bombastic Walters has been quiet as founder and CEO of Apprise Labs. He did not return request for comment following Tuesday’s announcement, offering a statement at the bottom of Envestnet’s press release that he was, in part, looking “forward to continuing our collaboration to provide new ways for advisors to improve the way they connect with their clients.”

“Edmond is known for his big ideas,” said Stich. “Two years ago, Walters walks back up to the stage and is celebrated for his new venture with Envestnet, and at the time, MoneyGuide. They make a lot of commitments around the powerful nature of this new tool and how it will impact the market.”

“Fast forward two years later, and he's exiting stage left, creating another visionary vacuum,” he said.

Leal said Walters has simply been busy. Walters had to quickly mature a complex product, bring it to market and get it to work with—and look good with—existing technology, he said.

“He had everything from large enterprises to mid-size firms, to ensemble practices, to individualize RIAs that he piloted/ran it with, and he had gotten feedback from all those types of firms,” said Leal. Apprise Labs’ tech “matured to a point where it's time now to get out there and truly maximize it from a sales standpoint, which means we needed it all under one umbrella.”

COVID-19 has also impacted the direction of technology, evidenced by the lack of oversize touch-screen TVs in Tuesday’s announcement. “That story is incredibly different,” acknowledged Leal. “The marketing during COVID-19 is different. I don’t think it’s ever going to go back to what it was.”

While some clients may eventually end up back at their advisor’s office, ready for a fancy presentation, far more will be accessing Apprise Labs’ tech via MoneyGuide at home, through the Wealth Studios portal, he added.

That’s not to say that Envestnet and Walters are parting ways, however. Envestnet “will continue to partner with Edmond [Walters] on future ventures and technologies that advance the [Envestnet] ecosystem,” according to an Envestnet spokesperson. Unless something changes, however, the deal marks the end of the formal joint venture between Envestnet, Leal and Walters, leaving the founder of eMoney alone at the helm of Apprise Labs—in a landscape that looks far different from the one in which Walters first rose to prominence.