(Bloomberg) -- As Britain’s housing market braces for a pivotal year, a cliff edge awaits the nation’s buy-to-let investors.

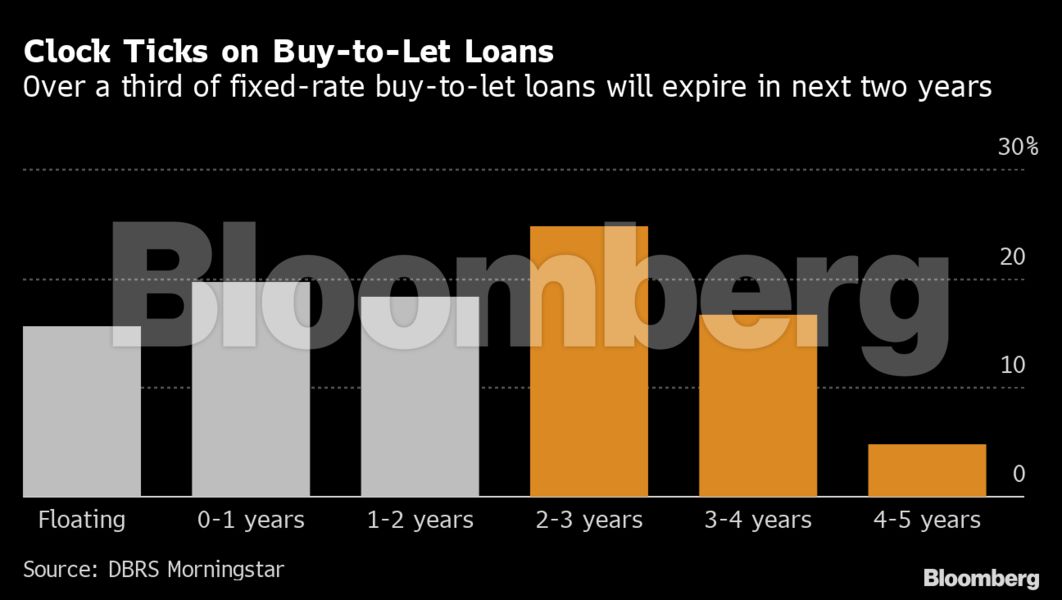

More than a third of buy-to-let fixed-rate mortgages are due to end in the next two years, leaving these landlords vulnerable to the highest interest rates since 2008. And almost one in six buy-to-let loans are floating deals, meaning payments are already rising as the Bank of England increases rates, according to DBRS Morningstar.

“Borrowers of loans whose fixed-rate periods end within the next two years will feel the pinch earlier and more significantly as the loans move to a standard variable rate or are locked in at a higher interest rate,” Alejandro Tendero Delicado, analyst at DBRS Morningstar, wrote in a report. “They may face the brunt of higher interest rates in the medium term once their fixed-rate periods end.”

Landlords are more exposed to rising mortgage rates than other borrowers, according to broker Savills Plc. That’s because many have interest-only loans that feed through rate changes quickly.

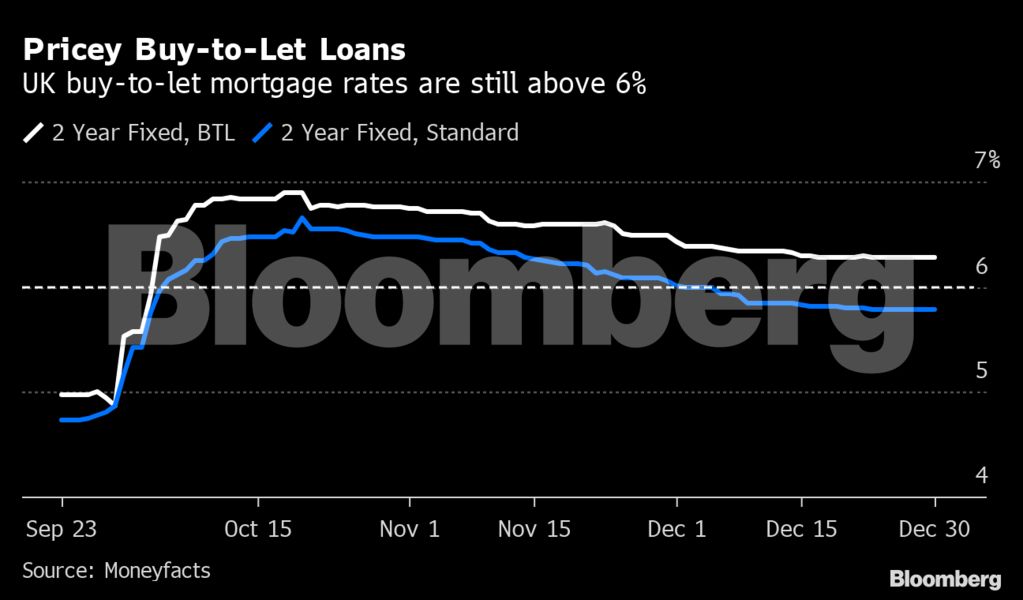

The average buy-to-let mortgage could be fixed for two years at 6.27% on Jan. 4, after reaching highs of 6.9% in October when the government’s mini-budget sent rates spiraling. Buy-to-let loans aren’t settling down as quickly as standard deals.

“Over the last few months, we have witnessed a steep decline in the number of buy-to-let mortgage deals and have seen a number of landlords having to either sell up or raise rents,” said Daniel Chard, conveyancing solicitor at law firm Bird & Co Solicitors.

Chard’s claims are backed up by BOE Deputy Governor Jon Cunliffe, who last month predicted that some of Britain’s 2 million buy-to-let owners will be forced to sell “and take capital profits” since the vast majority are on interest-only deals. The financial crunch for landlords would have a direct impact on homes available for rent, which are already in limited supply.

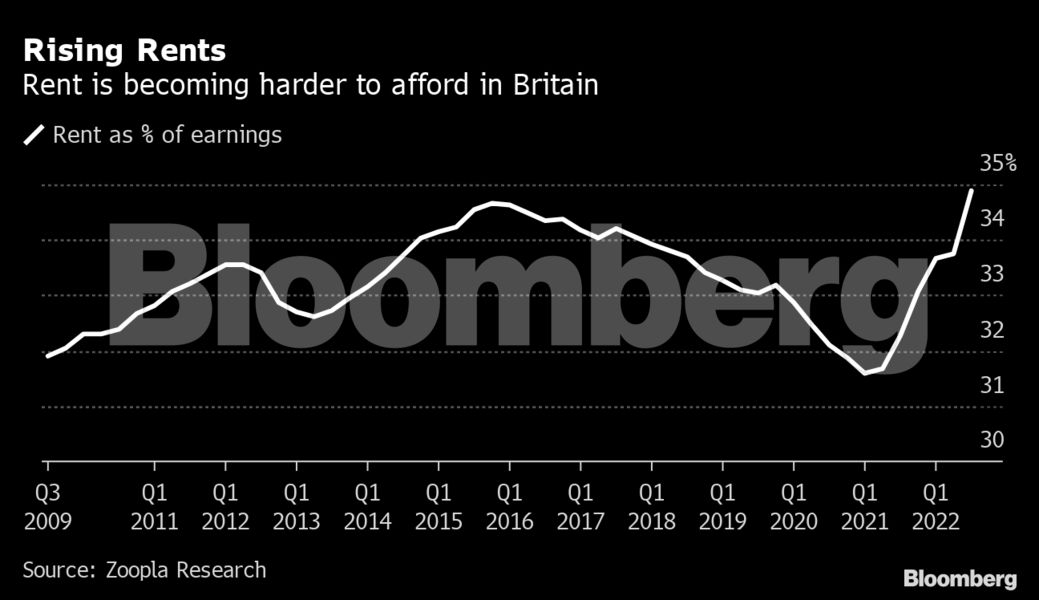

Property portal Zoopla has reported that the cost of a new rental agreement rose 12.1% in the year to October, far outstripping average annual wage growth of around 6%. Rents are likely to increase at a slower pace this year because landlords won’t be able to pile even more pressure on tenants’ budgets in the middle of a cost-of-living crisis, last month’s report added, meaning landlords face the risk of losing money on the homes they let.

“All this will do is exacerbate an already serious shortage of rental properties, which is leaving tenants struggling to find a place to call home,” said Chris Norris, policy director for the National Residential Landlords Association.

Buy-to-let landlords are set for another blow in April when Chancellor Jeremy Hunt’s decision to cut capital gains tax allowances comes into effect. Exemptions will be more than halved to £6,000 and then cut again to £3,000 from April 2024, meaning owners looking to sell up will have to pay duty on properties that sell for more than the amount they paid for them.

Regardless, landlords may find it tricky to sell their properties as demand dries up. The number of homes sold with offers from three or more buyers fell to 30.9% in December, the lowest in more than two years and down from a peak of 42.7% in January 2022, according to broker Hamptons International.

“The buy-to-let space is becoming a less attractive investment for individual landlords,” said Jackie Bowie, head of Europe at risk consultant Chatham Financial. “Landlords may achieve higher yields elsewhere in places like the bond market given how much interest rates have risen.”

Still, owners with several properties may find some comfort in their fixed-term loans expiring gradually. And for landlords whose properties are registered under a limited company, mortgage interest is treated as a business expense, meaning it’s possible to deduct interest costs before paying corporation tax.

“Investors with five or six properties may be shielded to higher rates somewhat by a staggered refinancing, rather than a big hit all at once,” Bowie added.

© 2023 Bloomberg L.P.