Rossby Financial, a Melbourne, Fla.-based registered investment advisor launched in March 2023, has added three female-led wealth management practices to its platform with a combined AUM of about $150 million. All three join from Cambridge Investment Research, and cited Rossby’s subscription fee structure as one attraction.

Red Oak Advisors, led by Jennifer Szeklinski, joins Rossby, and is based in the greater Milwaukee area. Szeklinski’s firm focuses on financial coaching and generational wealth building.

Rossby also added Life Strategies Financial Partners, a firm based in Augusta, Ga. and led by Kelly Renner. The firm provides financial planning for small business owners, widows, retirees and military or former service members.

The RIA also welcomed EViE Financial Group, an Upper Marlboro, Md.-based practice led by Melissa Reaktenwalt. The firm focuses on socially responsible investing.

Rossby Financial was created early last year by Andrew J. Evans, a former executive vice president at Tag Advisors, a $14 billion AUA office of supervisory jurisdiction with Cambridge Investment Research.

Evans said he was tired of waiting for the industry to catch up with the rest of the world in terms of technology and “antiquated” pricing. He thought advisors should have more flexibility around how they select and pay for the tools and services that best suit the needs of their practice.

“It was time for a change,” he told WealthManagement.com. “Most firms are just doing continuous improvements inside of the systems they already have, as opposed to biting the bullet when something doesn’t work and saying, ‘Let’s burn it down and build a new one.’ They may have put money into it, but if it’s not working, get rid of it. The attitude I had was, 'why are we waiting around for these things? Why don’t we just make it better?'” he said, explaining that the new venture is an attempt to do exactly that.

Evans filed a Form ADV with the U.S. Securities and Exchange Commission that allows for a broad range of service offerings and structures, laid the groundwork to offer an ever-evolving menu of technology tools and revamped the traditional payment structure. The goal is to enable advisors to provide a bespoke set of family office-type services without running into compliance roadblocks or spending money on components they won’t use.

Headquartered an hour south of the Kennedy Space Center on Florida's east coast, Rossby has a total of $185 million in assets. It currently has 10 advisors across six firms on the platform, including Evans’ own small, private practice. That does not include EViE Financial Group, which is still transitioning about $50 million in assets to Rossby.

It may seem innovative in the wealth management space but, as Evans will tell you, his approach to pricing is nothing new.

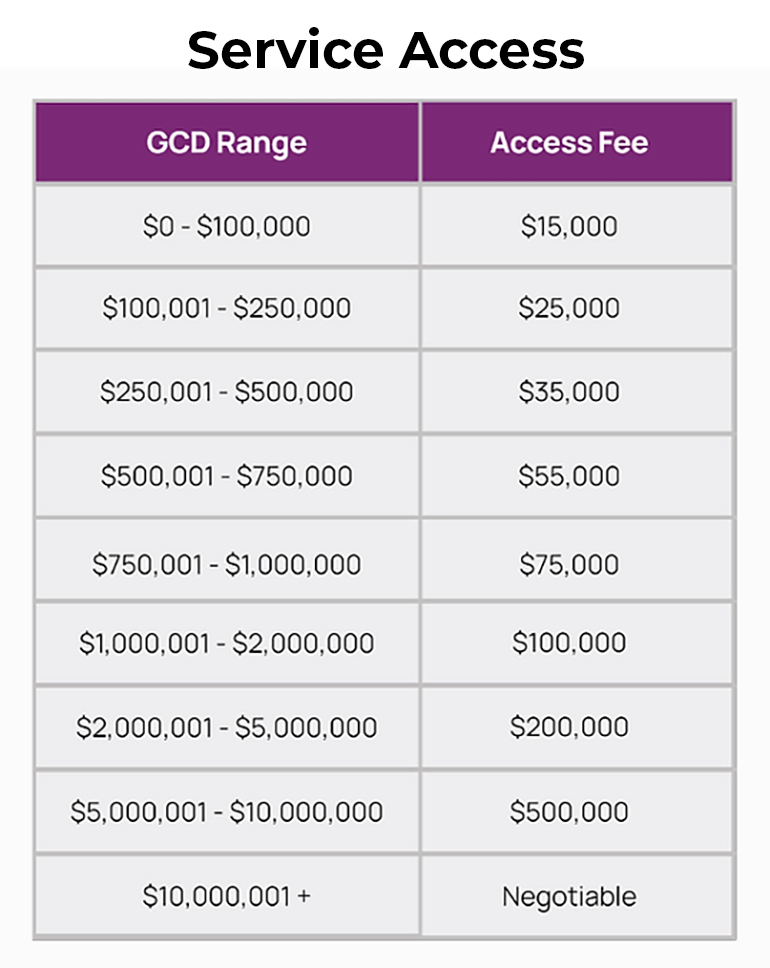

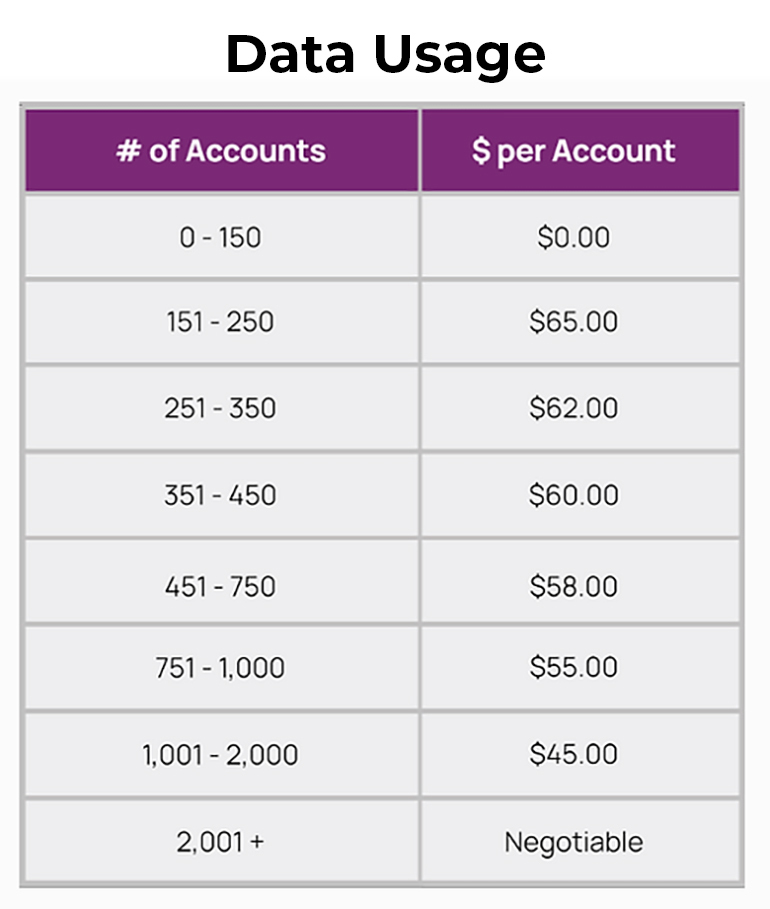

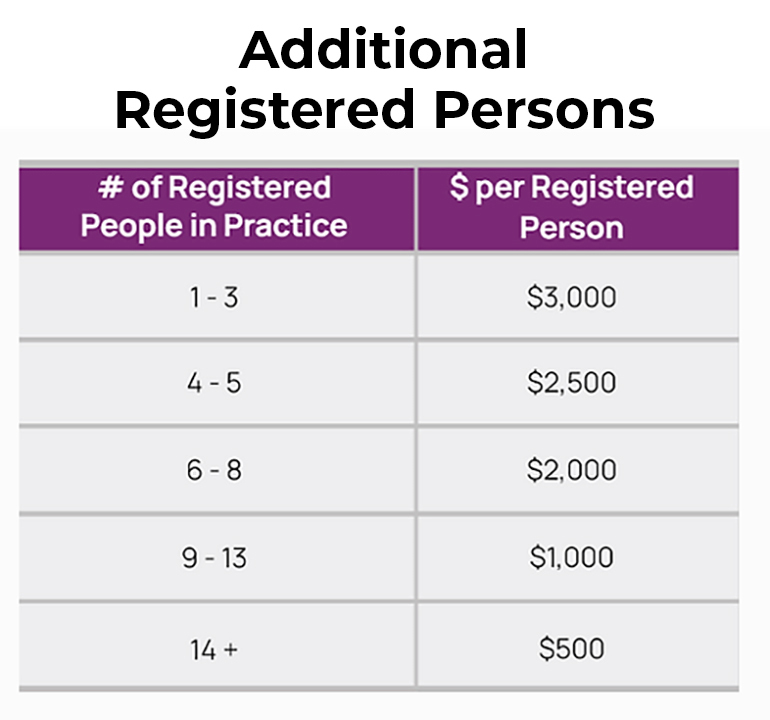

“We do not have basis points,” he said. “We don't have payouts. You have an access fee, you have a data charge, and you have a per advisor charge.”

The structure is modeled after cell phone contracts. The access fee covers the bare essentials, such as recordkeeping and regulatory tools, including compliant text messaging, while the data costs apply to any additional tools they choose to access and how many client accounts they support. Levied to offset the cost of E&O insurance, the per advisor charge applies to any additional registered advisors using the platform, but not support staff.

“You're paying for what you need at a baseline level, and then everything else is yours to do with what you please,” Evans said. “I don’t care what CRM you have; I don't care what tool you have. As long as it reports to me, it doesn't matter.”

Rossby’s overhead is overwhelmingly composed of fixed costs. It will also enable him to offer fractional packets of certain services and negotiate large group pricing on others, he added, which will eventually allow him to reduce platform prices as more firms join.

“I love the idea,” said Nexus Strategy President Tim Welsh. “I think it's very transparent and all that good stuff, but it's extremely expensive.”

Welsh gave the firm credit for “innovative unbundling of bundles.”

Christopher Marsico, owner of the first firm to join Rossby and an equity partner, pointed out that discount deals are available, including a 15% price break for signing a three-year contract and a “kickstarter” promotion for advisors early in their careers—a flat annual fee of $5,000 over the first three years.

Rossby is willing to add just about any desired tool that passes its due diligence process, Evans noted. The firm’s primary custodian is Charles Schwab, but advisors are welcome to connect with any (and as many) others as they would like, including SEI.

As the Black Diamond-based platform grows and more providers plug in, Evans said he plans to add new employees at around the same rate as he adds new firms to the platform. He expects to hire eight or nine this year, bringing the firm to no more than 16. The plan is to pair seasoned professionals with emerging talent to ensure the firm’s longevity and continuity.

He extended equity ownership to all early joiners, a limited window expected to close early this year.

Rossby is open to M&A opportunities, he added, but isn’t interested in serving end clients. Rather, the purchased firm would be absorbed, and its book of business would be transferred to a younger platform advisor.

Evans said the firm may consider taking on a private equity partner or other external capital down the road. But he said there’s no need for that in the near term, and he would be wary of giving up more than a small minority.

Echelon Partners Managing Director Mike Wunderli said the business model reminds him of a small turnkey asset management program.

“Many other pseudo-TAMPs have a similar pricing structure,” he told WealthManagement.com, describing an ostensible markup as “smart and justifiable." He also noted the apparent use of a “customized API wrapper” to offer a range of third-party apps on a single platform, as well as Rossby’s stance on M&A.

“That’s also in line with many of the TAMPs that we are speaking to recently,” Wunderli said. “It’s a solid model because it’s a value-add to their clients, grows their client base, could be a profitable lending business, and could eventually be a way to get equity ownership in their clients’ businesses if they decide to go that direction.”

“Where I believe we’ll win is with the under-50 advisor who is very tech-forward and planning-focused, and really wants to live and operate in the true digital nomad sense,” said Evans. “Someone who really embraces flexibility and transparency, with full and fair disclosure into what it is they’re paying for.”

The firm is named after 1930s meteorologist Carl Rossby, who laid the groundwork for understanding atmospheric turbulence with his work on "Rossby waves,” which ultimately made it safer to travel by both air and sea. Evans said he wanted a name that would reflect “calm, blue ocean and clear skies.”

Managing Editor Diana Britton contributed to this report.