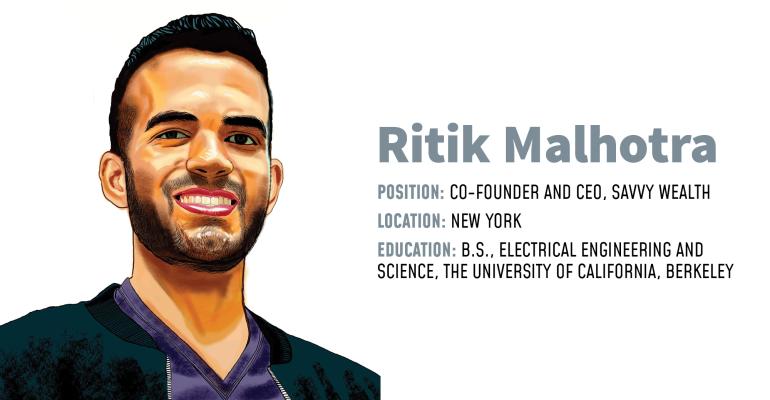

When he was 11 years old, Ritik Malhotra started a small business developing turnkey web applications. Before he turned 19, he worked project-based engineering jobs with Intel and Twitter. And by the time he was able to legally drink, he had launched his first full-scale technology start-up.

After he sold his cloud-based data storage system to Box in 2014, Malhotra found he had more money than he knew what to do with—and needed advice. The search for a financial advisor formed his first impressions of the industry. He says he “fell in love” with it but found the technology advisors used surprisingly lackluster.

Between then and now, Malhotra, 31, created and sold another company—a blockchain-based financial ledger for multi-party digital transactions now known at Brex Cash—before putting his talents to work building Savvy Wealth with co-founder and CTO Muller Zhang, and creating an ‘all-in-one’ wealth management platform for its affiliated registered investment advisory firm Savvy Advisors.

Between then and now, Malhotra, 31, created and sold another company—a blockchain-based financial ledger for multi-party digital transactions now known at Brex Cash—before putting his talents to work building Savvy Wealth with co-founder and CTO Muller Zhang, and creating an ‘all-in-one’ wealth management platform for its affiliated registered investment advisory firm Savvy Advisors.

What sets Savvy apart is its approach to solving the technology and human advice problem. The firm has taken a modular, open architecture approach to ensure flexibility and adaptability as the industry evolves. A strong culture of feedback and collaboration allows Savvy to stay ahead of the curve by making iterative improvements based on needs and pain points identified by its growing stable of advisors.

The son of Indian immigrants, Malhotra’s father worked in an emerging Silicon Valley and introduced him to his first computer at age 5—an expensive investment in the 1990s for a family living in a one-bedroom apartment, but one the elder Malhotra thought would help with his own work and expose his son to a possible career path. His mother introduced him to the Internet via a dial-up connection.

“I just fell in love with the fact that you could use this seemingly magic box to go and access all this information online, games online, everything at your fingertips,” he said. “As I grew up, it evolved from a this-is-so-cool-that-you-could-just-do-this magic box thing to wanting to figure out how I could build it myself. I was really just driven by fascination until I realized that—wow!—I could make money and a career out of this.

“I really think of technology as a way to enable rich experiences and make things so much more efficient,” he said.

Yet Malhotra found rich client experiences and efficiency were two things lacking in most advisor tech. Describing the traditional wealth management model as surprisingly analog given the lucrative nature of the business, Malhotra said no one had yet cracked the combination of technology and human financial advice.

“I had spent so much time in this industry, just as a personal passion, and talked to over a hundred advisors who really resonated with the lack-of-technology problem,” he said. “I finally said, ‘Let’s go build it.’”

Malhotra describes Savvy Advisors as a decentralized, AI-enabled technology platform consisting of three main components: Fully digital client onboarding and account opening; an integrated advisor dashboard with a CRM, financial planning and investment tools, including proprietary direct indexing capabilities, and a digital client portal that allows clients to view and manage their portfolios, track performance, communicate with their advisor, schedule meetings and manage files.

Perhaps even more unique are the financial backers, including some that worked for or continue to work at an array of technology companies outside wealth management, including Venmo, Uber, Opendoor, Paypal, Brex and others.

Building the technology from the ground up may seem like a small distinction but the impact is much larger, Malhotra said, “because, by default, you’re thinking of how to improve the experience and make things efficient from the get-go, and I think it’s the best solution to the efficiency problem.

“I really think the more that we do here, and even the more that other competitors are going to do, really validates that this is the new way of working. There will be a shift to this more tech-forward way of working, and I think we’re starting to see that with our recruiting and growth,” he said.