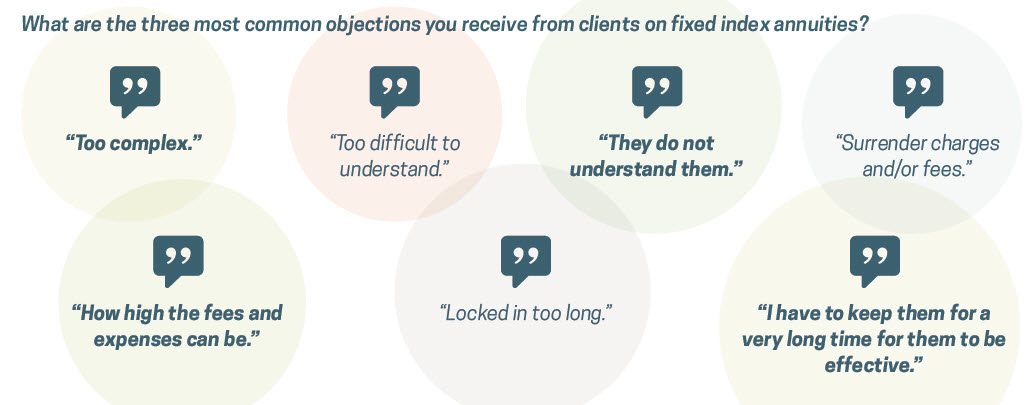

Nearly a quarter of advisors cite complexity or a lack of understanding as their number one objection to using fixed index annuities. These findings suggest that, while more advisors are recognizing the value of these products and using them in their clients’ portfolios, their complicated nature may be holding them back.

Nearly one in five advisors cited objections related to surrender charges or other fees associated with fixed index annuities, suggesting the cost of these products

may be a secondary issue holding back their growth. Other common objections cited caps on gains, which advisors say is limiting the growth potential of these

products for their clients.