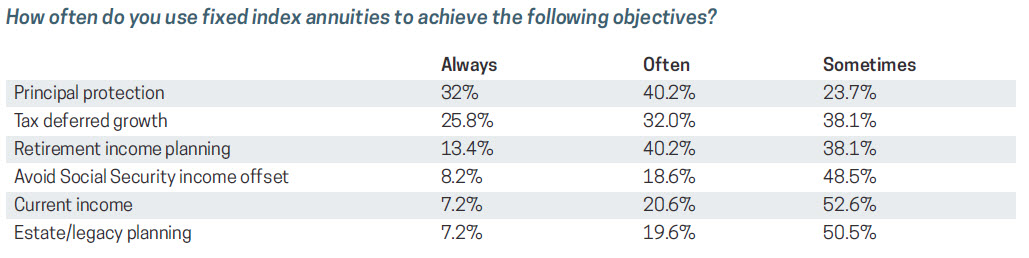

When advisors use fixed index annuities, they appear to do so in a highly targeted fashion. On average, advisors report that their clients hold about 12% of their portfolios in fixed index annuities. Advisors also report using the products in client portfolios most frequently for retirement income planning, principal protection, and tax-deferred growth. These objectives align with survey results showing their use predominantly for clients over the age of 50 with an average net worth over $1 million.

When considering recommending a specific annuity to clients, advisors report that the most important features are principal protection (87%) and downside market protection (86%), ahead of predictable income (57%). In keeping with their common objectives, advisors see features such as liquidity as much less important. Only 18% of advisors indicate they weigh liquidity as a very important factor when recommending a specific fixed index annuity.

More than two-thirds of advisors say they combine traditional mutual fund spend-down strategies with insurance products such as annuities as a way to increase the potential for income success for clients dealing with retirement issues. As one survey respondent noted, “clients have peace of mind knowing that their fixed expenses are covered with guaranteed income from annuities that they can’t outlive.”