Outsourcing key business functions, like legal and compliance tasks or even investment management, can make financial advisors more efficient—but doing so won't relieve their stress.

Or so one can conclude from the findings of a couple of recent industry studies. By the numbers, 43 percent of advisors outsource some part of their business to external consultants, third-party providers or other specialists, according to a recent survey by Fidelity Investments. Investment management or portfolio construction, technology, and legal and compliance were the most common things outsourced, and the majority of advisors surveyed said they were able to do that successfully.

The advisors also said outsourcing is essential to achieving scale while growing a firm. Those who outsourced tasks managed more assets—$145 million for those who did outsource compared with $110 million for those who did not—and had greater compensation as a result, $365,000 compared with $335,000, respectively, according to Fidelity's study.

But advisors who think outsourcing will lead to more time on the golf course, or reduce their overall stress, will be disappointed.

Advisors are already more stressed than the average American, and outsourcing business functions is not a predictor of lower stress, according to the latest Insights Into Advisor Wellness study by Northern Trust's FlexShares.

In 2018, growing their business organically was the top thing advisors were stressed about, followed by regulatory and compliance concerns.

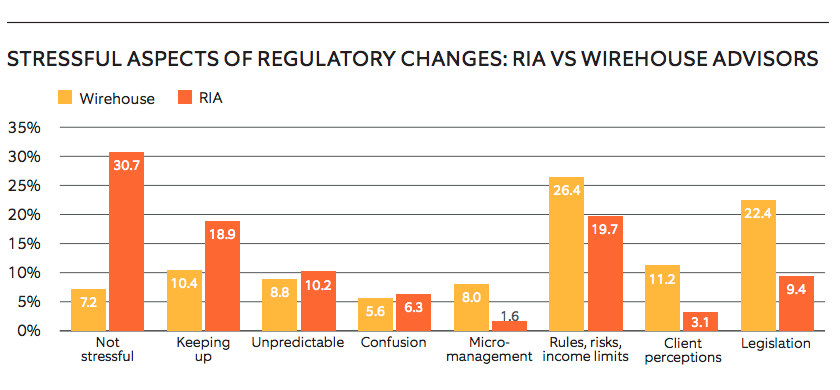

When it came to regulatory changes last year, wirehouse brokers were far more concerned about legislative changes. Mandated by Congress, the Securities and Exchange Commission has been considering changes after the Department of Labor’s fiduciary rule for advisors to retirement accounts—which went further in assuring a best interest standard—did not survive a court challenge. Registered investment advisors weren't as stressed about regulatory changes, but they were concerned about keeping up with whatever changes might have occurred, according to the FlexShares study.