Focus Financial Partners, the consolidator that went public last summer, led a record first quarter for deals involving registered investment advisors.

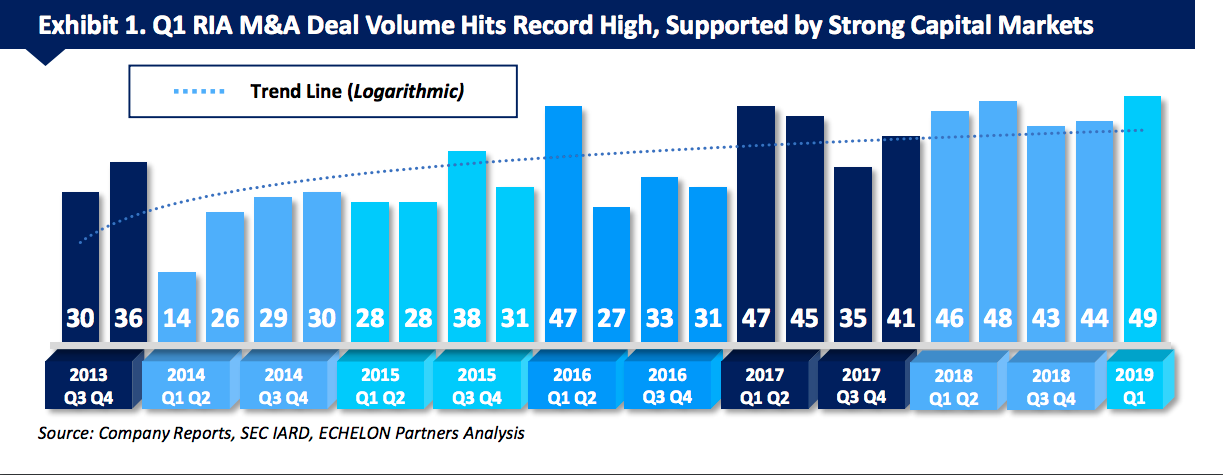

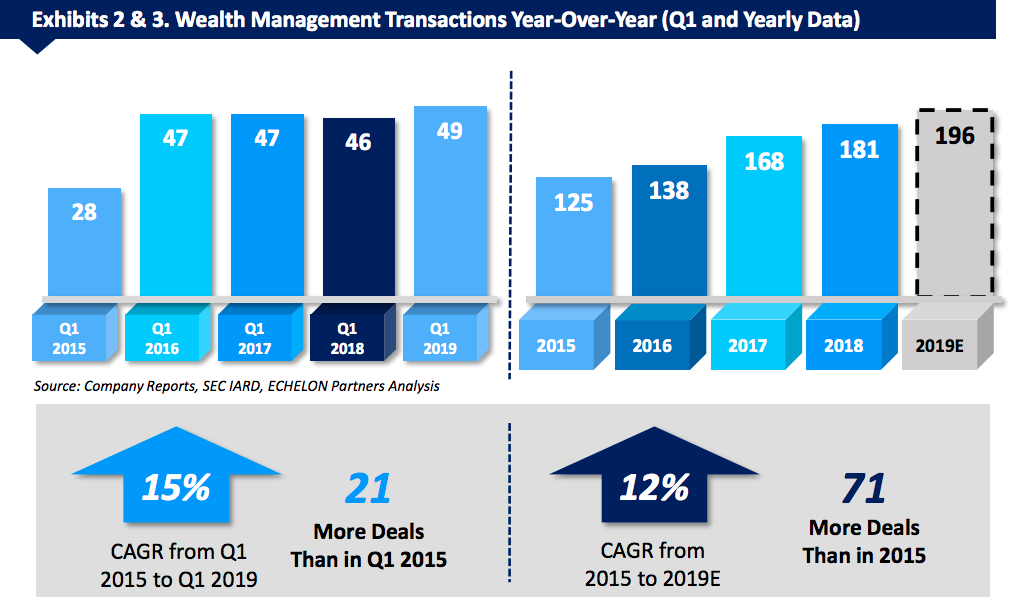

There were 49 mergers and acquisitions involving RIAs in the first quarter, the highest volume in any three-month period since Echelon Partners, a Los Angeles-based investment bank and consulting firm focused on wealth and investment managers, began keeping track in 2013. Focus and its affiliated firms accounted for 11 of those deals, a quarterly high for the firm.

Deals exclusively between RIAs tallied 17 in the first quarter, or about a third of the total. If that trend continues, RIAs will be buyers in 69 deals this year, a 41% increase over 2018. Those deals tend to be smaller and dragged down the average deal size by 13% in the first quarter. Still, the average deal involved over $1 billion in assets under management, according to Echelon.

One blockbuster deal stands out against the others so far this year. In February, private equity firm Warburg Pincus acquired a majority stake in Kestra Financial, an independent broker/dealer with about $75.5 billion in assets. Terms of the deal were not disclosed, but sources close to the firms indicated the stake could be worth about $700 to $800 million, a figure eight to 10 times earnings before interest, tax, depreciation and amortization (EBITDA).

The strong M&A activity followed a tumultuous year for markets in 2018 and occurred amid a stock rally that has pushed indexes back to near-record levels. But the deal process typically begins six to 12 months prior to an announcement or closing so "it will be interesting to see in the coming quarters if potential sellers have been spurred to action given the recent volatile market backdrop," according to an Echelon report on the first quarter.

Volume aside, Echelon expects the average deal to continue to involve assets over $1 billion in the coming quarters. There are more than 500 wealth managers with at least $1 billion in assets under management, according to Echelon; given deal activity over the past several years, only 10% of them have conducted a transaction, according to the firm. Meanwhile, the advisor workforce is aging and seeking liquidity as buyers target large firms with "more infrastructure, systems, management, protective redundancy, and financial wherewithal." Private equity buyers also like that most of the RIAs managing over $1 billion have EBITDA of at least $3 million, which serves as a cushion in the event of a market downturn, the bank said.

Assuming there are at least 49 deals per quarter through the rest of 2019, the total would top last year by 15 deals—though, in recent years, deal activity has slowed in the third and fourth quarters.

As deals involving RIAs get larger and volume creeps up, investment banks have looked to add expertise in the space. Raymond James Financial's acquisition of Silver Lane Advisors, a boutique investment bank that specializes in mergers and acquisitions involving financial services firms, including wealth managers, was an example of this.

"Here we have a very major bank that sees [asset and wealth management] as something likely to continue, if not get more active,” Peter Nesvold, a managing director and the head of strategy at Silver Lane, said about the deal. “That tells you the trend toward asset and wealth management is one that is likely to continue."