VanEck launched a new exchange traded fund this week that invests in U.S. large-cap stocks with the highest degree of positive social sentiment and bullish investor perception. The new VanEck Vectors Social Sentiment ETF (BUZZ) tracks the BUZZ NextGen AI US Sentiment Leaders Index, which analyzes interactions across social media platforms, news articles, blog posts and other content from online sources to measure stock-specific sentiment.

“We are experiencing a monumental moment within the history of the retail investor—Twitter, Reddit, Stocktwits and dozens of other platforms have established communities for investors to discuss stocks and as a result of soaring online engagement they have become an alternative dataset for investors to scour and utilize for a performance edge,” said Ed Lopez, managing director, head of ETF product for VanEck, in a statement.

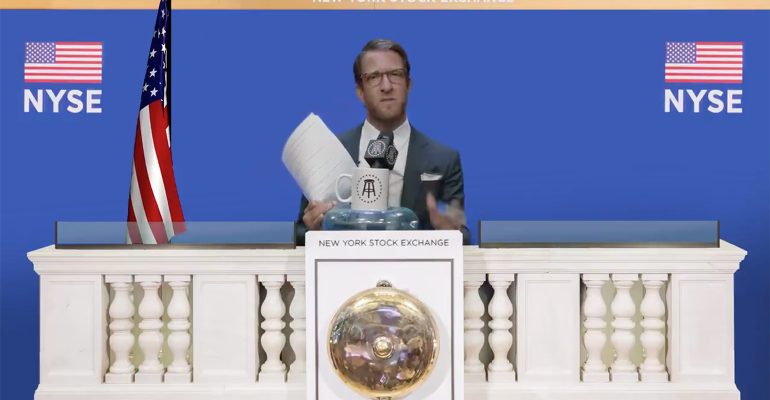

Internet celebrity and Barstool Sports founder Dave Portnoy promoted the new ETF on Twitter this week, saying, “I got approached by these guys who built an algorithm five years ago. The algorithm was basically designed to scrape the Internet, social media and find positive sentiment on stock,” Portnoy said. “If you don’t adapt, you die. Twitter, social media, all of it is dictating stock prices. Nobody has seen that more than me over the past year.”

The fund invests in the 75 most talked about large-cap stocks. The portfolio is constantly rotating, Portnoy says, based on the most positive sentiment. The fund has an expense ratio of 75 basis points.

As of 12:30 p.m. eastern time Friday, the ETF was down 7%.

The First Mutual Fund-to-ETF Conversion Is Coming

A year ago, Jim Atkinson, CEO of Guinness Atkinson Asset Management in Pasadena, Calif., said his firm was considering converting some of its mutual funds to fully transparent active ETFs, in response to the fact that investors prefer ETFs over open-end mutual funds. And this month Guinness Atkinson will be the first asset manager to make the conversion, when it converts two of its mutual funds on March 26.

In related news, Dimensional Fund Advisors also filed this week to convert four equity funds, with $26 billion in assets, into ETFs “on or about” June 11, according to Bloomberg.

Over the last year, law firms, asset managers and fund issuers have been working on a pathway for conversions, which allows managers to port over the fund’s assets, track record and performance.

Avantis Taps Two More DFA Folks

Avantis Investors, a subsidiary of American Century Investments, has added two executives to its relationship management team. Caroline Gaynor and Justin Yost will both serve as vice presidents, relationship directors and investment specialists.

The two join from Dimensional Fund Advisors, where Avantis’s senior executives, Eduardo Repetto and Patrick Keating, also came from. Most recently, Gaynor was a regional director in DFA’s global client group, responsible for expanding the firm’s relationship with advisors on the East Coast. Yost was a vice president at DFA, responsible for updating advisors in the central U.S. on capital markets research, investment concepts, and consulting on asset management and business development.

American Century launched Avantis in June 2019, with the goal of bringing a new suite of actively managed mutual funds and ETFs based on academic research and financial science and promising diversification and low cost.

Alger Launches First ETF

Growth equity investment manager Alger has launched the Alger Mid Cap 40 ETF, the firm’s first foray into the ETF space. The actively managed ETF is a high conviction and focused portfolio with 40 mid-cap growth stocks. It will be managed by Amy Zhang, executive vice president and manager of the existing Alger Small Cap Focus, Alger Mid Cap Focus and Alger Small Cap Growth Strategies.

Fidelity Expands Active ETF Lineup

Fidelity Investments has added two active bond ETFs to its suite, the Fidelity Investment Grade Bond ETF and Fidelity Investment Grade Securitized ETF. With the new funds, Fidelity now has 39 ETFs with more than $25 billion in assets. They both charge an expense ratio of 36 basis points.

The Fidelity Investment Grade Bond ETF will invest at least 80% of the portfolio in medium and high quality investment-grade debt securities, while the Fidelity Investment Grade Securitized ETF will invest at least 80% in investment-grade securitized debt securities, of medium and high quality.