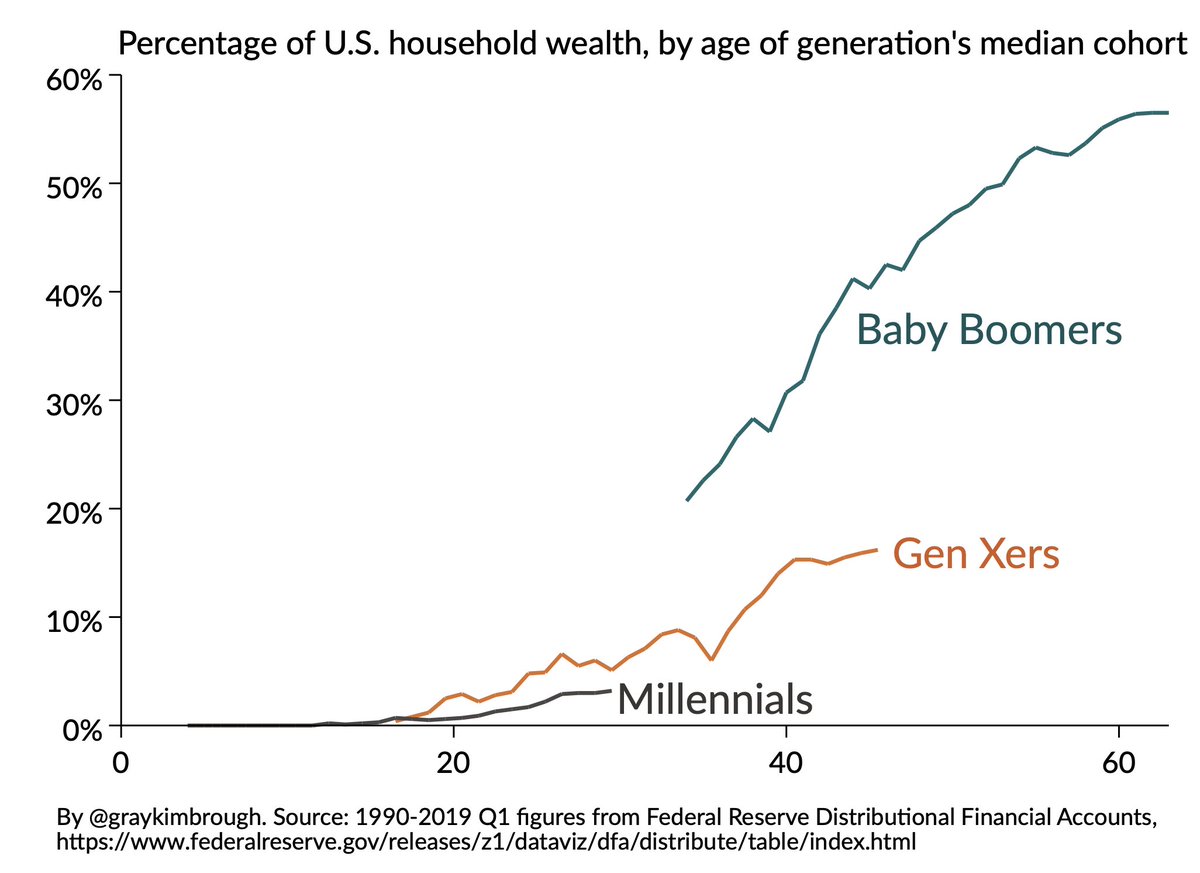

While many are cognizant of the existence of the wealth gap between baby boomers and millennials, it can be hard to picture its size. However, a macroeconomist has illustrated the extremity of the problem: To match boomers’ percentage of wealth held when they were 35, millennials would need to multiply the percentage they hold sevenfold.

Gray Kimbrough, a senior economist with the Federal Housing Finance Agency and an adjunct lecturer at American University, created a chart using data from the Federal Reserve to track the share of national wealth held by each generation according to their median cohort age; Kimbrough’s findings were featured in a Washington Post op-ed.

According to Kimbrough, by the time the median baby boomer was 35 in 1990, they collectively owned 21% of the nation’s wealth. Generation X (defined as those born between 1965 and 1980) collectively owned only 9% in 2008, the year in which the median member of that generation turned 35. It will still be several years before the median millennial reaches 35, but currently millennials hold only 3.2% of the nation’s wealth.

In the Post article, Christopher Ingraham notes several significant caveats to consider; for example, in 1990, boomers were about 31% of the country’s population, while in 2008, members of the Gen X generation accounted for only 22% of the nation’s population, concluding that boomers and Gen Xers had a 0.68 and 0.41 wealth-to-population ratio, respectively. Ingraham also acknowledges that the greatest gaps in wealth disparity exist within generations, with wealth being “highly concentrated among the richest members of each cohort.”

While Ingraham also acknowledges the gap between boomers and other generations may close as boomers pass on their wealth, he also notes many Americans may not have any inheritance to pass on at all; in fact, younger Gen Xers and millennials may end up using their accumulated wealth to take care of older family members.

According to an October report from The Spectrem Group, nearly three in 10 high-income millennials who are not planning to retire are doing so because they believe they will not be able to save the money necessary to do so. Kathy Dordick, a senior consultant with Spectrem, said the first several years of millennials’ professional careers were profoundly impacted by the Great Recession.

“While they’re not as hesitant about investing, they have a more pessimistic view of their ability to save enough and recover,” she said.

As millennials age, financial advisors continue to seek out ways to approach and engage with potential millennial clients, with firms prospecting with the children of existing (and older) clients, diversifying services and tech options, and lowering minimums to reach a wider range of potential customers.