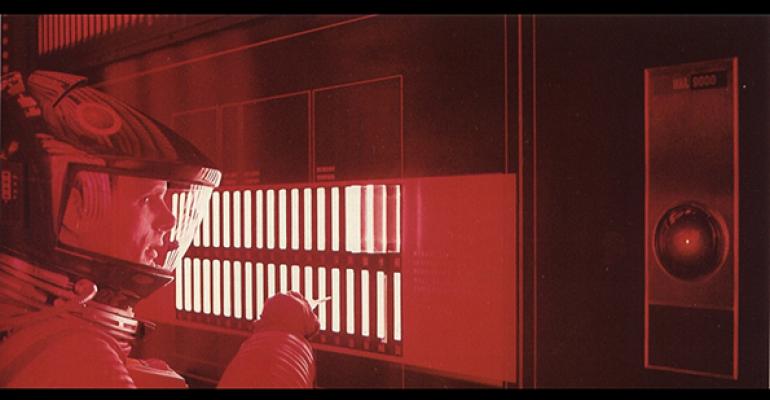

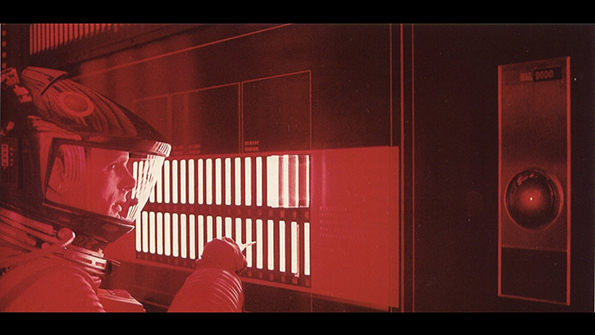

In the ongoing debate about robo-advisors, one argument that technology detractors like to fall back on is that an algorithm can’t provide the same service as a flesh-and-blood advisor. MarketWatch decided to put that idea to the test, and had four robo-advisors and four humans design portfolios for the same fictional 35-year-old investor. The robos’ suggestions weren’t very different from portfolios proposed by humans, and many professional investment advisors had trouble figuring out which was which in an online quiz. Can you?

Fund fees are coming down, according to a recent Morningstar report. The average asset-weighted expense ratio across mutual funds and ETFs was 0.64 percent in 2014, down from 0.65 percent in 2013 and 0.76 percent five years ago. “The trend is being driven more by investors seeking low-cost funds than it is by fund companies cutting fees,” Morningstar writes. Over the past 10 years, 95 percent of fund flows have gone into funds in the lowest-cost quintile. At the same time, assets under management have grown at a faster pace than fees have fallen. In fact, industry fee revenue reached an all-time high of $88 billion last year, up 78 percent in the last decade.

Canadian Imperial Bank of Commerce’s CEO Victor Dodig has $1.6 billion to spend on a U.S. wealth management firm, but can’t seem to find anything that isn’t overpriced, he said Thursday during CIBC’s annual meeting in Calgary. The bank wants to increase its push into the U.S. wealth management and private banking space, adding to its current businesses Atlantic Trust Private Wealth Management and American Century Investments. But Dodig said current valuations of wealth management businesses south of the border are too “frothy.”

SigFig, a San Francisco-based automated investment service, announced Wednesday it received a $1 million investment from venture capital firm Nyca Partners, bringing the robo-advisor’s total funding to $30 million. As part of the investment, five financial services industry veterans are joining SigFig’s advisory board. Among them are Hans Morris, the managing partner of Nyca and former president of Visa; Stephanie DiMarco, founder of Advent Software; and Tom Miglis, who was the chief information officer of Citadel LLC for 13 years.

Raymond James tapped Michelle Lynch to lead the Network for Women Advisors, an internal support network for the firm’s women advisors. Lynch will oversee the 800-member group’s ongoing objectives to recruit women advisors and professionals, as well as organize the annual Women’s Symposium event. Most recently, Lynch oversaw marketing for the firm’s private client group. She replaces Nicole Spinelli, who left Raymond James at the end of January to lead Lincoln Financial Network’s new WISE Group (Women Inspiring, Supporting, and Educating).