Ever since Bernie Madoff fleeced unsuspecting investors in the worst Ponzi scheme in history in 2008, Kenneth Springer's business has been booming, Crain's New York reports. As head of Corporate Resolutions, Inc., Springer oversees a team of 30 who investigate money managers for potential financial fraud. Among his clients: the New York State Common Retirement Fund. He charges $7,500 per background check, generating $6 million in annual revenue for the firm. Mainly, Springer's staff scours databases in state and county courthouses to find information. Facebook stalking works too, as well as face-to-face interviews with people who know the subject being investigated. The former FBI agent said while business has been steady for the past eight years following the financial crisis, banks and wealthy families are starting to let their guard down and failing to fully look into the people they're entrusting with millions of dollars. “So long as there’s greed and people willing to turn a blind eye, I’m busy,” he said.

Millennial Advisors Boost Firm Profitability

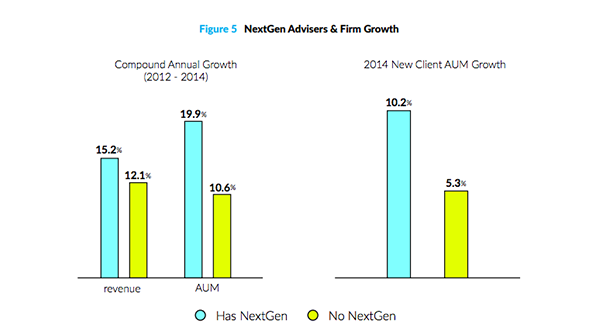

When it comes to hiring younger advisors, a frequent objection is there’s no way to know if it will be worth the time and resources spent to train them. According to new research from TD Ameritrade Institutional, hiring millennials provides a boost to a firm’s growth and profitability. After employing a next-gen advisor, firms saw assets increase an average of 20 percent annually from 2012 to 2014, compared to 11 percent among firms that did not hire them. TD said millennials provided the third biggest impact to RIAs behind investing in technology and operational efficiencies, but adding a millennial could help out with new technology as well. TD also reported in “The Rise of the NextGen Adviser" that two-thirds of firms generating at least $5 million in annual revenue had at least one next-gen advisor, and those firms had 20 percent higher income per owner than firms that did not.

Small Business Owners Also Don’t Have Succession Plans

It’s a well-known fact that advisors are terrible at planning for their retirement; very few have a succession plan. But small business owners are just as bad, if not worse, according to a new survey by Securian Financial Group. The survey of 600 small business owners with an average of 27 employees found that over half of them plan to leave their business in the next 10 years, but 72 percent have no exit strategy. Only 14 percent have a formal exit strategy in place. “For most small business owners, the business is by far their largest asset,” said Andrew O’Brien, who directs Securian’s business owner client solutions group. “Not properly planning for the sale or transfer of their business can leave a lot of people—including the business owner—in a very difficult position.” Advisors can step in and help their business-owner clients generate a written plan.