Investors have been in a giving mood lately. Grants from Fidelity Charitable and Schwab Charitable donor-advised funds are at record levels, the two firms said Wednesday. Schwab Charitable said its donors gave $1.06 billion in grants to charities in fiscal year 2015, up 30 percent from the prior fiscal year. Sixty-eight percent of contributions into Schwab Charitable’s DAF accounts were appreciated investments or assets, the firm said. Meanwhile, Fidelity Charitable made more than 310,000 donor-recommended grants totaling $1.5 billion to charities during the first half of this year, up 33 percent from the same period last year.

Ten-Word Investment Strategies

Few professions use jargon and unneeded complexity more than asset management. The Motley Fool asked a range of financial folks to explain their investment philosophy in 10 words or less. Taking the (very, very true) maxim that if you can’t explain something in simple terms everyone can understand, you probably don’t understand it yourself, the 10-word investment philosophies help focus the mind and take the mystery out of the markets. Most advise not to follow trends, keep emotions in check and take a long-term view. "Keep it simple, do less, and manage your stupidity," says Barry Ritholtz of Ritholtz Wealth Management.

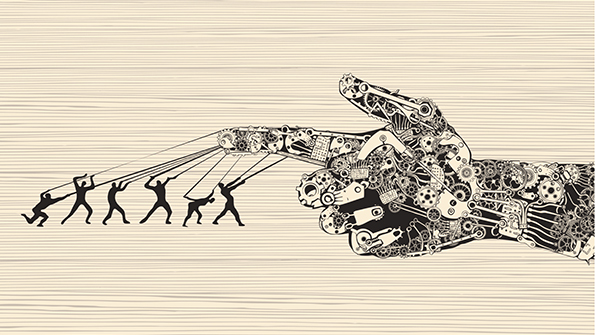

Despite the hype around robo-advisors, only about one in five wealthy investors say they’re familiar with automated investment advisory services. Among those who have heard of robo-advisors, only about a third currently use or have used one of these platforms to manage their finances, according to a recent Wells Fargo survey of almost 2,000 investors ages 30-75 with $250,000 or more in investable assets. Three-quarters of affluent investors say that a robo-advisor could never take the place of a human financial advisor. Instead, nearly-two thirds of investors surveyed said they’d like to use technology to manage their investments along with the help of a human advisor.

HighTower has added its 14th West Coast practice by folding Murray Wealth Management into its network. Based in Seattle, the firm, run by Managing Director and Partner Michelle Murray, manages $200 million in assets and specializes in investment consulting, wealth management, financial planning and retirement planning. The Murray team joined HighTower on Tuesday from UBS, where the firm had been since 2004. It is HighTower's second Washington State firm. "HighTower's elite community, collaborative culture and commitment to clients' best interests firmly established it as the ideal place for both me and my clients to grow and prosper," Murray said in a statement.