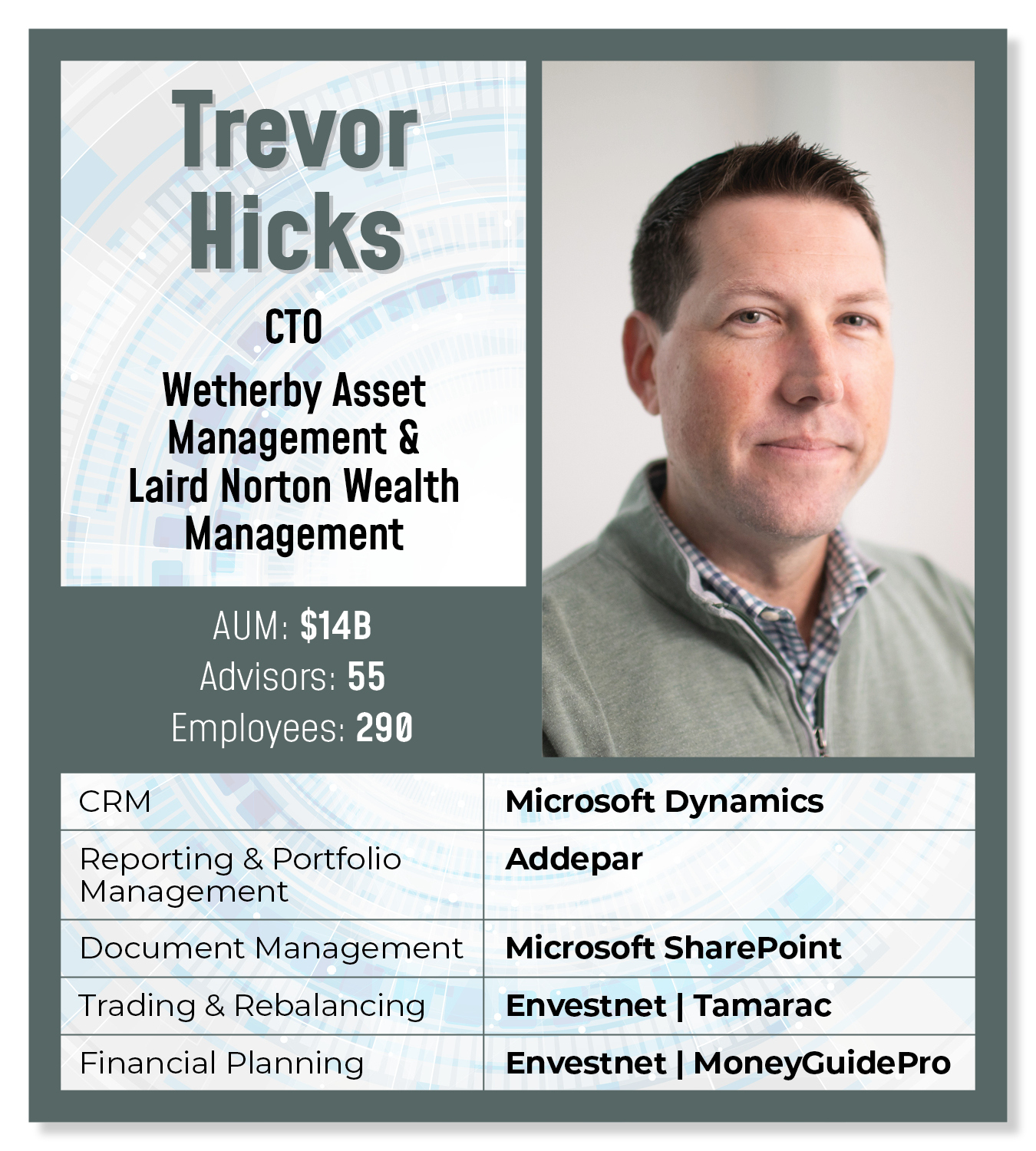

In January 2022, Seattle-based Laird Norton Wealth Management, a registered investment advisory and subsidiary of the Laird Norton Company, merged with Wetherby Asset Management, a San Francisco–headquartered RIA.

Our entire tech stack is up for grabs and being rehashed. Technologically, I hope to be done before the end of 2024. Culturally, it’s probably well into 2025.

CRM: Microsoft Dynamics

We’re both on Microsoft Dynamics, but CRM is like a piece of clay where you can make it whatever you want to fit your business. They [the two iterations of Dynamics] were built [out] in significantly different ways. It’s not possible to mush them together. You must pick one or the other or start fresh.

Both firms were also using Salentica [an RIA-specific third-party overlay for Dynamics] and both cut ties about five years ago but stayed with Dynamics. The value became less and less. Salentica worked well if you stayed within their bounds. And it works well, but when you get too customized, their support becomes less valuable. They can help, but we ended up realizing we can do it ourselves.

I like that Dynamics is available everywhere. It is cloud-based. Our client information is there. We have automations with DocuSign. It’s all helpful, but I like it with [only] a cringey face—it’s good but it could be so much better, especially with the integrations. If CRM could be the central go-to so our client service folks could use it that way, that would be better.

I like that Dynamics is available everywhere. It is cloud-based. Our client information is there. We have automations with DocuSign. It’s all helpful, but I like it with [only] a cringey face—it’s good but it could be so much better, especially with the integrations. If CRM could be the central go-to so our client service folks could use it that way, that would be better.

We needed to combine into one CRM if we wanted to be one company. We’re leaning toward a new CRM because there is some cultural benefit to starting fresh. Our goal is to decide before the end of this year and then implementation will start early next year.

The two we’re looking at are Salesforce and Dynamics [as a new] custom-build. Salesforce has a ton of potential. You can integrate just about anything with Salesforce. Your workflows out of Salesforce can tie into third-party platforms, which then smooths out the whole workflow. There’s less reliance on the individual employee to figure out what they’re supposed to do next.

Reporting/Portfolio Accounting: Addepar

Laird Norton was on Tamarac, but the decision was made years ago before we merged to move to Addepar. When Wetherby was acquired and we started merging, Addepar was dictated as the portfolio accounting system. We’re working on an Addepar launch at the Laird Norton office and the Wetherby conversion started months ago.

Tamarac is great. It’s a nice, packaged solution. The cost is decent. They’re constantly developing. Their release cycle is fantastic.

But there was less flexibility in what you could do through reports and the client portal. Also, they seem unsettled. There’s been a lot of turnover. They’re a large company [acquired in 2012, Tamarac and its platform are a unit within Envestnet]. We’re not sure about their strategic direction. What do they want to be?

But there was less flexibility in what you could do through reports and the client portal. Also, they seem unsettled. There’s been a lot of turnover. They’re a large company [acquired in 2012, Tamarac and its platform are a unit within Envestnet]. We’re not sure about their strategic direction. What do they want to be?

For Addepar, I like flexibility in the reporting. You can do more about alternatives and complex accounts where clients have split ownership of LLCs between family members. You can show and calculate that on the fly, which is sweet. But their rebalancing system is half-baked. And the cost is ridiculous.

Trading/Rebalancing: Tamarac

Trading is sticky, especially in our transition. Both firms were using Tamarac. The plan was to move to Addepar after they bought AdvisorPeak in October 2021. We loaded our data and found that AdvisorPeak couldn’t handle the number of accounts we had. There was this latency problem in displaying the data. Now we’re on Tamarac trading for the foreseeable future. It’s probably the best rebalancing trading platform on the market.

Financial Planning: MoneyGuidePro

We were on eMoney and we’re now moving to MoneyGuidePro. I think they all do the same thing, but we had to choose one. With Addepar, Tamarac and others, you can load client portfolio data and refresh it on the fly into MoneyGuidePro. Then you don’t have to do a whole bunch of downloading and uploading of client data to update a report. MoneyGuidePro has a client portal, but we don’t share that with clients. And I haven’t talked to an RIA yet that does, at least unsupervised.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what's in your wealthstack? Contact Rob Burgess at [email protected].