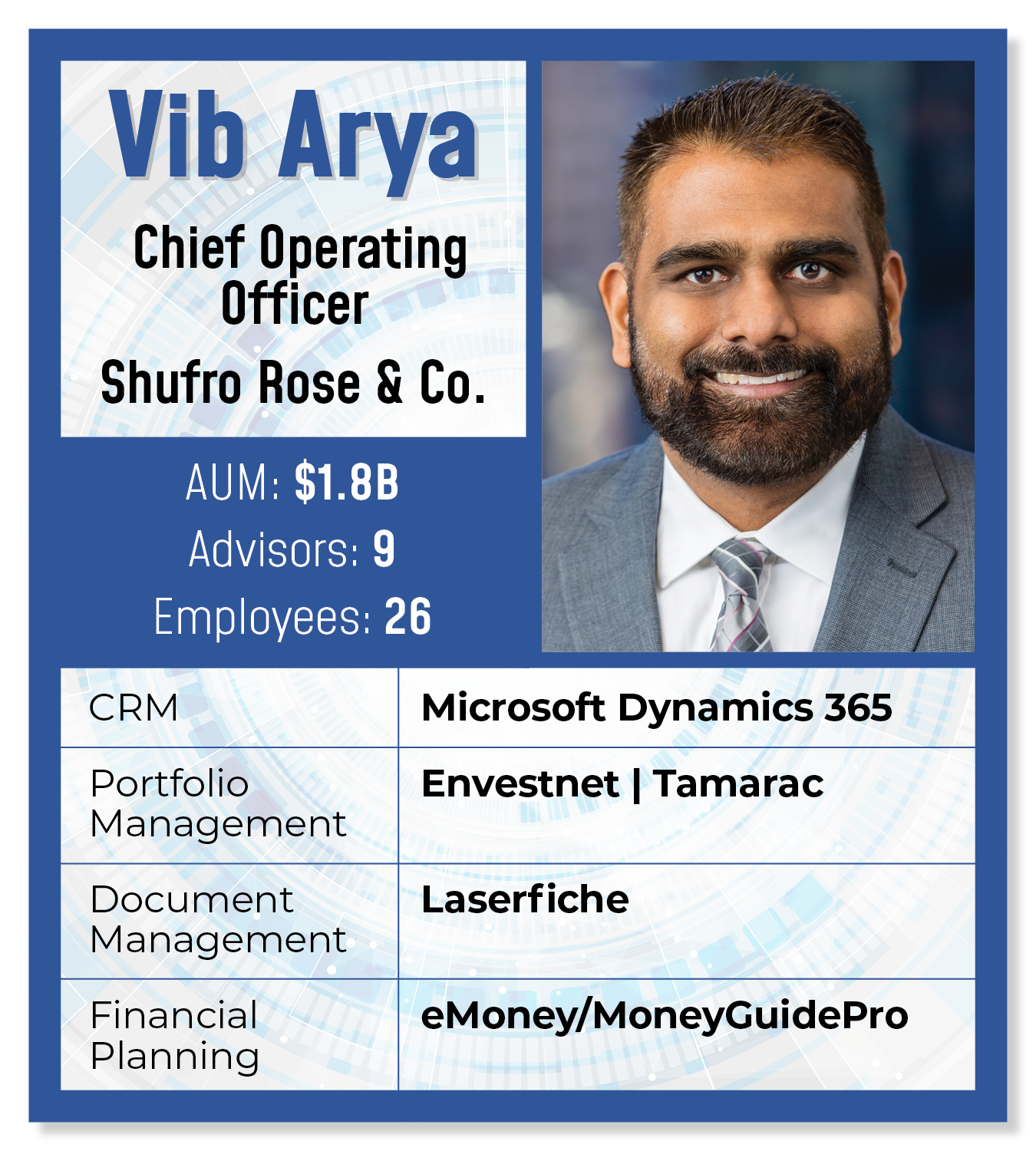

Financial Planning: eMoney / MoneyGuidePro

We started using eMoney, but now primarily use MoneyGuidePro. We are finding that each platform has some pros and cons.

For more goals-based wealth planning, MoneyGuidePro seems to be more intuitive. It aligns with our philosophy of simplifying the financial planning process for our clients.

eMoney is more favored for cash flow and stock compensation analyses. In our opinion, eMoney also has a more user-friendly client portal.

I want to get to a point where we pick one financial planning platform so we can think about more automation and integration. But, for now, we do have both—and both work.

I want to get to a point where we pick one financial planning platform so we can think about more automation and integration. But, for now, we do have both—and both work.

Document Management/Workflow: Laserfiche

Over the years, we have built out operational workflows in Laserfiche. We are rebuilding much of our workflow capabilities in our CRM, which is ultimately where we want things to be. Laserfiche also serves as our “books and records” document repository.

Portfolio Management: Envestnet | Tamarac / Microsoft Dynamics 365 (With an AI Assistant From CogniCor)

We’re heavily using Envestnet’s Tamarac platform for portfolio management, rebalancing, reporting, trading and CRM—as well as Tamarac’s overlay of the Microsoft Dynamics 365 CRM. We’re using the Tamarac Client Portal for daily performance. We are also integrating AI technology using the CogniCor platform. This allows us to have an embedded AI assistant.

We’ve been on the Tamarac CRM platform since even before I got here in 2016. We were on an older version of Microsoft Dynamics, the non-365 version. In 2019, Envestnet finally made the push to get everyone onto this current 365 version of Microsoft’s CRM platform. Once that happened, it opened a lot more of the capabilities of what we could do in CRM.

We are keen to try to continue to leverage the broader Microsoft integration. We spent time over the last few years integrating our CRM within the Microsoft ecosystem. If you set up a meeting in Outlook, it tracks in the [Microsoft Dynamics] CRM as an appointment. That way, we can go in, add notes and mark the appointment as completed. It then updates files including the “last contacted” data of the client.

And now that we’re on the Microsoft Teams phone system, if I, for example, initiate a phone call through the CRM, it automatically creates a phone call record. I can then start to take notes on it and mark it as complete when I’m done. I’d love to get to a point with Microsoft where if there’s an incoming call from a client, the CRM window would pop up and you could just start taking notes. I don’t think that integration is there yet, but I would hope Microsoft is strategically thinking about that, as well. We’re thinking about a platform that creates efficiency, that creates as much integration and automation as possible.

And now that we’re on the Microsoft Teams phone system, if I, for example, initiate a phone call through the CRM, it automatically creates a phone call record. I can then start to take notes on it and mark it as complete when I’m done. I’d love to get to a point with Microsoft where if there’s an incoming call from a client, the CRM window would pop up and you could just start taking notes. I don’t think that integration is there yet, but I would hope Microsoft is strategically thinking about that, as well. We’re thinking about a platform that creates efficiency, that creates as much integration and automation as possible.

We have established data connectivity from Tamarac into Laserfiche. If you have four different types of accounts with us, that Tamarac account reference data—including account number, account name, account type and primary advisor—flows into Laserfiche and updates the reference data there. We’re leveraging the integrations from Tamarac and Laserfiche to update that reference data systematically.

The Tamarac Rebalancer is where we originate trades. Then, we push them into the custodian for execution. On the equities side, based on what’s available to us, we can generate all the orders. We then systematically send a file into a Fidelity Wealthscape “unsent orders” tab. Finally, our trader reviews the trades and hits “submit.” There’s an intentional speed bump there.

I think of CRM as the brains of the organization for client information. Both in the sense of prospecting, as well as a facilitator of workflows. I want to be able to see a client’s whole history. We have also begun to explore utilizing meeting assistant capabilities.

We have begun to extract data from our custodians. We have started with Fidelity and begun to import eight different data sets from Fidelity’s Wealthscape platform into our secure environment and then load them into our CRM daily.

Want to tell us what's in your wealthstack? Contact reporter Rob Burgess at [email protected].