The best robo returns for the second quarter of 2018, according to BackEnd Benchmarking, goes to micro-investing startup Acorns, a Main Street-friendly investing app that has an average account size of just $500 and recently announced a partnership with money managing behemoth BlackRock. The more than 1.8 million investing clients of the fintech company received a boost from high allocations to small-cap and domestic equities, according to the robo chartwatchers.

Acorns posted returns of 1.59 percent for the second quarter of the year, against loss-leader FutureAdvisor’s negative 0.91 percent returns.

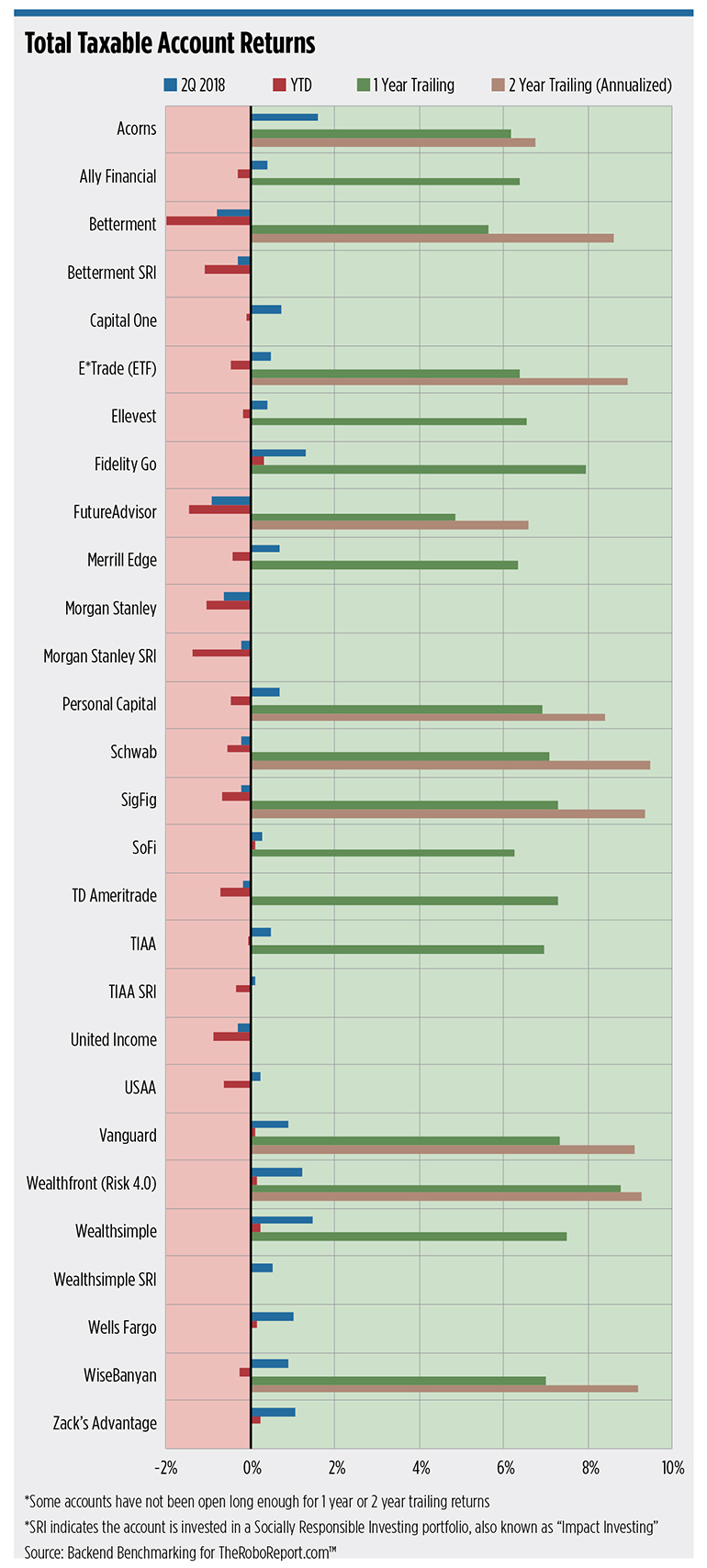

Returns for taxable accounts managed by built-from-scratch robo advisors.

Acorns’ strong quarter comes at an important time. While the company has pulled in gains of 6.16 percent across its taxable auto-investing portfolio over the past 12 months—putting it on the lower side of its robo peers—it has seen its customer base and assets under management grow with the addition of retirement products and a debit card. Assets under management has gone from just $74 million in early 2016 to $545 million almost 2 years later, according to filings compiled by BackEnd. It reported $804 million in assets as of this April.

Over a broader timeline, Wealthfront leads the pack of taxable accounts, with returns of 8.76 percent in its total portfolio over the past 12 months. It was followed by the 7.94 percent gains of Fidelity Go, which is changing its product mix based on its recent introduction of zero-fee funds. FutureAdvisor scuffled over the same time period, managing to earn returns of 4.85 percent, the lowest of its tracked peers.

Wealthfront’s success comes at a key time, as it faced reportedly low valuations and criticism about a product’s fee structure earlier this year. Despite those headwinds, the robo has seen growth in AUM, from a reported $5 billion in January 2017 filings to over $10 billion in March 2018 filings. Co-founder Andy Rachleff announced the firm had $11 billion in assets in June, also revealing a recently launched addition to its goals-based planning tool, Path.

Fixed income investing is becoming the Achilles heel or a return differentiator for many robos, as they take varied approaches to allocation and yield. SoFi ultimately led the category for the quarter with returns of 0.93 percent in its fixed income portfolio, which BackEnd attributes to the firm’s large allocation to high-yield municipal bond funds. Fidelity Go dialed in strong returns with its fixed income portfolio, concentrated in domestic bond funds, and Vanguard and Wealthsimple also found success in domestic bond funds, with Vanguard choosing to hold only municipals.

Meanwhile, Schwab saw losses of 1.65 percent for the quarter on a complex mix of international, high-yield, municipal, inflation-protected and corporate bonds. Over a 2-year period, however, it’s been a winning formula, netting an annualized gain of 2.39 percent, according to BackEnd.

On the IRA side, legacy-derived robos took top honors, with Fidelity Go bringing in the quarter’s top returns of 1.38 percent, followed by T. Rowe Price at 1.33 percent. SigFig had a rough quarter among retirement accounts, charting losses of 1.29 percent.

Over the past12 months, E*Trade wears the crown among non-taxable accounts, with returns of 10.98 percent, followed by WiseBanyan with returns of 10.64 percent. Betterment has had the lowest trailing 12 months, with non-taxable account returns of 7.97 percent.

While nowhere near striking distance of Betterment’s built-from-scratch, robo-leading $13 billion-plus AUM, WiseBanyan has been quietly bringing in assets, climbing from a reported $94 million in AUM to $152 million according to filings pulled by BackEnd in March 2017 and 2018. It’s nearly twice the size of the late built-from-scratch robo Hedgeable, which folded its portfolio management in July after having reached nearly $80 million in assets managed.

This quarter’s report includes something new, which BackEnd is calling “Normalized Benchmarking” to better compare allocation mixes across robos in an attempt to strip out differences in equity holdings. Based on the benchmark, Acorns still had the best second quarter, with positive returns of 0.89 percent, while FutureAdvisor had negative returns of 1.56 percent. For the past 12 months, Wealthfront managed the top return of 0.81 percent against the benchmark, while FutureAdvisor’s asset mix returned a loss of 2.40 percent.

According to BackEnd Benchmarking’s methodology, results are affected by fees charged, which can vary based on account amounts and tiering of fee tiering. Fees have been a point of criticism for automated investing platforms, from robos unable to generate enough income to stay in business to automated investing platforms looking at the B2B space as a more reliable business than going directly to consumers. For its part, BackEnd reacted positively to Fidelity’s move to implement “pricing transparency” as part of the move to zero-fee funds, noting accounts would now only cost customers a 35-basis point management fee for the robo.