RBC Correspondent Services, RBC’s clearing firm for independent broker/dealers, and RBC Advisor Services, which custodies assets for registered investment advisors, announced Tuesday the launch of BLACK, a new financial technology suite that bundles together and integrates five wealthtech vendors. BLACK provides RBC’s clients with single sign-on access to account aggregation and portfolio analytics from CircleBlack (which developed the platform), CRM from Redtail, risk assessment from Riskalyze, financial planning from MoneyGuidePro, and trading and rebalancing from Vestmark. John Michel, the CEO of CircleBlack, said his firm worked closely with RBC to build something specifically designed for RBC’s needs as a boutique provider, adding that that BLACK was made with “the latest scalable web technologies and seamlessly enables secure data flow between all the partners.”

The Source of Fee Compression? Not What You Think

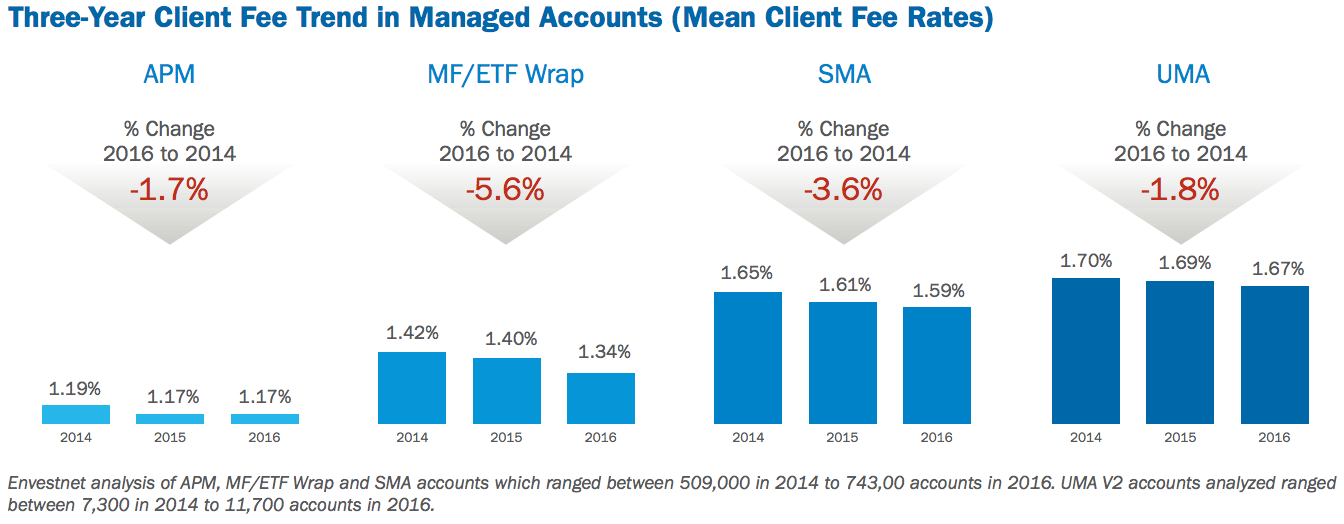

While the total fee a client pays is declining, it is not coming at the expense of the advisors' fees. Rather, it's from the reduced cost of investment management. According to an analysis by Envestnet, the fee compression trend belies the fact that the vast majority is due to advisors seeking out lower-cost passive products. Envestnet found that the mean client fee in mutual fund and ETF wrap accounts declined 5.6 percent over the last three years, while mean client fees in separately managed accounts were down 3.6 percent over that same period. Advisor fees (fees credited to advisor commission grids or to the advisor directly) were particularly resilient in SMA and unified managed accounts, where advisors can provide additional value through tax management. Advisor fees increased one to three basis points in these accounts.

Vase Sells for Nearly 2000 Times Initial Estimate

This Chinese cloissoné vase sold for more than 2000 times its auction estimate.

A family in Washington D.C. experienced an unexpected windfall last week when a Chinese cloisonné vase that it had consigned shockingly sold online at iGavel Auctions for $812,500 according to Artnet. The piece, missing its lid and somewhat the worse for wear, was originally estimated to be worth around $500, but a bidding frenzy drove the gavel price up to almost 2000 times that. Lark Mason, founder of the auction site chalked the disparity between expected and final prices up to human error, noting “Objects are sometimes cataloged quickly and esoteric objects can be overlooked.” One of the benefits of online auctions is the sheer number of eyeballs that see each piece for sale, making surprises like this possible.