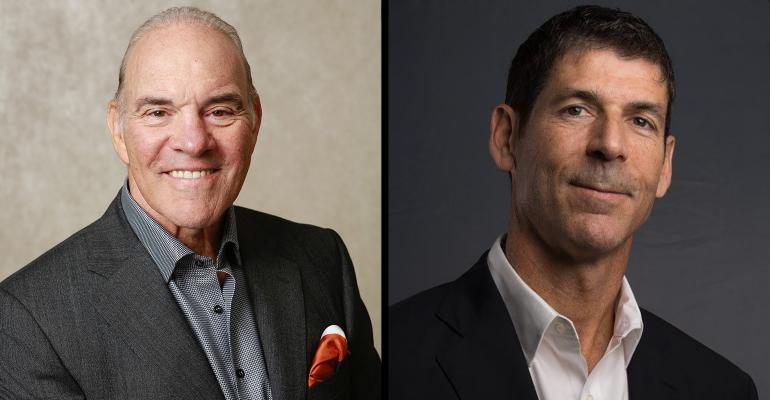

It might sound outrageous to suggest that something as simple as a search bar will change the way advisors work in fundamental ways but that is exactly what the founders and developers behind Magnifi, a small fintech startup, intend their "transformational" technology to do. Just shy of a year ago, former Schwab CEO and former Hightower Advisors chairman David Pottruck joined its board as executive co-chairman, and made a sizeable, though undisclosed, investment in the natural language and machine-learning tool. Since then the startup, with CEO Rick Hurwitz at the helm, has organically and exponentially grown the investment searches performed on the system and most recently hired a chief product officer and built an integration with Schwab’s custody platform. The two spoke recently with WealthManagement.com about the why and how of the technology and where the advisor industry is headed.

WealthManagement.com: What are the parallels that most stand out for you between the challenges you faced at in the early days at Schwab, taking it into the digital world, and what the investing industry faces today?

David Pottruck: My time at Schwab, the ‘80s and ‘90s, were really about OneSource and how we brought mutual fund open architecture to the world, to retail investors and advisors. That was really all about simplifying access, open systems, removing layers, and getting broader reach—those three principles. And then when we looked at the digital online brokerage evolution of the late '90s and 2000s, that was really about the same thing but a much bigger use of technology. That was the added element;we now have technology in everyone's hands. We actually sent software to our customers back in the early ‘90s and that was clunky. Now everybody has access to [their tools on] the Internet.

WM: What aspects of Magnifi’s work drew you in?

DP: When I was first looking at Magnifi and talking to Vinay [Nair, Tifin Group CEO, of which Magnifi is a part] back in March of 2020 before the pandemic I had Vinay come to my house in Utah and I had my advisor, a Hightower advisor that happens to be on the board of Hightower with a billion dollar plus practice. He and I sat there and listened to Vinay as he showed us what Magnifi can do. And I turned to him [advisor] and I said, “What do you think?” And he said, “I think this ultimately transforms our industry. I think Dave you should put your money and your time and your reputation into this company.” That's how I made the decision.

What attracted me and got me excited is that it had the same principles that I saw as so successful for us at Schwab: simplify access, remove layers, broaden reach—same principles—but done in a much more digital way. [Back during much of my time at Schwab] it was simple transactions; anything more complicated needed a person. You don't need any people here to get simple access, removing layers, broader reach, and a great product offering.

Rick Hurwitz: With 3,500 ETFs, 8,500 mutual funds and more than that in the form of portfolio solutions, SMAs and models we have a discernibility dilemma. Advisors spend a copious amount of time jumping from Morningstar to Yahoo Finance, or Google, to other places just trying to identify and discover products that might match with their clients. And they're doing that in the face of increased regulatory burden.

The combination means that their time is pressed. Magnifi drops into that mix and solves that problem. It’s a way to discover, do some diligence and act upon investment products in a seamless way. That's on the supply side. On the demand side, today's wired investor thinks differently about how he or she purchases and consumes investment products. We're used to customizing our clothing with Stitch Fix and curating our entertainment on Netflix and Spotify. Why shouldn't we be able to do the same hyper-personal approach and seamless experience in the investment industry?

WM: What do you think the investment industry gets most wrong today?

DP: I think it's what has been wrong for a very long time. Things are not simple and they're not clear. We live in a very manufacturing-centric world. Everybody brings out more product to solve problems or to sell solutions. A lot of vendors are selling solutions to problems that have already have been solved. It's just hard to find them. So we get more and more product. Add to that proliferation a lack great digital approaches, a simple user-oriented ones and it's become overwhelming.

RH: As fees and profitability decline and the number of products keeps going up, advisors are getting squeezed. Short of cloning themselves, it's imperative that wealth managers take advantage of the next best thing, which is artificial intelligence and machine learning. Magnifi is bringing that to the process, allowing them to better design, adjust and communicate with their clients.

WM: And what is the industry getting right?

DP: It's the flip side of what I just said. There are a lot of great products and choices. Want to invest in an index of real estate investments, you've got an ETF that does that. You like Bitcoin but you don't know how to buy it, or don't want to own the coin itself you can invest in a cryptocurrency index. What’s missing is a simple way to find them. Type Bitcoin into Magnifi and we'll show you how to invest in it.

RH: David wrote Stacking the Deck in 2014. The breakthroughs we talk about since then, robo-advisors, the advent of models—portfolio solutions—10,000 of them. And by the way, they don't have ticker symbols. So back to that discernibility dilemma the industry faces and we've seen this massive increase in independent advisors, in fact, because of that, [we’ve seen] the aggregation of them [with firms] like Hightower. But what we haven't seen is the industry embrace the kind of seamless user experience, the kind of Internet-based, Amazon-like e-commerce support that we're seeing in a host of other industries from shopping to music to entertainment, to travel. And it doesn't have to be that way.

WM: While the Schwab Marketplace ended up being a big success, there was some pushback from many firms for various reasons. What kinds of pushback are you getting from incumbents with Magnifi?

RH: Your point is a good one, but we're not seeing that kind of a reticence or any reluctance to embrace the platform. In fact, just the opposite. If you think about what Magnifi is at its core, it's an investment marketplace, a one stop shop for ETFs, mutual funds, SMAs and models, and we'll continue to add data, but it's all supported with that combination of natural language search and very robust investment intelligence. So people can apply plain English queries and get very relevant answers back.

With respect to the asset manager, they face a distribution challenge. They are spending 40% of the revenues on distribution in the face of topline pressure. And that sort of dynamic is leading to very poor measurement of demand. Magnifi is changing that because the folks that arrive at our marketplace are highly intended. They're there to look for investment products and to compare and contrast them just like you and I do when we go shopping on Amazon. And those asset managers, the manufacturer wants to be in that space to show off their brand and products in front of that highly intended audience.

DP: Those who don't really want open architecture, they don't like Magnifi. You've got a lot of firms that claim to be open architecture because they have a few other products besides the house brand products, but they really drive all the purchases to the house brand because that makes a lot more money. Not a little more money, a ton more money. The RIA community, firms that have no proprietary products that really want to give advice customers the very best investments, they're very excited about Magnifi. It does represent a new way of doing things and that takes a little time to wrap your head around, Google wasn't Google overnight, Amazon wasn't Amazon overnight, or we wouldn't be here. We'd all be in The Bahamas with our wealth because we bought those stocks when we could have owned them cheap.

WM: I understand that your former firm Hightower is using Magnifi, David. Can you describe how it is being used there?

DP: I think in a place like Hightower, you don't have a top down decision by someone in headquarters who tells all the RIAs how to do something. So it's really a one-on-one, us talking to advisors, helping them see what Magnifi can do. And it's a slow process of getting them to learn, to do things differently and what we offer and how that can help them.

RH: I think it's important to give you a context. Remember, Magnifi just came to market in March of last year. We went from 7,000 searches in March of 2020 to 700,000 searches at the end of 2020. It's exponential growth. Those [Hightower advisors] who are using it are using it to be faster and more engaging over Zoom. The days of sitting across the kitchen table with clients are gone and post-pandemic I suspect we're going to continue to work the way that we are all interacting now.

They're using it very actively to convert prospects [too]. Magnifi's machine learning lets you take a prospect portfolio and within seconds demonstrate alternative product that can enhance the performance of that portfolio under whatever metric you're looking at, low cost, higher risk-adjusted return, a better fiduciary risk profile. They're using it to identify attrition risk early. They're uploading client portfolios… and quickly searching across those client portfolios to uncover actionable ideas. [For example] Who has a low yield-portfolio here? I might make a call. Who holds too much Tesla relative to where I think the value is in that name.

WM: Can one of you go into a little more detail and depth about the compliance aspects of Magnifi?

RH: One of the most prevalent uses for the platform that we're seeing among our paid subscriber base is compliance with Reg BI. Advisors are overworked and have little time to satisfy the personalization requests and demands by their client, comply with all this increased compliance and find the right products among this mass proliferation. So what they're doing to comply is just looking for lowest cost funds, it's a downward spiral to lower cost product.

Because of the speed and precision available on plain English queries, you don't need to know systems nomenclature or esoteric jargon or a ticker symbol. Type in “best performing, low-cost, highest fiduciary score, ESG fund.” Then through the platform with a click, you can generate a proposal, sort of a search book, a diligence report. And they're dropping that in the file to satisfy Reg BI right from the workflow.

WM: How do you anticipate the advisor’s world and day-to-day workflow potentially changing in light of Magnifi?

DP: Rick and I always talk about the opportunity for the advisor, especially over Zoom, to do screen sharing with clients, which puts your skill and enablement front and center—you are a digitally powered advisor, not doing things the way we did them 10, 20, or 30 years ago. In less than five minutes, a prospect comes in; he doesn't come in with $4 million in cash, rather a potpourri of products that he's bought over the years, now you have to assess them. That's a big job in 2019. In 2021, it takes about two minutes to look at every product that customer has and show them alternatives, higher performance, lower cost, easily, and, and a client or prospect looks at the advisor and thinks, "boy, I want a guy who's using tools like this." That's the bet we've made.

RH: A client says, “I'm interested in having my capital impact my social interests. I want to see us invest in clean tech.” Well, they [the advisor] can go to our builder module and very quickly tilt the existing portfolio and say, look, if we add a 10% of this clean tech fund, and here's why I'm choosing that again, they're seeing it on the screen. Here's the impact of doing that. SEI recently did a study that suggests that the average wealth manager is spending nearly a day a week in portfolio construction and research. That's a lot of time. Magnifi turns that upside down, they could do what was taking a day and turn it around in the matter of an hour. That's what the machine learning does. Magnifi has 165 different metrics in it, so they could torture the data as they want to.

WM: What are the changes you anticipate and what changes, if any, would you like to see a Democratic administration and Congress try to achieve regarding the industry?

DP: We're going to see more regulation. I think that's going to be inevitable. We're going to have more taxes. I think we're all prepared for the tax code to change yet again. New rules may be on cap gains, more complicated rules of one sort or another. There's going to be more paperwork, more time and effort spent in only marginally productive things, frankly. So we need to evolve with that. I think our platform allows us to add tools that make it more and more compliance, regulatory and tax sensitive. A lot of companies have problems because they're relying on core technology that's 20 years old.

RH: In the Biden administration it's a function of who they put in. As he makes appointments into the various regulatory bodies these guys will be compelled to act. I agree with Dave, we're going to see increased regulation again, well-intended but it's going to have unintended consequences that we'll all have to contend with. ESG metrics are not commonly part of mandatory financial reporting. I could see that becoming some kind of requirement for example, making disclosures in their annual reports.

WM: You are still teaching in San Francisco David? How have the students changed?

DP: Yes, Wharton’s San Francisco campus, their executive MBA program. It's really very different from the normal MBA because our average student is 35 years old. So they are really seasoned executives as opposed to your 27-year-old MBA who has been an analyst for two years and doesn't know really much of the world or what's really going on. So we have this amazing array of highly ambitious well-qualified 33, 34, 35 year old executives that are still in their jobs. I love teaching these students.

It's just technology, technology, technology. If you are person who is the last generation or older generation, we do offline things. My students use technology all the time. If they're doing anything that's not technology, they are also doing technology as they multitask. You've got to be always available, they're emailing me, they're in touch with me. As I'm preparing to teach, I know my students are going to want to be Zooming with me; as a professor, I need to be able to be tech savvy, enough to use whatever's out there in teaching my students. It's fun for me. I'm excited to sort of reinvent myself instead of just doing the same old thing.

This interview has been edited for clarity and length.