I grew up in the automotive industry. I became a consultant doing a lot of [manufacturer] turnarounds in the ‘90s. I approached my practice the way I was approaching my consulting business. I’d walk into a distressed manufacturer. The first thing I would do is build a model and determine, “OK, here is where you have problems. Here are the fixes.” I do the same thing now, but the fixes are based on portfolio allocations. I’ll say, “This is what you need to get your house in order.” Then, we need to make sure that we’re maintaining that order.

I bought Summit in 2012 along with three other people. The guy that we bought it from didn’t do any of this. He used the technology to run SMAs like you’d run a mutual fund. All he did was manage his models. You picked what you wanted to go into. He did no planning. His communications were just emailing back and forth. They had to be archived separately.

I do my own marketing. We’re 100% referral [for getting new clients] at this point. We’re very small and niche. Most of my clients have never met me face to face unless they’ve gone to a conference I’ve spoken at. I’m not typical. I try to keep it very simple. Coming from automotive, one thing I’ve learned is, the more complex you make either your business model or product, the more failure modes you’re introducing into the system.

I do my own marketing. We’re 100% referral [for getting new clients] at this point. We’re very small and niche. Most of my clients have never met me face to face unless they’ve gone to a conference I’ve spoken at. I’m not typical. I try to keep it very simple. Coming from automotive, one thing I’ve learned is, the more complex you make either your business model or product, the more failure modes you’re introducing into the system.

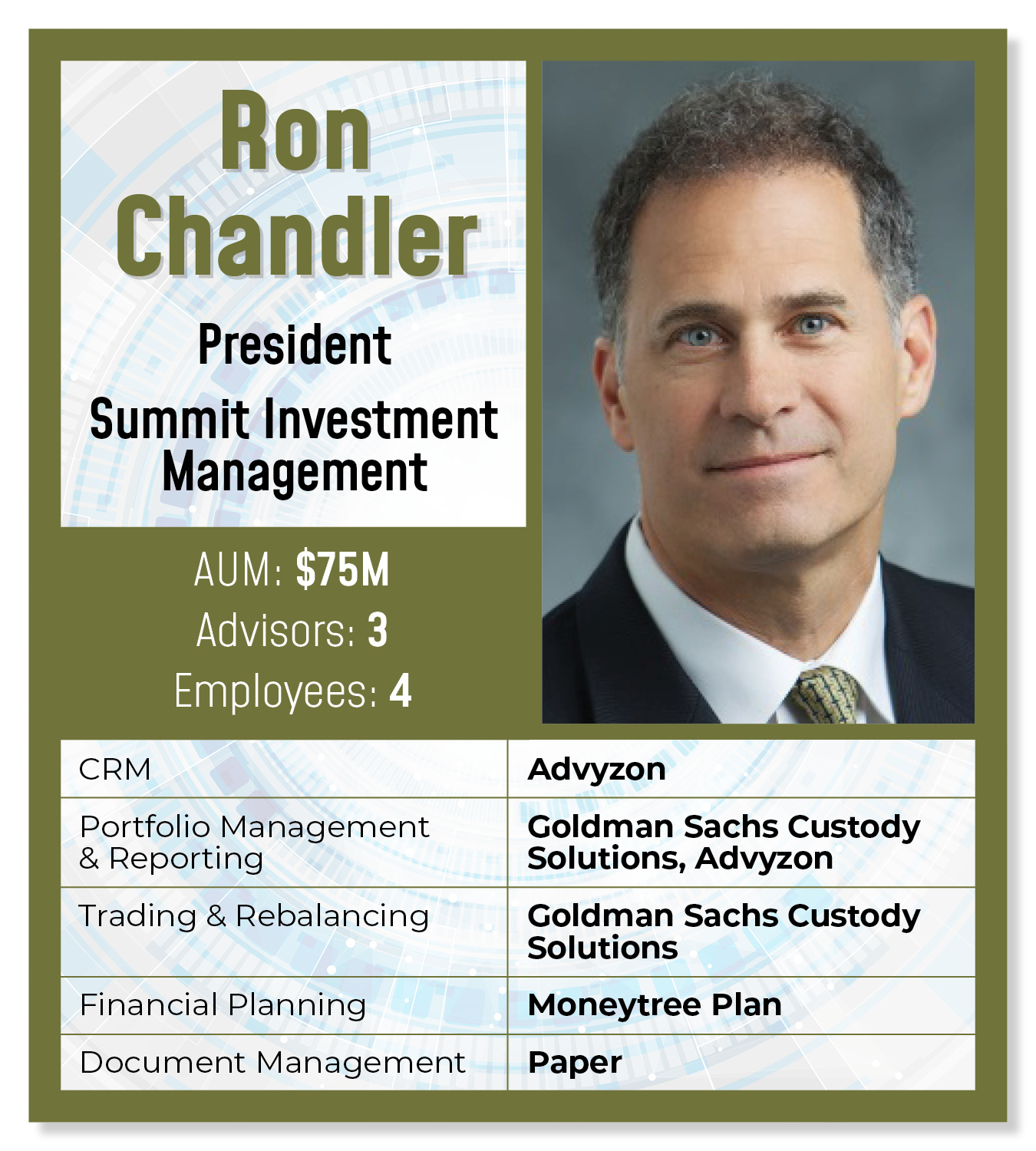

Portfolio Accounting/Trading/Rebalancing: Goldman Sachs Custody Solutions

Our custodian is now Goldman Sachs, after Folio Financial was acquired in 2020. Folio was always very responsive. There has been some indigestion since the Goldman takeover, but I have found Goldman is tracking well in getting to the level that we were used to. The benefit of the platform is the ability to do models. I have created dividend, growth, innovation and defensive portfolios. Depending on the client’s needs and their risk tolerance, we will allocate across those. With one click I can make trades in the various portfolios and have it sweep across all those clients. They’re always where they need to be based on what I’m doing. That helps a lot. What Goldman doesn’t do is reporting. They issue statements and 1099 at the end of the year, but nothing about percent, benchmarking or cumulative returns. You’d have to go through all your statements and do your own math.

CRM/Portfolio Reporting/Client Portal: Advyzon

Goldman and Advyzon are integrated. Advyzon seemed to be at the time the most complete in terms of giving me everything that I needed between CRM, reporting and portals. They also have tools for practice management. They have a good reporting suite as well as a client portal. On our website, clients can log in to Goldman [through the Advyzon client portal] and see everything that’s in their accounts. We’ve structured the portal, so it has real-time reporting. Everything is as of end-of-day yesterday. You can see what your returns are. You can see how much distribution income you’ve made. You can see what’s projected out. That’s been powerful in terms of client satisfaction. We even have a phone app. I have clients that struggle with passwords. With their app, they can get on and see everything including all the reporting we send out. I send out a quarterly missive called a client letter. It tends to be more of an overall outlook as opposed to discussions about individual accounts.

Financial Planning: Moneytree Plan

What Advyzon doesn’t do well is planning. Their module is terrible. I use Moneytree Plan. I’m amazed. It is an extremely powerful, low-cost platform. Some clients have complicated estates. Moneytree allows me to model and project it out. I can run various, “What if?” comparisons. I have what I’m told is a unique practice in that many of my clients give me their life savings. I’ve got everything. We built these databases in Moneytree. A client will call me up and say, “I need a new car. What can I afford?” And we’ll go through, “What are you looking at?” I can run the numbers. We can project it out. When a new client comes on board, I create an initial financial snapshot of where they are. Then we get on to what we think they need to do and where we should position their investments to align with the objectives laid out in the snapshot. Neither Goldman nor Advyzon talks with Moneytree. But that’s okay because of the way I structure the account allocations. It’s very easy for me to type in a couple of numbers when I’m dealing with a client.

What Advyzon doesn’t do well is planning. Their module is terrible. I use Moneytree Plan. I’m amazed. It is an extremely powerful, low-cost platform. Some clients have complicated estates. Moneytree allows me to model and project it out. I can run various, “What if?” comparisons. I have what I’m told is a unique practice in that many of my clients give me their life savings. I’ve got everything. We built these databases in Moneytree. A client will call me up and say, “I need a new car. What can I afford?” And we’ll go through, “What are you looking at?” I can run the numbers. We can project it out. When a new client comes on board, I create an initial financial snapshot of where they are. Then we get on to what we think they need to do and where we should position their investments to align with the objectives laid out in the snapshot. Neither Goldman nor Advyzon talks with Moneytree. But that’s okay because of the way I structure the account allocations. It’s very easy for me to type in a couple of numbers when I’m dealing with a client.

Document Management: Paper

At this point, there is no secure, SEC-approved electronic platform, cloud or otherwise, for keeping client records. So, we have a hard-copy client folder for each client household that are kept in locked, fireproof cabinets in a locked room at our physical HQ. For electronic signatures, we use DocuSign. Administrative records needing less security measures are kept on a file server, again at HQ.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what's in your wealthstack? Contact Rob Burgess at [email protected].