The robots are coming for your job. Kind of.

That was the sentiment shared by several panelists asked about artificial intelligence and its impact during a discussion on advanced analytics at the FINRA Annual Conference in Washington, D.C., this week.

Kerry Gendron, a senior vice president of member supervision, analytics, innovation & solutions with FINRA, said AI would more likely be employed as a tool to “augment” human intelligence, with more industry jobs shifting into risk management and training.

Aleksandra Radakovic, a managing director and global head of compliance surveillance at JPMorgan Chase, also believed AI would help advisors do their jobs more effectively.

“I don’t think they’re going to completely replace us in the next 50 years; I can’t go beyond that,” she said. “But I don’t think you’ll be able to do a job in the next three years that doesn’t have some component of what we’ve talked about.”

The panel took place as AI tools like ChatGPT continue to make headlines daily, with financial services compliance officers fretting over regulatory pitfalls while other employees worry that advanced analytic tools and generative AI will usurp them entirely.

Advanced analytics is often understood as containing four segments, including descriptive, diagnostic, predictive and prescriptive, according to many technology experts (with AI seen as a type of advanced analytics). But in short order, the arrival of ChatGPT and the proliferation of large learning models and natural language processing has widened the window of what professionals in all industries may have considered possible a short time ago.

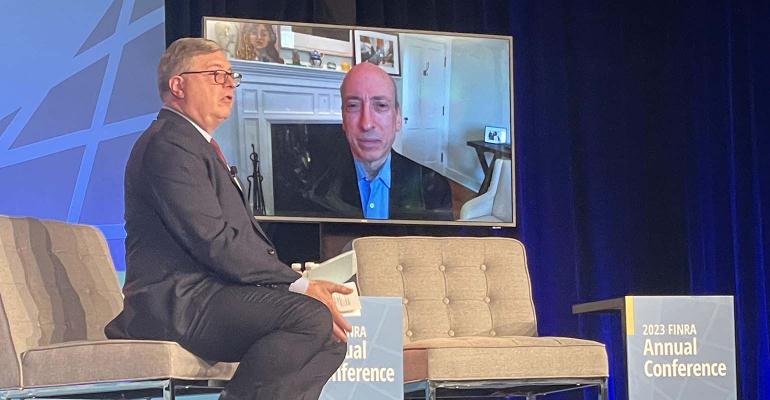

Its impact was underscored during a keynote chat between FINRA President Robert Cook and SEC Chair Gary Gensler. Gensler has previously spoken about the “inherent conflicts” that predictive data analytics may create when investment advisors (including robo advisors) are making recommendations to clients.

During his conversation with Cook, he said SEC staff were considering recommendations to commissioners about potential rules to address the conflicts, and after weighing the recommendations, the SEC may put out proposed rules for public comment. Gensler explained that while AI can optimize for a client’s best interest, it might optimize for other factors, including the interest of the robo advisor or brokerage app, creating a conflict.

Gensler also worried about what overreliance on these systems could mean for the markets and economy at large. The AI sea change hitting industries from healthcare to driverless vehicles and finance raises “significant regulatory challenges around systemic risk,” he said.

“And the data aggregators and AI platforms could well be serious parts of fragility in the future when we look back and say, ‘Oh my God, the crisis of 2027 was because we were relying on one ... generative AI level, and a bunch of fintech apps built on top of them,’” he said.

The use of AI and other advanced analytics isn’t limited to advisors and firms. Regulators are also in the game, with Gendron detailing a “recommendation engine” FINRA was using to leverage machine learning in finding patterns about regulatory events. The tool could help regulators focus on higher-risk events and pinpoint events that are causing real customer harm.

Gendron said firms are increasingly using standard large language models with their own proprietary models overlaying it, and she predicted a “prolific rate of change” in this space, with firms and vendors rushing in and white papers being released hourly.

She also urged firms to start small when incorporating AI for the first time, suggesting they find their most-pressing business problem, and see if it could be solved through analyzing unstructured data (with natural language processing) or structured data (with machine learning).

“If you’re a big firm or a small firm, Rome was not built in a day,” she said.

But one panelist did not believe robots were coming to make the industry’s employees obsolete. Harvey Westbrook, a senior director and assistant chief economist with FINRA, expected advanced analytics would bring many disruptive changes to financial services, but he reminded the audience that spreadsheets or the computer were just as disruptive at one point.

“I’m excited because we’re going to be able to ask questions we haven’t asked before,” he said.