Online farmland investing platform AcreTrader announced this week an expansion of its oversubscribed $40 million Series B funding, which was first made public in January. This brings its total in the raise to $60 million, following a new investment from Columbus, Ohio–based venture capital firm Drive Capital.

Founder and CEO Carter Malloy said the additional funding would be put toward continued expansion of the company’s technology and head count, which has grown from 15 in early 2020 to 80 today.

“RIAs are constantly looking for new ways that they can add value to their client base, which is increasingly interested in exposure to alternative investments outside of the traditional 60/40 stocks and bonds allocation,” said Malloy.

The startup, which first launched in 2018, uses its technology platform to match farmers and sellers of farmland with investors and buyers.

“To invest in farmland in the past, investment advisors would have to help their client through a very arduous process of evaluating an asset class they are not familiar with,” he said, adding that the upfront capital required to buy an entire farm would usually prevent their clients from participating.

“Despite attractive historical performance, it was very rare for any investor to even consider farmland as an investment opportunity,” said Malloy.

The AcreTrader platform currently provides multiple investment opportunities each week and makes it far easier for interested advisors and their clients to research their options.

With it, Malloy said that RIAs are able to introduce their clients to a high-performing yet unfamiliar asset class in an approachable manner and help them diversify their portfolios with farmland far more quickly, easily and in a compliant fashion.

AcreTrader also announced plans to expand its platform called AcrePro, a land brokerage application intended to simplify assessing, selling and purchasing farmland for all parties from agents to buyers and sellers.

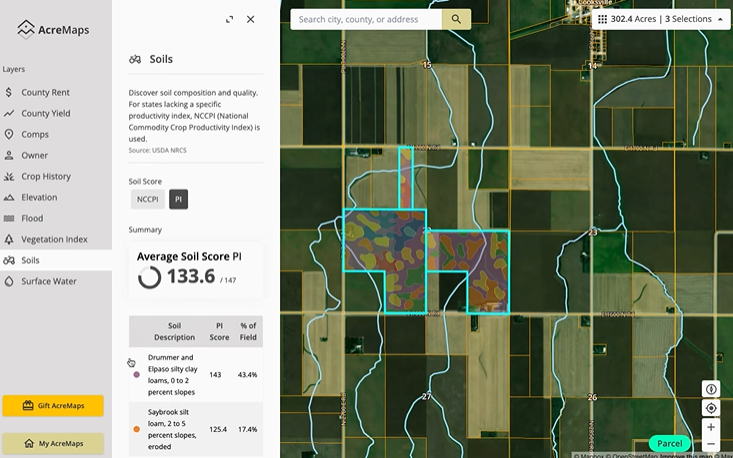

The funding will also be used to build a geospatial analytics platform for land valuation.

A screenshot of the AcreTrader geospatial platform, currently under beta.

RZC Investments, founded by heirs of Walmart founder Sam Walton, led an initial oversubscribed $5 million seed round in AcreTrader in April 2020. This was followed a year later by a $12 million Series A funding round, led by Jump Capital. Narya Capital, Revolution’s Rise of the Rest Seed Fund, and existing investors RZC Investments and Revel Partners also participated.