Changes in ownership and an extensive development to-do list significantly pushed back the broad market launch of the estate and legacy planning tools being built at Apprise Labs. The joint venture between eMoney founder Edmond Walters, Envestnet and MoneyGuidePro’s parent company PIETech was announced at the 2019 T3 Advisor Conference and had an estimated broad market launch scheduled for September 2019.

Envestnet’s acquisition of PIETech, however, meant the ownership structure of Apprise had to be updated. Tony Leal, president of Envestnet | MoneyGuide, became an individual owner, alongside Envestnet and Walters with the liquidation of PIETech’s stake in the joint venture.

That paperwork, along with development tweaks following a pilot release to family offices in October and November, pushed the scheduled launch date back by half a year to March 2020.

“Next month it’s going out,” said Walters. He said the first launch partner would be a yet-to-be named enterprise.

The timing of Apprise’s launch incorporates integrations MoneyGuide is building, too, said Leal. Developers at Envestnet’s financial planning division are three weeks into work on integrating Apprise and expect to wrap up coding on their portion of the venture by March 1.

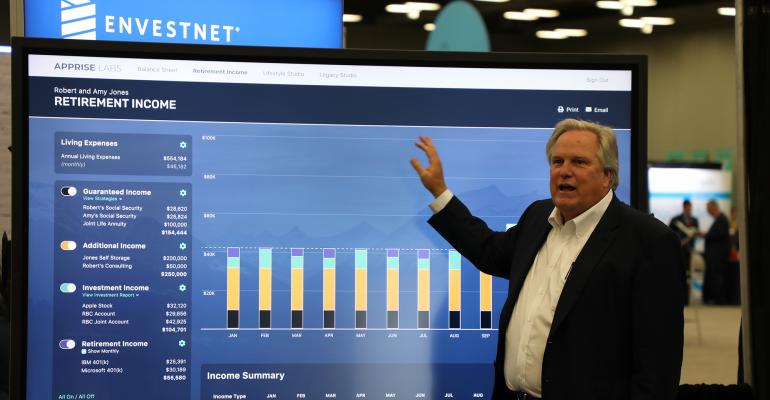

The Apprise user interface still has an Income Studio, which used to be called the Retirement Income feature, Lifestyle Studio and Legacy Studio, alongside a detailed Balance Sheet feature. Walters said feedback he received last year resulted in changes to the Income and Legacy features. “We weren’t as tightened up as I would want it to be with the estate and cashflow talking to each other,” he explained. “You go out to what you think are the best advisors in the market, and you get as much feedback as you can.”

But Walters is also worried competitors are angling to copy his tool. Apprise employees asked a person taking photos of Apprise features to leave, he said. “We’ve busted our butts,” he said, explaining that copycats were a concern for him.

“I don’t want to feel like Fidelity and people are looking at it,” he said. For that reason, he’s not planning on updating the company’s website when the tool is ready for the broad market. “I don’t think websites work,” he said. “Nobody is going to go to our website and buy,” he said, a sign that he doesn't believe the website is the right interface for marketing the planning software.

Secrecy and concern over competitors building something similar hasn’t dampened advisors’ curiosity or enthusiasm. Some three dozen or so attended Walter’s demonstration on Wednesday, a sign that advisors are eager to get access to the legacy and estate planning tools and marketing materials Walters has showcased since last year.

In a sign of anticipated demand, Walters said he’s begun hiring support personnel. “We won’t be hiring any more dev [developers],” he said. The first two enterprises he expects to onboard will be “thousands of seats,” he added, stating that by July he expected to have five enterprises signed up with Apprise.

While Walters declined to say who the first clients using Apprise would be, he hinted that they would be familiar with MoneyGuide. “A lot of them are co-clients,” he said. Just last month, LPL announced an integration with MoneyGuide on its ClientWorks Connected platform and last summer it unveiled a “strategic alliance” with Jackson National Life Insurance Company