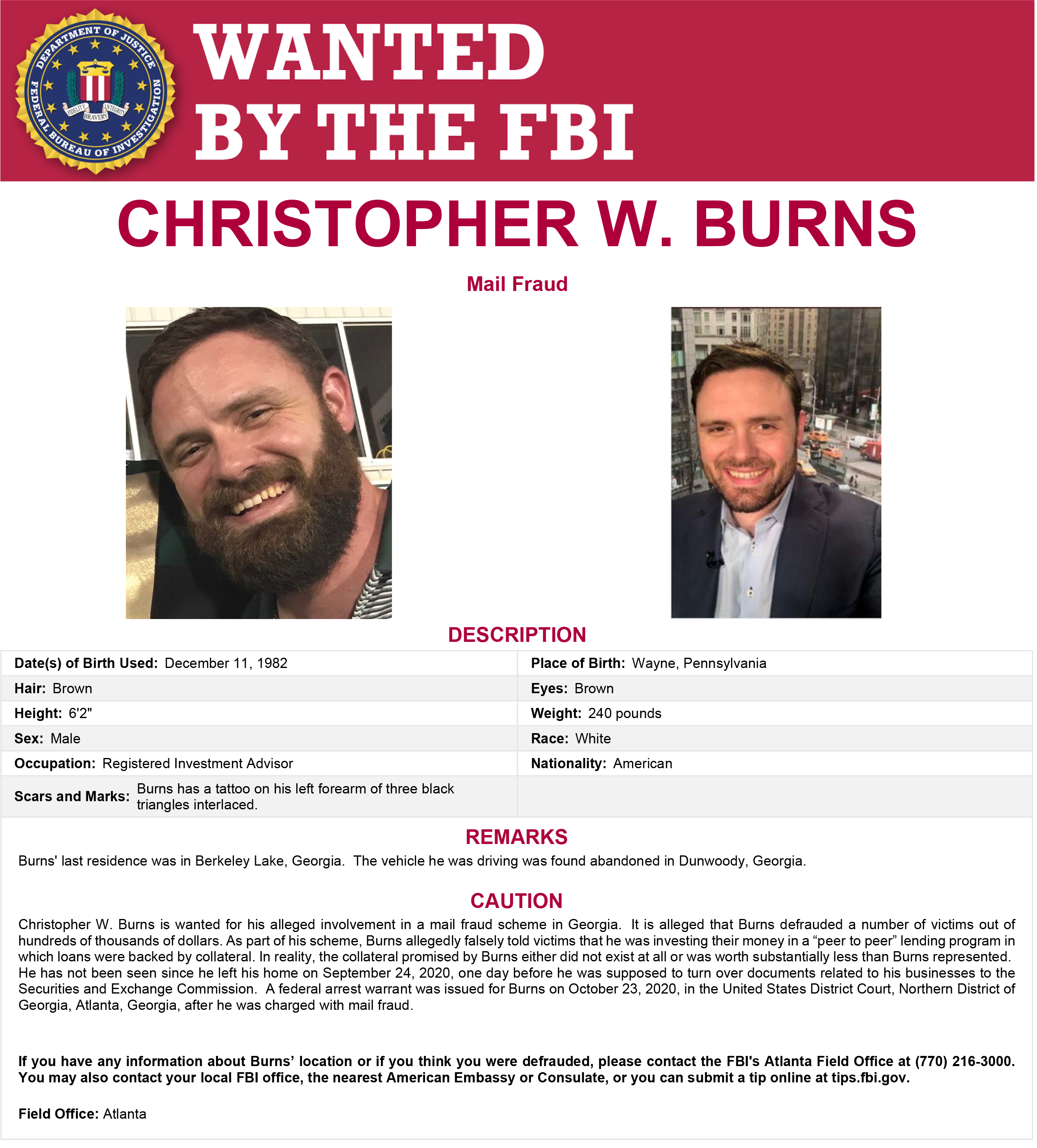

A fugitive financial advisor is facing new charges from the Justice Department, more than 2 1/2 years after he originally disappeared.

This week, a federal grand jury in Georgia charged Christopher Burns with 10 counts of wire fraud, two counts of mail fraud and four counts of money laundering related to a scheme in which he allegedly stole $10 million from dozens of clients, according to the DOJ.

U.S. Attorney Ryan Buchanan said Burns had violated his clients’ trust to “fund his lavish lifestyle,” and said the FBI was continuing the search for Burns, who disappeared in September 2020.

“He betrayed investors and stole their savings with promises of safe investments that would yield high rates of returns,” he said. “Individuals who brazenly cheat their clients should expect to be held accountable.”

The details in the DOJ indictment mirror Securities and Exchange Commission charges filed in November 2020, shortly after Burns went on the run. According to the DOJ and SEC filings, Burns ran his own firm, Investus Advisers, in the Atlanta area. In the several years before he disappeared, Burns raised his profile by purchasing radio time for “The Chris Burns Show,” marketing his financial advice.

Starting in early 2017, Burns recommended his clients to buy promissory notes, claiming the products were part of a “peer-to-peer” program to lend small businesses capital. Burns claimed the notes held little risk, and he personally guaranteed them against losses, according to the SEC.

But the lending program was a sham, according to the DOJ; Burns never loaned any of the money to small businesses and instead used it to fund his lifestyle, including more airtime for his self-titled radio show. But by September 2020, Burns sold more than 70 promissory notes to at least 40 investors in Georgia, North Carolina and Florida, raising more than $10 million.

The rate of promissory note sales increased in the months leading up to his disappearance, but regulators were getting suspicious. According to the SEC, Burns knew he was under investigation, and Investus Advisers was scheduled to supply documents to the regulator on Sept. 24, 2020.

The day before, Burns filed paperwork to divorce his wife, Meredith, awarding her their boat, home and all its contents, signing a quitclaim deed granting the home to his wife for $10; he also transferred hundreds of thousands in earnings to his personal accounts, according to the SEC.

On Sept. 25, Meredith Burns reported her husband as missing. Burns’ car was later found in a parking lot in Dunwoody, Ga., with several cashiers’ checks totaling $78,000, but he was nowhere to be found.

The Justice Department charged him with mail fraud on Oct. 23, with a warrant issued for his arrest, but he hasn’t been seen or heard from since. His disappearance landed him on the FBI’s Most Wanted list.

Meredith Burns agreed to disgorge more than $300,000 her husband gifted her, and a federal court ruled in the SEC’s favor last year, demanding Chris Burns and his assorted companies pay $12 million, according to The Atlanta Journal-Constitution. Meredith Burns maintained she was unaware of her husband’s schemes, urging her fugitive husband to turn himself in during an interview with Atlanta’s WSB-TV in early 2021.