Confession. I follow this stuff compulsively. This is what I think I know today.

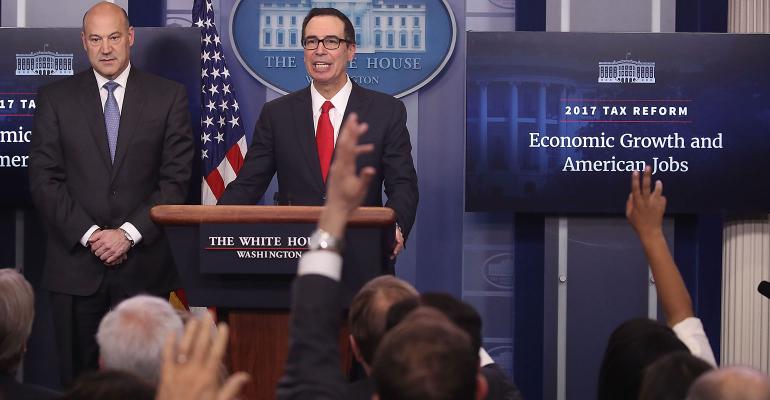

Here’s a quote from the joint July 27, 2017 statement issued by Treasury Secretary Steven T. Mnuchin, Speaker of the House Paul Ryan, Senate Majority Leader Mitch McConnell, Senate Finance Committee Chairman Orrin Hatch, House Ways and Means Committee Chairman Kevin Brady, and National Economic Council Director Gary Cohn:

"The White House and Treasury have met with over 200 members of the House and Senate and hundreds of grassroots and business groups to talk and listen to ideas about tax reform. ...

Over many years, the members of the House Ways and Means Committee and the Senate Finance Committee have examined various options for tax reform. During our meetings, the Chairmen of those committees have brought to the table the views and priorities of their committee members. Building on this work, as well as on the efforts of the Administration and input from other stakeholders, we are confident that a shared vision for tax reform exists, and are prepared for the two committees to take the lead and begin producing legislation for the President to sign. ...

While we have debated the pro-growth benefits of border adjustability [20 percent tax on imports], we appreciate that there are many unknowns associated with it and have decided to set this policy aside in order to advance tax reform. [Emphasis supplied]

Given our shared sense of purpose, the time has arrived for the two tax-writing committees to develop and draft legislation that will result in the first comprehensive tax reform in a generation. ...

Our expectation is for this legislation to move through the committees this fall, under regular order, followed by consideration on the House and Senate floors. As the committees work toward this end, our hope is that our friends on the other side of the aisle will participate in this effort. The President fully supports these principles and is committed to this approach. American families are counting on us to deliver historic tax reform. And we will."

Comment. The joint statement by the White House, the House of Representatives and the Senate says that any new law will follow “regular order.” If regular order is followed, individuals and institutions concerned about tax incentives for private support for the public good will have an opportunity to make their views known.

The Known Knowns

The Ways and Means Committee’s June 2016 Blueprint and former W&M’s Chairman Dave Camp’s proposed Tax Reform Act of 2014 (H.R. 1) (many of its provisions are in the W&M’s Blueprint) would significantly reduce and sometimes eliminate long-standing tax incentives for charitable giving. And the tax proposals on candidate Trump’s website and the president’s short April 26, 2017 press release would curtail tax incentives for charitable contributions.

Now You Tax It, Now You Don’t?

Trump former advisor Steve Bannon proposed the top income tax rate of 39.6 percent be raised to 44 percent for Americans earning more than $5 million a year. But Marc Short, White House director of legislative affairs said on Fox News: “I don’t think that’s on the table [tax table?] right now, to be honest with you.” And he added: “We don’t believe raising taxes is the way to encourage growth.” Meanwhile, House Speaker Paul Ryan says he supports the top 35 percent rate in the Trump Administration’s April press release: “We’re not in the business of raising taxes.”

Lump Sum

Lumping the Administration’s and the W&M’s proposals together, they would: (1) make the income tax charitable deduction available to only 5 percent (instead of the current approximately 30 percent) of taxpayers; (2) impose a 2 percent floor before an itemized deduction is allowable; (3) curtail the benefits for some appreciated property gifts; (4) place a $100,000 ceiling on itemized deductions ($200,000 for joint filers); (5) curtail the benefits of donor advised funds; and (6) impose capital gains taxes on appreciated property bequests to private foundations.

Issues to Focus On

When the promised tax proposals are released, be prepared to tell Congress about the importance of long-standing charitable tax incentives enabling charities to serve our citizens. In addition to urging retention of current tax incentives for outright and life-income gifts, urge Congress to:

- Enact an All-American universal charitable deduction that would be available to both itemizers and nonitemizers—the so-called above-the-line deduction (deductible from gross instead of adjusted gross income).

- Include the Legacy IRA (H.R. 1337) in tax reform legislation. That bill allows taxpayers ages 65 and over to transfer assets from their individual retirement accounts to create life-income plans that will benefit charities at the end of the trust term. The cost of this bill is only $106 million over 10 years.

Multiple Choice: What Will Happen?

□ A tax reform bill will pass the House in October, be approved by the Senate in November and be quickly signed by the President, said Marc Short, White House Director of Legislative Affairs, at a July 31 event sponsored by Americans for Prosperity and Freedom Partners.

□ Senate Finance Committee Chairman Orrin Hatch (R-UT) in an Aug. 3 press release says that his committee is “crafting a reform bill” and will move it though the committee this fall.” Further “. . . the committee process will be robust—I plan to hold multiple hearings and full markup.”

□ Senate Democrats in an Aug. 1 letter to President Trump and Republican leaders offered to work with Republicans on bipartisan tax reform if: The legislation doesn’t cut taxes for the wealthy and wouldn’t be deficit financed; the Republicans agree that the legislation would be passed by a simple majority and not under the “reconciliation” procedure. Forty-three Democrats and two independents signed the letter. Not signing were three Democrats up for re-election next year: Heidi Heitkamp of North Dakota, Joe Donnelly of Indiana and Joe Manchin of West Virginia.

□ Senate Majority leader Mitch McConnell (R-KY) says: “We will need to use reconciliation” because Democrats are “not interested in addressing Republican priorities.”1

□ Nostradomus predicted that Congress will at the very least give Americans a tax cut by lowering tax rates and increasing the standard deduction—resulting in only 5 percent (instead of the current approximately 30 percent) of taxpayers who could itemize their charitable and other deductions. He didn’t predict whether the tax cut would be retroactive for this year.

□ Taxes schmaxes. I’m worried about Nuclear Armageddon.

Endnote

1. Reconciliation would require only a simple majority in the Senate and would be a slam dunk in the House. Democratic backing wouldn’t be needed, but the bill would have to be revenue neutral—easier if dynamic and not static scoring is used.

© Conrad Teitell 2017. This is not intended as legal, tax, financial or other advice. So, check with your adviser on how the rules apply to you.