Los Angeles-based registered investment advisor Miracle Mile Advisors, headed by managing partners Duncan Rolph and Brock Moseley, announced the launch of a three-person institutional consulting team.

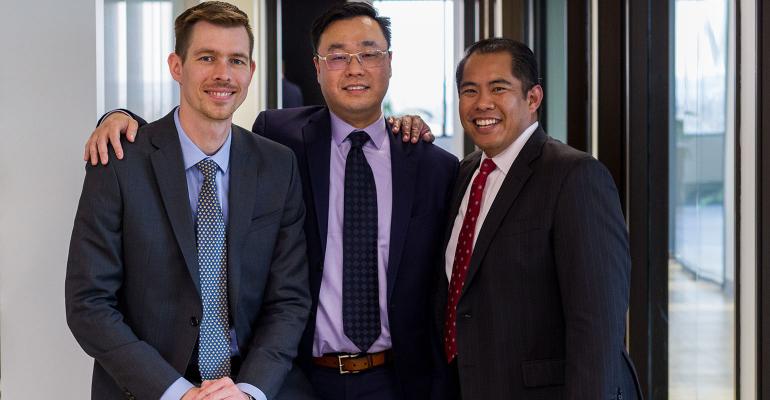

Gerard Tamparong, Frank Lee and Michael Treidl make up the trio joining the firm, and all three come from Payden & Rygel, a privately owned investment and asset management firm with $119 billion in assets under management. Not so surprisingly, the new unit will be called Miracle Mile Institutional. Tamparong, formerly a senior portfolio manager with Payden & Rygel, will lead the new team. Lee, who once co-managed all equity strategies at his former employer, is now managing director, while Treidl will manage operations. The team will be based out of Pasadena, Calif.

Miracle Mile Advisors manages $1.4 billion in assets and provides wealth management, asset protection, estate planning, tax planning and business planning to individuals alongside its services for small-to-midsize institutions.

Tamparong and Lee had nearly 20 years at Payden, and Treidl had five, before leaving. The team left seeking to be associated with an investment firm that practices the fiduciary standard set by the Securities and Exchange Commission for RIAs.

"The market has been shifting to significantly more transparency, a complete understanding of how fees are assessed, and identifying the conflicts of interest. It’s clearly become an area that is going to be a challenge to continue in a firm such as the one [we were at],” said Tamparong.

“We’re joining a firm that has similar thoughts and philosophies as far as putting the clients first. And in terms of how we’re investing, focusing on low-costing portfolios and index funds,” said Lee.

In a prepared statement, Rolph wrote of the growing need for full-service, cost-effective providers of investment advice to small and midsize institutions that need fiduciary guidance and don’t have the resources to do so in-house. Many of the larger institutional asset management firms typically dismiss those groups with assets under $100 million, he wrote.