(Bloomberg) -- A Pacific Investment Management Co. office landlord that defaulted on $1.7 billion of mortgage notes sent shockwaves through a troubled part of the real estate market.

For years, property owners have been grappling with the rise of remote work — a problem so large that one brokerage estimates roughly 330 million square feet (31 million square meters) of office space will become vacant by the end of the decade as a result. But low interest rates allowed the investors to muddle along more easily without worrying about the debt.

Now, many office landlords are seeing borrowing costs skyrocket, leading owners such as Pimco’s Columbia Property Trust and Brookfield Corp. to default on mortgages. While remote work hurt the office market, rising rates could push landlords, which often use floating-rate debt, closer to a tricky edge.

“It’s just a group psychology, like, ‘Now that one of my peers has done it, everyone’s going to do it,’ so I wouldn’t be surprised over the next six months, if you just saw a wave of defaults and keys getting handed back, because the offices are not getting filled up,” said Nitin Chexal, chief executive officer of real estate investment firm Palladius Capital Management. “A lot of these assets will never recover.”

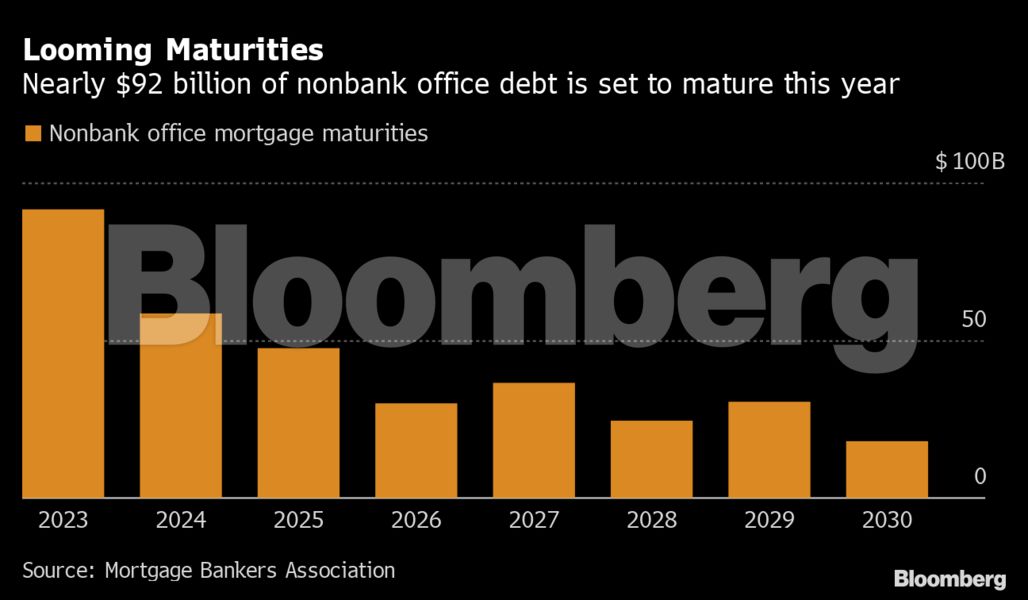

The clock is ticking for more office owners with the Federal Reserve on the path to raising its benchmark rate even higher, more than 17% of the entire US office supply vacant and an additional 4.3% available for sublease. Nearly $92 billion in debt for those properties from nonbank lenders comes due this year, and $58 billion will mature in 2024, according to the Mortgage Bankers Association.

“If you have a loan coming due this year, you’re in trouble,” GFP Real Estate Chairman Jeffrey Gural said. “If you have a loan coming due in three years and you don’t have a lot of vacancy, you’re going to just wait it out.”

Gural’s GFP recently defaulted on a Manhattan office building on Madison Avenue and is in talks with lenders to extend the loan. But the recent defaults by other landlords could help negotiations because lenders may not want to take back the assets, he said.

“It’s helpful for me, that we’ve seen some big players basically give the keys because it makes it easier to negotiate with the banks,” Gural said.

Floating-Rate Debt

The financing challenges are a particular problem for the real estate industry given the proliferation of floating-rate loans, where interest rates reset more frequently. About 48% of debt on office properties that matures this year has a variable rate, according to Newmark Group Inc.

Landlords often have to purchase interest rate caps, which limit payment increases when rates rise and have also become more expensive. The price for one-year protection on a $25 million loan with a 2% rate cap soared to $819,000 in February from $33,000 in early March 2022, according to Chatham Financial.

Even for owners who haven’t defaulted, the math has become a lot more complicated. Blackstone Inc.’s Willis Tower in Chicago, for example, has roughly $1.33 billion of commercial mortgage-backed securities and has seen monthly payments on that debt jump nearly 300% in February from a year earlier, according to data compiled by Bloomberg. A Blackstone spokeswoman said the building is highly occupied with long lease terms.

“We are extremely selective in the types of office we want to own, which is why US traditional office represents only approximately 2% of our portfolio today,” Jillian Kary, a Blackstone spokeswoman, said in a statement.

Defaults don’t necessarily mean owners are giving up on offices entirely. In many cases, such as GFP’s Madison Avenue tower, the investors are looking to negotiate better terms with lenders, or explore other options such as converting the buildings to apartments.

“Every situation is unique,” said Dustin Stolly, a vice chairman at Newmark. “If you’ve got a building that’s well-leased, well-located and has an institutional owner, you’ll be fine. There’s high likelihood the lender you have in place will play ball on an extension. If it’s private ownership, the building is overleveraged, and sponsorship doesn’t have access to liquid capital, that’s where we are seeing situational loan sales or forced asset sales.”

Vacant Space

Higher rates are the latest of the office market’s woes. Many buildings have been struggling to lure workers back after the pandemic, a problem that’s worsened as companies lay off employees and cut back on real estate. Falling demand will leave the US with an excess supply of 330 million square feet of office space by 2030, according to a Cushman & Wakefield report.

Read more about how remote work is hurting a bunch of New York’s office towers.

Some cities have fared better than others. The average occupancy rate in Austin, Texas, was 66% of pre-pandemic levels for the week through Feb. 22, compared with 47% in New York and 44% in San Francisco, according to security firm Kastle Systems.

But the financing fallout has spread across the US. The default by Columbia Property Trust, which was bought in 2021 by funds managed by Pimco, involves seven properties, ranging from a Manhattan tower that used to house the New York Times, to a San Francisco building that’s battling Elon Musk’s Twitter over some missed rent payments. One building in the group of properties, 245-249 W. 17th St., is also seeing Twitter, a key tenant, look to sublease its space at the building.

Another one of the properties entangled in the default, 201 California St. in San Francisco, had roughly 42% of its office space available for lease, either directly or via sublease, as of Feb. 28, according to Savills. For 315 Park Ave. South in Manhattan, that figure stood at nearly 39%.

Overall, the seven-building portfolio is 84% leased, down from 87% when Columbia Property Trust was acquired in 2021, according to Columbia spokesperson Bud Perrone, who cited data that doesn’t include subleases. Columbia said last week that it had engaged with lenders to restructure the loans on the seven properties.

New York landlord RXR is looking to pare back its office buildings, negotiating with its lenders on at least two offices in the city for potential conversions. RXR declined to comment.

Seeking Relief

A Brookfield business defaulted on loans tied to two Los Angeles office towers earlier this year. Brookfield Property Partners, which owns a range of real estate including office and retail spots, said in a Feb. 24 filing that it had stopped payment on only about 2% of all of its properties while trying to negotiate a modification or restructuring of its debt.

“We are generally seeking relief given the circumstances resulting from the current economic slowdown, and may or may not be successful with these negotiations” the filing said. “If we are unsuccessful, it is possible that certain properties securing these loans could be transferred to the lenders.”

Brookfield declined to comment.

The office market’s pain has also ratcheted up as lenders pull back, with major banks weighing sales of office loans. For owners wanting out of this market, there have been few sales of the properties: Transactions in January fell to their slowest pace for the month since 2010, according to MSCI Real Assets.

US office values are down 20% through January from March 2020, according to a Green Street index. Ultimately, the decline in office prices is likely to outpace the drop for commercial real estate prices broadly, according to Matt Rocco, chairman of the Mortgage Bankers Association.

“It’s going to be a very tough two years until the market finds an equilibrium,” said Ran Eliasaf, founder of investment firm Northwind Group. “In the meantime, there’s going to be a lot of hurt and unfortunately, a lot of money lost.”

--With assistance from Layan Odeh.

To contact the authors of this story:

Natalie Wong in New York at [email protected]

John Gittelsohn in Los Angeles at [email protected]

© 2023 Bloomberg L.P.