Advisor Group announced plans Thursday to acquire Infinex Financial Holdings, a broker/dealer that currently supports more than 230 community-based banks and credit unions. While Advisor Group does have an existing presence in the financial institution market, primarily through its Securities America subsidiary, this deal gives the b/d network a foothold in that market on a much larger scale.

“As we think about where AG wants to position itself in the future, we’re looking at expanding our addressable market on a number of fronts, and one of them was the financial institution segment of the market,” said Greg Cornick, Advisor Group’s president, Advice and Wealth Management.

Infinex, which has over 750 advisors and $30 billion in assets, will not be integrated into one of Advisor Group’s other b/ds; rather it will become its seventh subsidiary, with its Meriden, Conn.–based back-office operations and executive leadership team remaining intact. Infinex will continue to clear through Pershing, one of Advisor Group’s clearing firms, so there will be no repapering of client accounts.

“We aren’t going to disrupt the business by any means; in fact, the whole concept of it being brought over as an additional wealth management firm in our ecosystem can allow it to continue to operate, but what we can bring hopefully to the table here is that incremental capital and backing of Advisor Group that will allow for Infinex, which has already had great growth, to even turbocharge that growth further,” Cornick said.

Advisor Group estimates that there’s $1 trillion in assets sitting in investment programs at financial institutions, representing a large market for the firm.

“There’s an untapped opportunity that we see in financial institutions for these services,” said Tim Kehrer, director of research at Kehrer Bielan Research & Consulting, which tracks the bank brokerage and insurance industries.

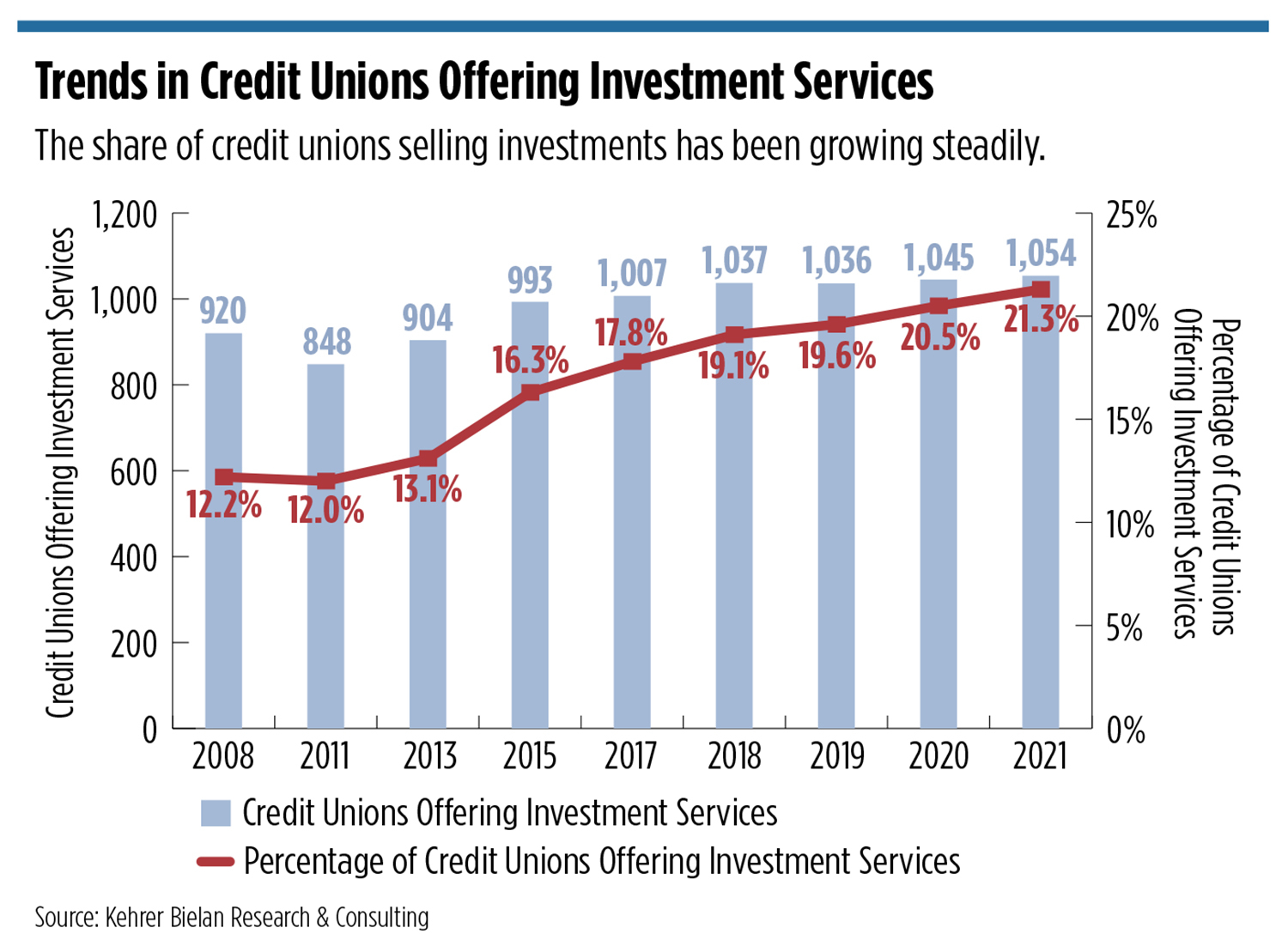

Kehrer said the share of credit unions selling investments has been steadily growing over the past decade. And his research shows that just 25% of community banks are currently offering investment services, indicating there’s room for growth.

“Our research indicates that the typical bank should have twice as many advisors as they have, which means twice as much assets, twice as much revenue and so on,” said Kenneth Kehrer, principal at the consulting firm.

The typical bank has one advisor for every $350 million in core deposits, but Kenneth Kehrer said he sees firms doing it successfully with one advisor per $125 million in core deposits.

“Firms that are very successful in this business and are helping to grow advisors and so on, as well as help them grow their individual practices, see an opportunity to go into this farmland that’s been farmed, but not farmed as well as it could be,” Kenneth Kehrer said.

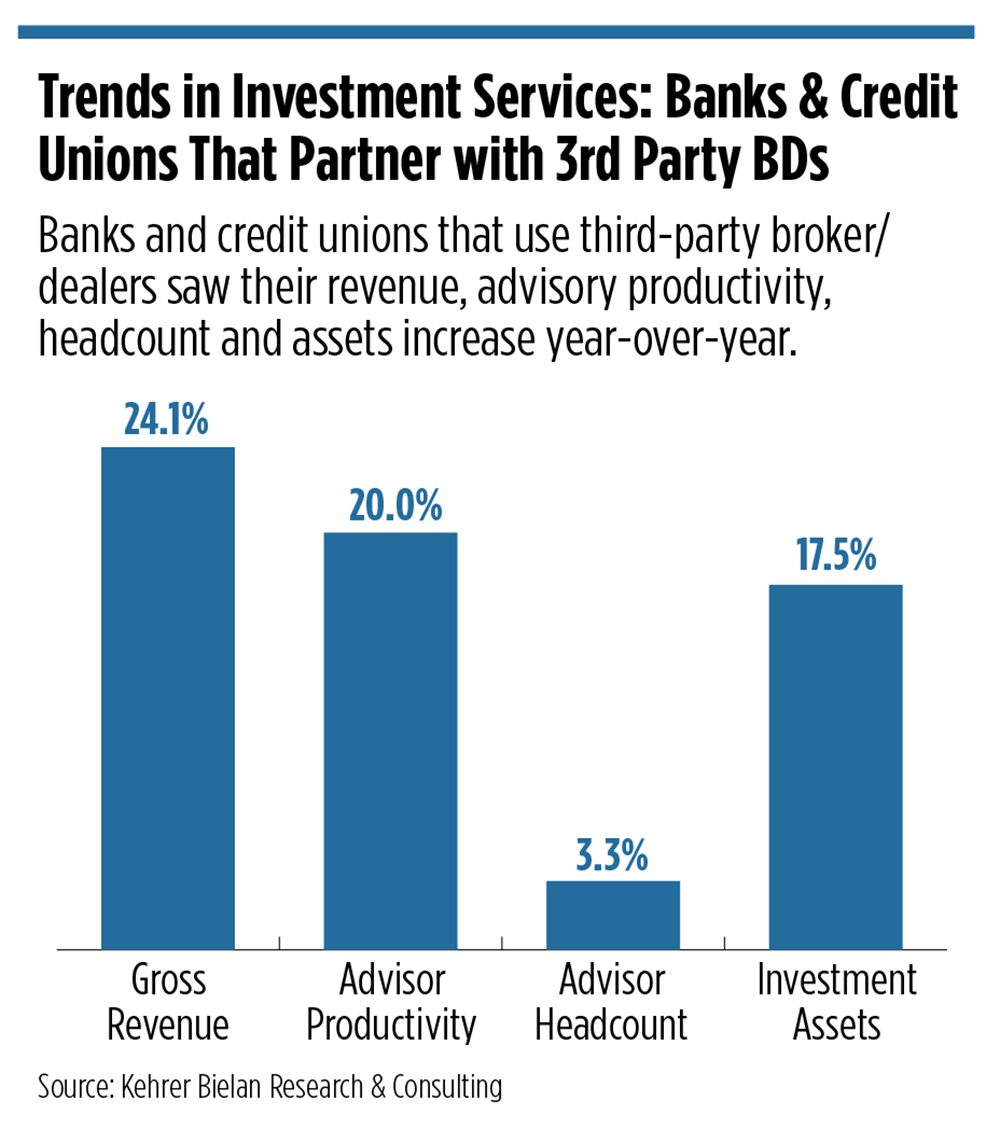

Further, banks are increasingly outsourcing the brokerage responsibilities to third-party broker/dealers, such as Infinex. Ten years ago, for instance, there were 80 bank-owned b/ds; now there are just 37, he said. The increasing regulatory risks and technology spend required to remain competitive have become unbearable for many banks.

“You’ve got a lot of banks and credit unions looking at this and thinking about ways, in terms of where their strengths are, that they can potentially outsource, and one way is a partnership with a firm like ours to create a one plus one equals three situation,” Cornick said.

Advisor Group joins other independent broker/dealers, such as LPL Financial, in creating a dedicated channel for financial institutions.

LPL has recently made a more concerted effort to support these firms and now serves about 800 financial institutions. Last June, the firm brought on Shawn Mihal, former president of Waddell & Reed Inc., the broker/dealer subsidiary of Waddell & Reed Financial, to lead institution services. And in early 2021, the firm launched the Institution Business Strategy department, focused on the evolution of financial institutions as they recover from temporary branch closures caused by slowly retreating pandemic restrictions. Large financial institutions have become a new source of growth for the firm in 2021, with the addition of BMO Harris and M&T. CUNA Mutual Group will transition its wealth management business this year.