Fees and expenses are two of the most important factors to consider when investing. You can’t control the direction of the financial markets, but you can control what you pay to invest.

Investment costs might not seem like a big deal, but they add up and compound over time along with investment returns. You don’t just lose the amount you pay in fees—you also lose all the growth that money would have generated for years into the future.

A Nickel Here, a Dime There

Every mutual fund or exchange traded fund (ETF) in a portfolio has an “internal expense ratio.” This is the amount charged by the fund company for managing the fund.

Internal expense ratios, even for funds with similar investment objectives, can vary widely. Those differences make a big impact on the performance of a portfolio over time.

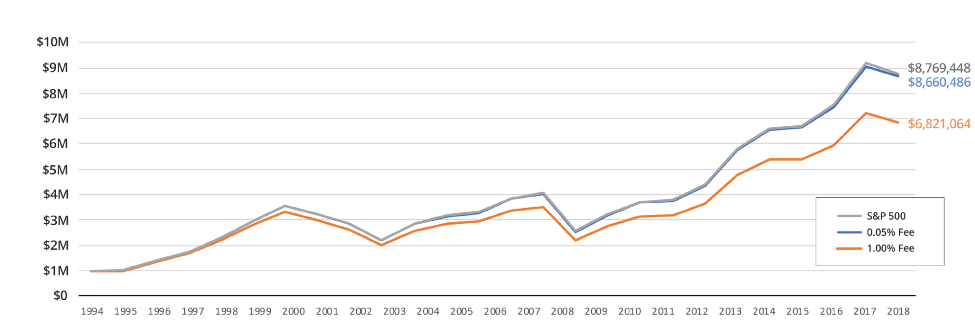

Here’s an example. Dozens of funds in the Morningstar database track the S&P 500 index. Many have internal expense ratios of .05% or less, while others have internal expense ratios of 1.00% or more. That’s quite a big range for funds that track the same index.

The chart below shows the growth of $1 million invested in the S&P 500 over the 25 years ending in 2018. It also shows the return you would have received if you had invested $1 million in an S&P index fund with a .05% expense ratio vs. a fund with a 1.00% expense ratio.

Growth of $1 million

(1994-2018)

The difference between investing in the low expense ratio fund vs. the high expense ratio fund— $1,839,422—comes out of your clients’ pockets. It could fund years of retirement!

Low Fees Are Correlated With Better Performance

Clearly, mutual fund and ETF expense ratios can have a significant impact on the performance of an investor’s portfolio. They are also a strong predictor of future fund performance.

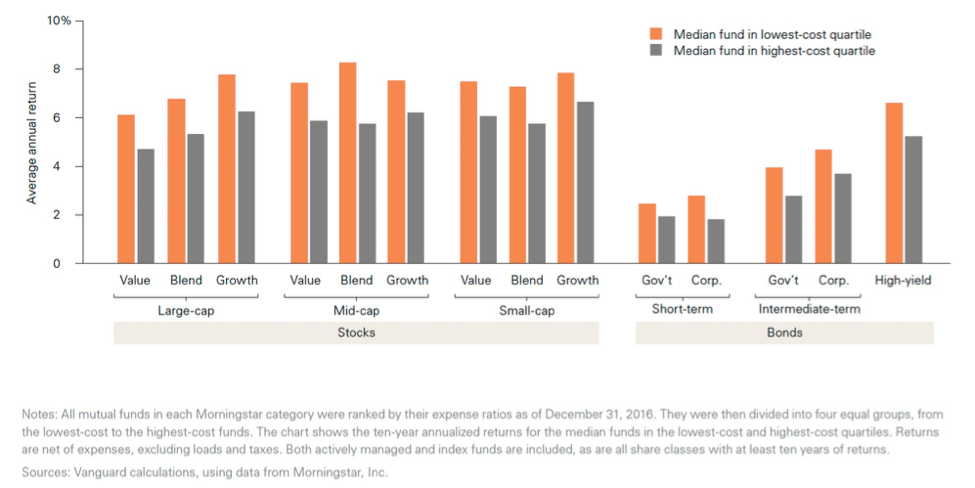

Many studies have shown that funds with low expense ratios have a performance edge over funds with higher expense ratios. A 2010 study conducted by Morningstar tracked the performance of funds in different asset classes over various time periods. In every asset class over every time period, the low expense funds outperformed the high expense funds.

Vanguard did a similar study using data through 2016 and came to the same conclusion—lower expenses and higher performance go together. The results of that study are shown below.

Average Annual Returns

10-Years Ending 2016

You can see that, on average, funds with lower costs outperformed funds with higher costs in all categories. This outcome may seem counterintuitive in a world where we often associate higher cost with higher quality. But in an investment context, it makes sense.

Interestingly, lower fees, themselves, do not completely explain the performance advantage that low-cost funds have over high-cost funds. Whatever the reasons, managers of low-cost funds, on average, generate higher performance than managers of high-cost funds.

Controlling Portfolio Turnover Reduces Expenses

Keeping an eye on expenses is important to long-term investment success. Mutual fund and ETF expense ratios are a big part of that, but expense ratios don’t include trading costs.

Trading costs, like a fund’s expense ratio, are a drag on performance. Every time a fund buys or sells a security, it incurs trading costs. Those costs may be highly visible, like commissions, or less obvious, like the spread between a bid and an ask price, but they are there nonetheless.

The more a fund buys and sells securities, the greater those costs. So, it’s important to track how frequently funds buy and sell the securities that they hold.

A fund’s “turnover rate” is the measure of how frequently it trades the securities that it holds. For example, a stock mutual fund with a 100% turnover rate, on average, trades all the stocks it holds once a year. A fund with a 25% turnover rate trades only about a quarter of its holdings in a year. Obviously, funds with higher turnover rates experience higher trading costs.

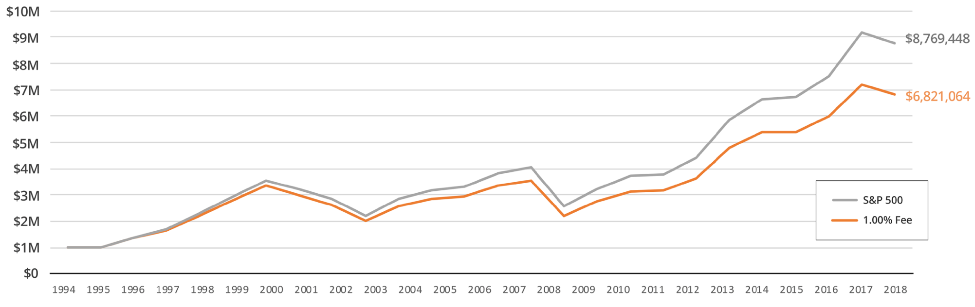

You might think trading costs have a small impact on the long-term value of a portfolio, but that is not the case. Experts like Vanguard Group founder John Bogle have estimated that a stock fund with a 100% turnover rate costs investors roughly 1% of their portfolio value each year.

In the chart below, you can see the impact a 1% performance drag would have on a $1 million portfolio over the 25 years ending in 2018 compared with the return of the S&P 500.

Growth of $1 million

(1994-2018)

A 1% bite out of your portfolio’s returns costs $1,948,384 over 25 years. Turnover matters.

Higher trading costs are fine if they enhance fund performance after taking those costs into account. But the academic research on this topic suggests that, on average, higher turnover rates do not result in better fund performance. Therefore, it’s important to monitor the turnover rates of the funds in a portfolio and keep them low when possible.

Strategist Fees Also Impact Long-Term Performance

Likewise, the fees that third-party portfolio strategists charge to build portfolios also have an impact on performance. If you use strategists, it’s important to monitor their fees as well.

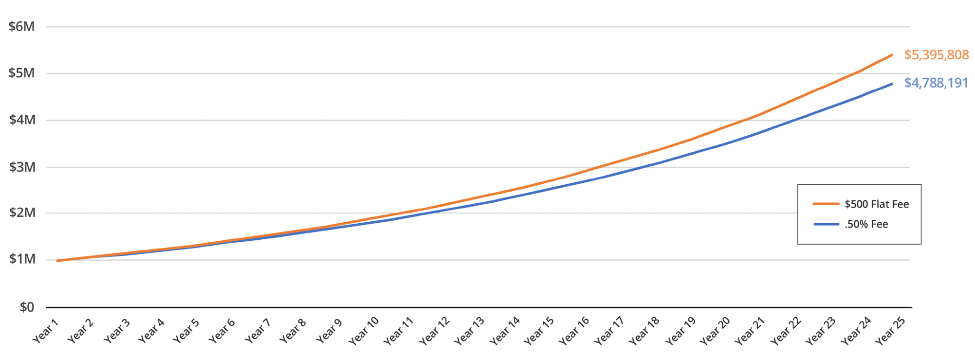

Most strategists charge a fee based on a percentage of assets under management (AUM). These fees can vary widely, but the average AUM-based strategist fee is around 0.50%.

Our firm, First Ascent Asset Management, charges a flat fee for portfolio management services. First Ascent’s current fee is $500 per account with a $1,000 household cap.

You can see below the portfolio value of a $1 million account paying a $500 flat fee over 25 years vs. an account paying a more traditional 0.50% of AUM strategist fee.

Effect of Fees on $1 Million Portfolio

(Assumes an annualized return of 7%.)

The flat fee results in a benefit of $607,617 over the more traditional percentage of AUM strategist fee. The benefit comprises two elements: (1) the difference in the fees and (2) loss of growth on the assets that were paid in higher fees to the traditional strategist.

The flat-fee strategist would have received total fees of $12,500 over the 25-year period, while the traditional strategist would have received fees of $313,485—a difference of $300,985!

Bottom Line

Worrying about fees and expenses may be less exciting than picking next year’s hot stocks, but it clearly pays off for clients over the long term.

Scott MacKillop is CEO of First Ascent Asset Management, a Denver-based TAMP that provides investment management services to financial advisors and their clients. He is an ambassador for the Institute for the Fiduciary Standard and a 40-plus-year veteran of the financial services industry. He can be reached at [email protected].