(Bloomberg Opinion) -- New York City’s population fell by an estimated 336,677, nearly 4%, between April 2020 and July 2021, according to the US Census Bureau. Timelier data from US Postal Service address changes, the Federal Reserve Bank of New York/Equifax Consumer Credit Panel and other sources indicate that more people are probably still leaving the city than moving in. Payroll employment (which includes those who commute into the city) has been rising but remains 161,500 lower than in February 2020.

So, uh, why is it so hard to find an apartment?

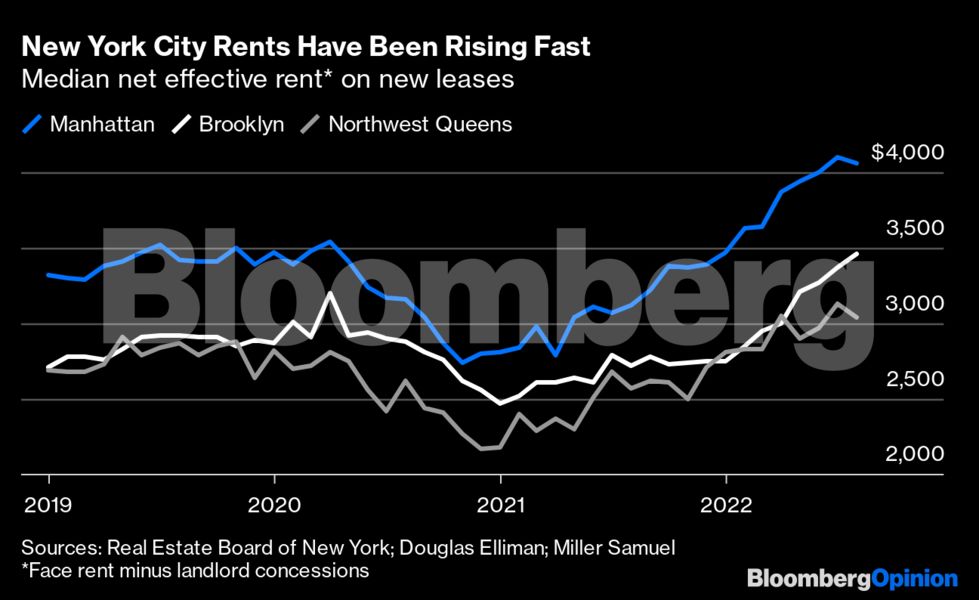

In August, New York had by far the lowest rental vacancy rate of any large city in Apartment List’s database, at 2.6%. Asking rents in New York are also much higher than in any of the other large cities tracked by listing service Zumper. The effective median rent on new leases passed $4,000 for the first time in Manhattan in July, according to the monthly rent reports prepared for brokerage Douglas Elliman by the appraiser Miller Samuel, and is now well above $3,000 for Brooklyn and northwestern Queens. It did dip in Manhattan and Queens in August, but Miller Samuel’s Jonathan Miller said all signs point to prices “stabilizing, not falling.”

A little context removes some of the shock value from these numbers. The vacancy rate in New York City was an even-lower 2.3% right before the pandemic, and rent increases have outpaced inflation only modestly since then in Manhattan and Brooklyn and have trailed it in Queens. Most other cities in the US, as well as New York’s suburbs, have experienced steeper increases in both rents and purchase prices. But again, New York City has been losing population. Shouldn’t that have pushed vacancy rates up and pulled rents down?

The metrics cited above reflect conditions in the unregulated rental market in New York, and a rent law passed by the state legislature in 2019 cut off what had been a substantial flow of formerly rent-regulated apartments into that market, so that’s an obvious reason for the vacancy rate to be tighter and rents higher than one might expect. It’s definitely not the only one, though. “The impact of the 2019 rent control is quite significant,” said Eric Kober, a three-decade veteran of the New York City Department of City Planning who is now a lecturer at Yale, senior fellow at the conservative Manhattan Institute and vocal critic of the 2019 law, “but clearly there are many other things going on that in their totality create a perfect storm of bad housing policy.”

Here’s my rundown of the main elements of that perfect storm, starting on the demand side.

Fewer people, but different types

If the people coming to New York have different needs, priorities and resources than those who are leaving, population totals might not give an accurate picture of housing demand. Many families with children left the city early in the pandemic, and by all appearances a lot of young single people have arrived since. This could mean that the decline in population hasn’t been matched by a decline in households, which are the relevant unit in assessing housing demand. Nationwide, the Census Bureau estimates that the number of households grew by 1.5 million, or 1.2%, in 2021, even as population rose just 0.1%. Young adults striking out on their own drove much of the increase. Another factor that may be affecting household size in the city is the decline in the number of arrivals from abroad before and during the pandemic (although they are of course arriving by the busload now), given that newly arrived immigrants are often willing to endure more-crowded living conditions than domestic migrants.

Also, the job losses in New York haven’t been across the board. Lower-wage sectors such as retail, food service and accommodation have experienced the biggest declines, while some high-wage ones such as information (which encompasses software and internet companies as well as publishing and broadcasting) and professional, scientific and technical services (law firms, consultants, etc.) have actually added jobs in the city during the pandemic. Then again, the biggest job increases have been in low-paying home health-care services, and employment in the city’s gigantic and high-paying financial-services sector is still down slightly.

The supply-side issues seem a little clearer and are definitely easier to document.

Not enough new housing

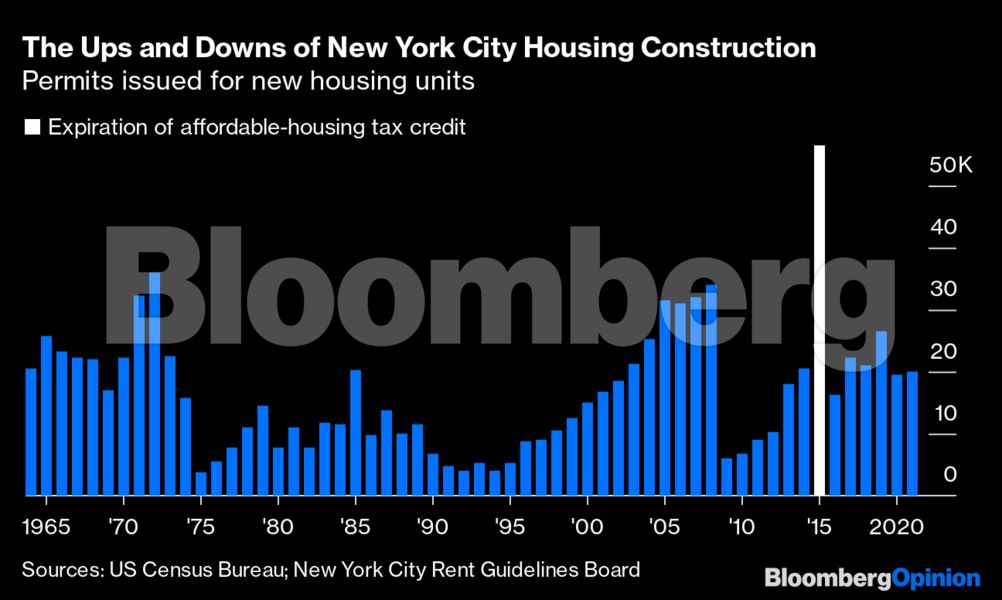

New York City built very little new housing from 1975 to 2000, enjoyed a modest construction boom after that, and hasn’t equaled its late-2000s building pace since then except for a big 2015 rush to start construction to take advantage of the expiring 421-a affordable-housing tax exemption. (The exemption was revived in less generous form in 2017 and expired again this summer.)

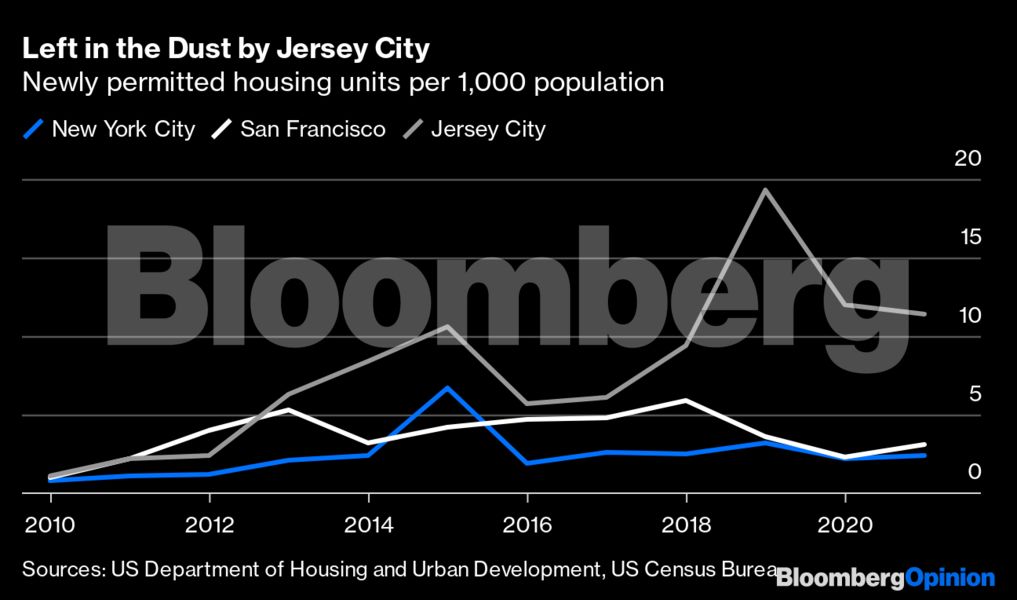

New York is already the most densely populated large city in the US, and building there is almost never as simple as putting up housing on an empty lot. Still, other US cities near the top of the density rankings have managed to outbuild New York on a population-adjusted basis over the past decade, with one just across the Hudson River in New Jersey doing so by more than a 3-to-1 ratio.

How much new housing would be enough? Payroll employment in New York City increased by nearly a million from 2010 to just before the pandemic, making the just more than 200,000 housing units permitted over that period look paltry by comparison. A recent analysis by Up For Growth, a “pro-housing” nonprofit research group, estimated that the New York metropolitan area was 342,144 units short of meeting its housing needs as of 2019, second most after metropolitan Los Angeles — although smaller as a percentage of total units than lots of other large coastal metro areas. In the city proper, the simple fact that market-rate housing is so expensive seems to indicate that there isn’t enough of it.

What’s more, in a few wealthy parts of Manhattan, the housing supply has been shrinking. In the Upper East Side, Upper West Side, Greenwich Village, SoHo and NoHo neighborhoods, the number of housing units declined from 2010 to 2020 as buyers converted small multi-unit buildings, most of which had originally been built as houses and divided into apartments decades ago, back to single-family dwellings and multiple apartments into larger ones. Two new apartment towers planned for the Upper East Side will reportedly also have fewer (if larger) housing units than the low-rise buildings they are replacing.

Not enough rental housing

Rent control was imposed as an emergency measure in most of the US during World War II and remained in place after the war in New York City, albeit only in buildings constructed before February 1947. In 1974, the state legislature replaced it with a somewhat more flexible system called rent stabilization for buildings completed before that year, as well as newer apartments subsidized by the 421-a tax exemption and similar J-51 exemption for renovated buildings. (Tenants of pre-1947 buildings got to stay on rent control as long as they didn’t move.)

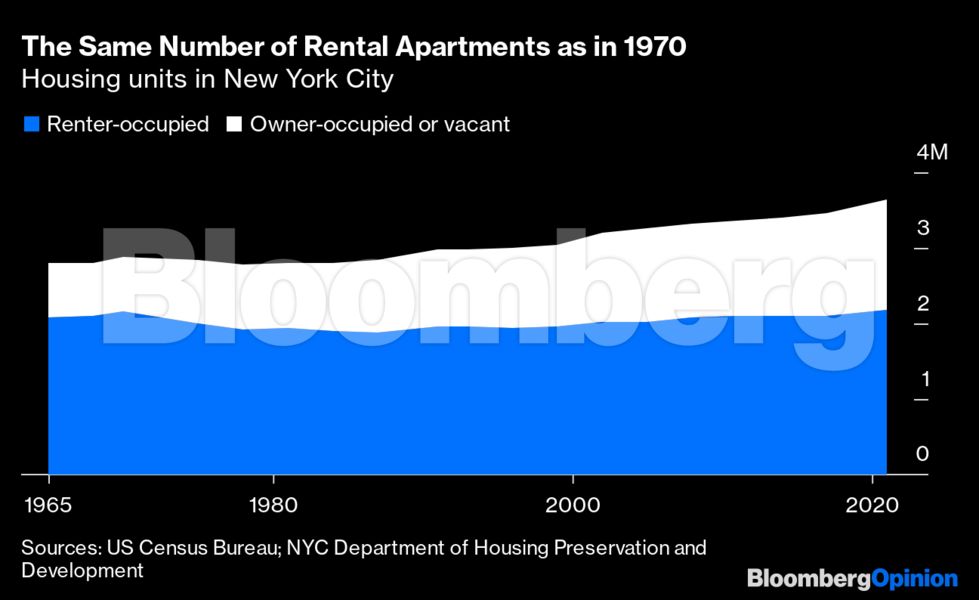

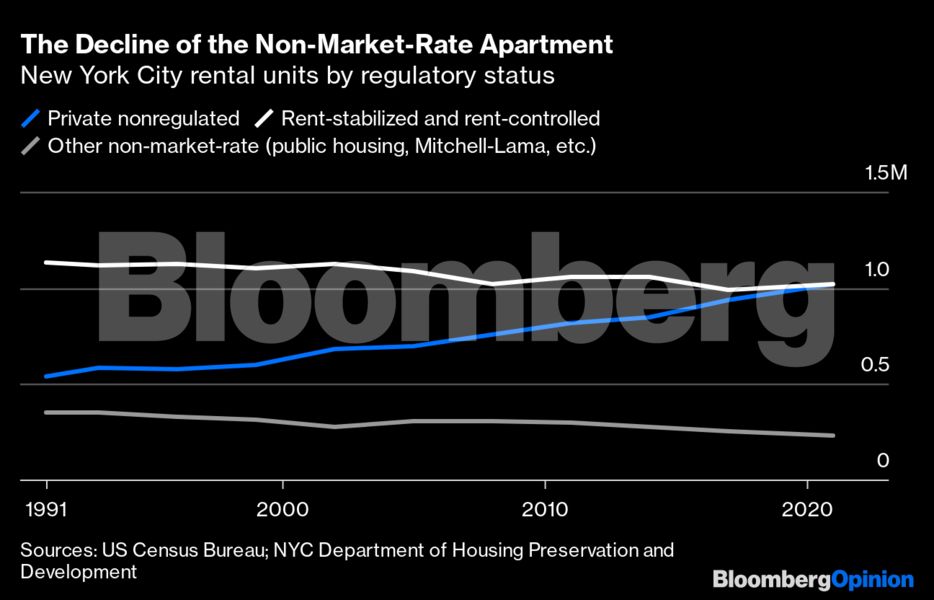

In a 1946 pamphlet that became pretty famous, economists Milton Friedman and George Stigler argued that rent controls depressed the supply of rental housing, which does in fact seem to have happened both nationwide during the 1940s rent controls and in New York City since. For decades, the US Census Bureau has been conducting a regular New York City Housing and Vacancy Survey to determine whether rental vacancy rates in the city are below the 5% threshold used to determine whether the “housing emergency” used to justify rent regulation still exists. It always has, in part because while the estimated overall number of housing units in New York City increased more than 27% between 1970 and 2021, to 3.6 million, the number of renter-occupied units has stayed the same.

The number of apartments covered by rent regulation has fallen outright over time. Statistics on this are readily available back to 1991, and they show the estimated number of apartments subject to rent control or rent stabilization has decreased by 122,295, or 10%, since then. The number of other non-market-rate apartments in the city — in public housing, semipublic Mitchell-Lama developments and other programs — fell 123,793, or 35%. In 2021, the estimated number of market-rate apartments surpassed the number of rent-controlled or rent-stabilized apartments for the first time, 1.023 million to 1.022 million.

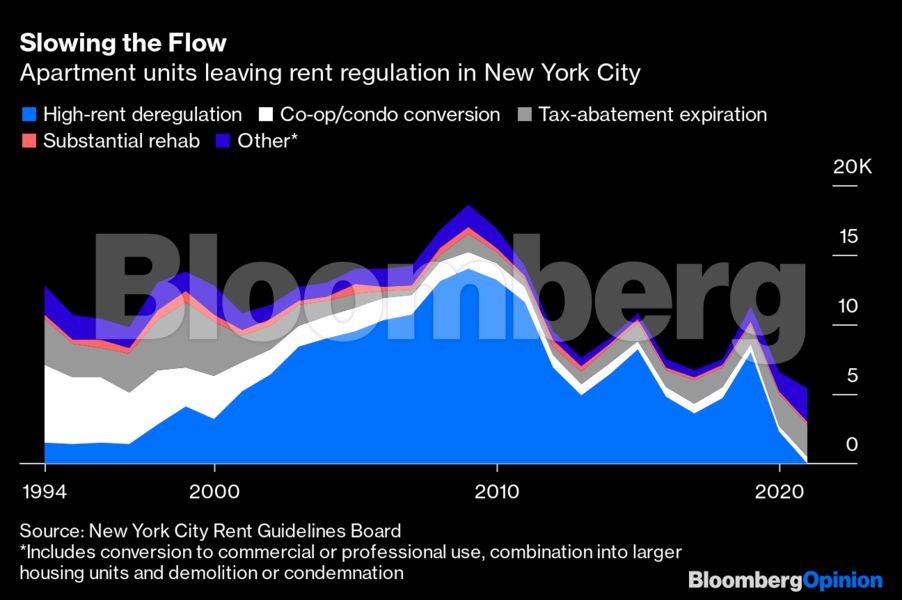

In the 1970s and 1980s, apartments left rent regulation primarily through conversion to owner-occupied cooperative apartments, which usually offered renters the opportunity to buy at what in retrospect turned out to be bargain prices. In 1985, the peak year for co-op conversion, 48,176 units went from rentals to co-ops. That number hasn’t topped 1,000 since 2011, though, and while rent-stabilized apartments in 421-a and J-51 buildings convert to market rates when the term of the tax break ends, this has accounted for only an average of 1,400 apartments a year over the past decade.

The chief destroyer of rent-stabilized units since 2000 has been something called high-rent decontrol, which shifted an average of 7,244 units a year from regulated to unregulated from 2010 through 2019. State legislation enacted in 1993 allowed apartments to be removed from rent regulation when the rent passed a certain threshold ($2,774.76 in 2019) and they either became vacant or were occupied by a renter with a high income ($200,000 or higher in 2019). This created some strong incentives for owners of regulated apartments to make improvements that allowed them to jack up the rent and harass non-affluent tenants into leaving. Uproar over the latter phenomenon helped lead to the 2019 state rent law, which restricted rent increases for renovations, ended high-rent decontrol and made it harder to convert rental buildings into condominiums.

Most of the conversions from regulated to unregulated apartments took place in Manhattan, and going by the Miller Samuel data they appear to have amounted to roughly 10% of the borough’s market-rate apartment listings in the 2010s, surely enough for their disappearance to be felt in that market now.

The flip side is that more apartments have remained under rent regulation than would be the case without the new rent law. The 2021 Housing and Vacancy Survey showed the first increase in their number since 2011, although the change was within the survey’s margin of error. The survey also found a vacancy rate for rent-stabilized apartments of 4.6%, more than double what it had been in 2017. That vacancy rate appears be a lot lower now. One indication is the comeback of so-called key money for rent-stabilized apartments, in the form of broker’s fees rising into five digits that are legal if the broker pockets them but not if part is passed on to the building owner, as some suspect must be happening. Meanwhile, rising market-rate rents increase the incentive for tenants to stay in regulated apartments even if they’d rather downsize or upsize or move to a different part of the city.

The flow of units out of rent regulation has not stopped entirely. Owners may still remove units from rent stabilization when units are merged or when a building is condemned or demolished. The number of units in this “other” category in the above chart more than doubled from 2019 to 2021, to 2,428.

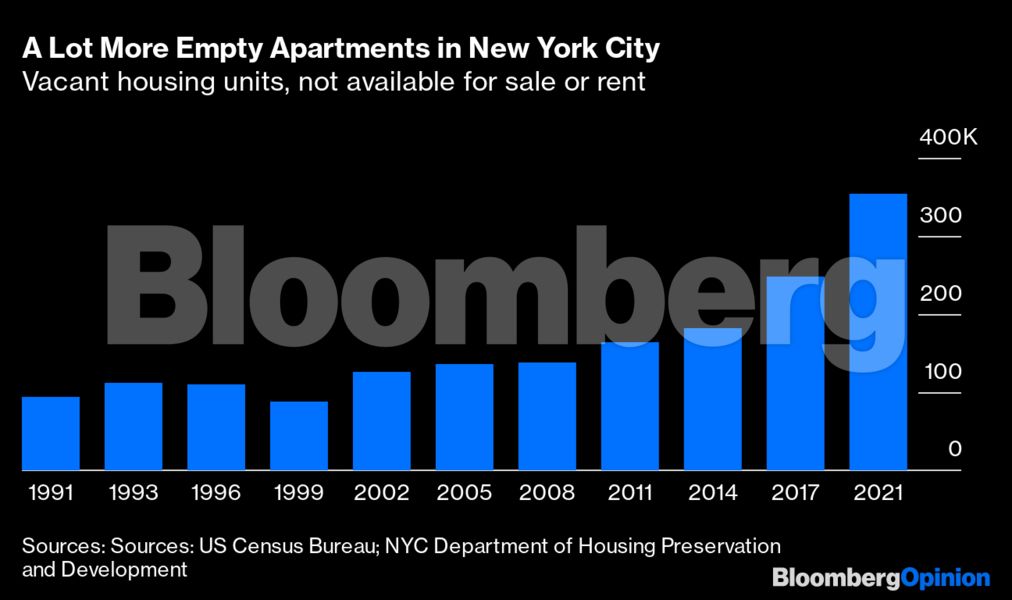

Too many empty apartments

Another thing that’s more than doubled — in this case over the past decade — is the number of city housing units classified as “vacant, not available for sale or rent” in the Housing and Vacancy Survey, which estimated that there were 353,400 such units in 2021.

In 2017, the reason most often offered for keeping units vacant was that they were under renovation. In 2021, it was that they were being “held for occasional, seasonal or recreational use,” which according to the city Department of Housing Preservation and Development comprises “those maintained as pieds-a-terre, units held for investment purposes, and those used as short-term rentals where the entire unit is occupied on a temporary basis.” Those who hold on to vacant apartments as investments or rent them out on Airbnb get a lot of (negative) attention in New York City housing discussions, but I’ve got to think that in 2021 the truly big driver was legitimate New York City residents with country or beach houses that became their primary residences during the pandemic. Also contributing was a change in survey methodology in which apartments were counted as vacant in 2021 even if someone was there, as long as that someone said their primary residence was elsewhere.

Another possible cause of the rise in vacancies since 2017 is that owners of rent-regulated apartments are holding them vacant because the rewards to renovating them and renting them have fallen or they’re casting about for some way to wrest them from regulated status or both. The Community Housing Improvement Program, a landlord association, has estimated that 20,000 rent-regulated apartments are being held vacant for such reasons.

The way out

Solving New York’s housing “perfect storm” will be incredibly complex. But building more housing is clearly the most important step.

To contact the author of this story:

Justin Fox at [email protected]

© 2022 Bloomberg L.P.