There are still a lot of reasons to invest in apartment properties—despite uncertainties and surprises both in apartment markets and the larger U.S. economy.

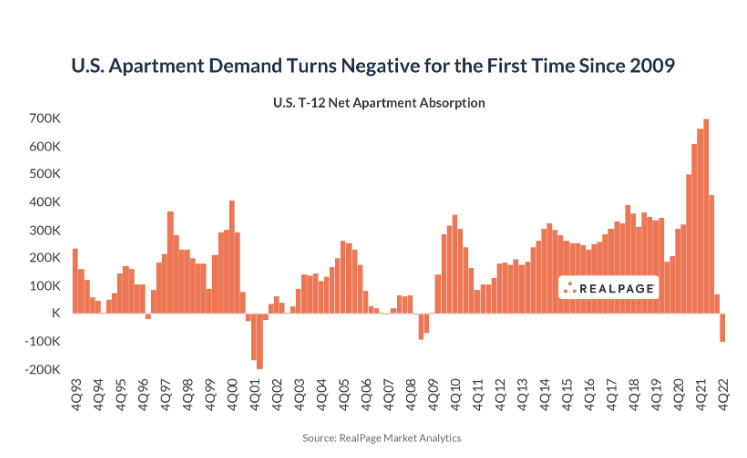

Net demand for apartments ended in negative territory for calendar 2022, according to Real Page. The primary culprit is turnover was at historically low levels. Renters largely stayed put amid the broader economic uncertainty and inflation in 2022.

According to RealPage, new -lease apartment rents fell in December for the fourth consecutive month, dropping 0.4 percent. Overall, there was a cumulative 1.6 drop in rents since September.

For the year overall, asking rents increased 6.1 percent nationally, but that number was largely fueled by rapid inflation in the early months of the year. The year-over-year number has dropped nearly 10 percentage points since peaking at 15.7 percent in March 2022.

In addition, effective rents are projected to grow by about 3 percent in 2023, according to Marcus & Millichap—but that would be a fraction of the explosive, 12 percent annual rate of rent growth over 2021 and 2022. . Finally, interest rates have risen several percentage points—but most potential sellers have not lowered their prices, despite the best efforts of potential buyers.

No wonder potential buyers and sellers struggle to understand the real value of apartment properties and decide on a price.

“As new leasing activity flatlined last year and rent growth began decelerating, investors are making a stronger effort to go into their investments closer to neutral or positive leverage,” says Matt Vance, Americas head of multifamily research for CBRE, working in the firm's Chicago offices.

Buyers still buying (some) apartment properties

Investors spent $11.4 billion to buy apartment properties in November 2022, according to MSCI, a data firm with offices in New York City. That’s a shocking, 74-percent decrease, compared to 2021. However, even that paltry $11.4 billion of investment is still more than twice as much as investors spent on any other property type over the same period, according to MSCI.

Very few real estate properties of any kind traded in the last months of 2022. High interest rates are increasing the cost of investing. At the same time, most sellers still refuse to lower their prices to make up for these high interest rates. Cap rates for apartment properties averaged 4.7 percent in November–their lowest level ever recorded, according to MSCI.

“The rapid interest rate increases have made it more difficult to get deals done,” says John Sebree, senior vice president and national director of the Multi Housing Division at Marcus & Millichap, working in the firm's Chicago offices.

Weakest absorption since 2009, and developer build a million apartments

Demand for apartments in 2022 was the weakest since 2009. Net demand was negative by more than 100,000 units, compared to positive absorption of more than 600,000 units in 2021, according to RealPage. For the first time in 13 years, in 2022 more people moved out of apartments than moved in—and very few people moved out. The rate of turnover in 2022 was the second-lowest ever recorded by RealPage, beaten only by 2021.

Worries about price inflation and the overall economy seemed to keep would-be renters from visiting leasing office. The consumer confidence index kept by the University of Michigan dropped like a rock from 88.3 in April 2021 all the way down to a low of 50.0 in June 2022. That’s the lowest reading ever since the index began in 1978—lower than the lowest consumer confidence readings during both the Global Financial Crisis and the stagflation of the early 1980s.

“Human nature is that when we feel uncertain, we’re much more likely to stay put—and that’s what happened in 2022,” says Jay Parsons, senior vice president and chief economist for RealPage.

At the same time, hundreds of thousands of new apartments are about to open. Developers were in the process of planning and building 971,356 market-rate apartments at the start of 2023, according to RealPage. Of those, more than 575,500 are scheduled to open this year. That is easily the largest number of scheduled deliveries that RealPage has ever counted for a single year since it began tracking the market about 30 years ago.

“Projects delayed during the pandemic have combined with a cascade of builds started in 2021 and 2022 when the sector was performing at historic levels,” says Marcus & Millichap’s Sebree. “That is resulting in an all-time-high delivery volume for 2023.”

There are signs that the pace of development might be slowing, however. RealPage cites the seasonally adjusted annualized rate of multifamily permitting falling by almost 18 percent in November from October’s rate to 509,000 units, according to the U.S. Census Bureau’s monthly report.

Apartment properties still attractive

Investors continue to bid for apartments properties, even though a historically large number of new apartments are about to open in markets with historically few new renters.

“The nation continues to face a housing shortage, which will be exacerbated in the coming decade as Millennials enter an age period that often correlates with growing their households,” Sebree says.

Also, uncertainty about the U.S. economy is unlikely to depress the demand for apartments forever.

“The absence of housing demand despite strong wage and job growth in 2022 remains somewhat perplexing,” says Carl Whitaker, director of research and analysis for RealPage. “It could point towards a potential release of demand in 2023. That’s especially true in the event that job growth persists through 2023 and the hoped-for ‘soft landing’ scenario plays out.”

The huge number of new apartments opening are also concentrated in apartment markets with a demonstrated need for more housing.

“With the exception of a few markets with particularly high concentrations of new supply, developers have done a good job building where new supply is needed the most,” says CBRE’s Vance.

Nationwide, the percentage of apartments vacant at the end of 2022 was close to 4 percent, according to preliminary numbers from CBRE, and is anticipated to rise in 2023 towards its long-run average of about 5 percent.

“If overbuilding does happen—it will be isolated to select markets (places like Phoenix where demand has slowed drastically) and will be short-lived,” says Whitaker.

Most places still having a shortage of housing overall and rental apartments in particular. “Vacancy remains below-trend and despite supply pushing that up, it should support healthy rent growth,” says Vance. “We expect supply to continue outpacing demand and for vacancy to continue its upward drift toward its long-run average of 5 percent.”

That will continue to support consistent rent growth, year over year.

“Below-average vacancy should support healthy rent growth which we expect to finish the year around 4 percent,” says Vance. “While this looks nothing like the last two years of unprecedented performance, it still well above the pre-pandemic cycle average of 2.5 to 3.0 percent.”