Most registered investment advisors with between $25 million and $100 million in assets were not looking forward to the switchover from SEC to state registration that took place earlier this year. But for those mid-sized RIAs whose principal place of business is in New York, it was a different story. A bit of an outlier from other state jurisdictions, New York was exempt from the switch to state registration, so those advisors stayed under SEC regulation.

Why the special treatment? Under Dodd-Frank reform, legislators decided that the SEC would transfer regulatory authority only to those states that had a dedicated exam program, which New York does not. The state’s investment advisor regulators, housed in the New York Attorney General’s office, only have authority to examine investment advisors if they receive a customer complaint. New York has another quirk in how it regulates investment advisors: The state does not register investment advisor representatives (IARs) of an RIA firm through the IARD system; only RIA firms are required to register.

But the Dodd-Frank exemption only applied to mid-sized firms; those RIAs with under $25 million in assets are still under the state’s jurisdiction, even though there is no routine examination process and no registration process for individual advisors.

“What this has created is a real gap in regulation,” says Brian Hamburger, founder and managing director of regulatory compliance consulting firm MarketCounsel. “There’s effectively a bit of a no-man’s land with respect to state-registered RIAs in New York.”

The recent switch to state registration has brought attention to the examination process, as states had to indicate whether they had an examination program in place. Ninety-four percent of states conduct routine, or non-cause, examinations of investment advisors, according to the North American Securities Administrators Association (NASAA).

Securities attorneys, investor advocates and compliance specialists say this gap in regulation in New York is problematic, especially in a state that is such a financial mecca, with a large population of investment advisors. Although there is no concrete data showing that New York has more investor complaints or instances of fraud (the state would not provide this data despite repeated requests and a Freedom of Information Act filing), anecdotally, sources believe this could be the case. Although these advisors are relatively small, there is certainly room for fraud and other nefarious activities to occur. Perhaps the issue here is not so much that these advisors are mostly unregulated, but that there is so much about New York and how it regulates advisors that is unknown.

“Our biggest fear is that those who are intending to conduct nefarious activities will open up there because they know there’s this gap. There’s this dearth of regulatory oversight where they can operate freely without significant risk of being detected,” Hamburger says. “The fact that you can’t go anywhere to get this information only serves to highlight what the real problem is, which is, we don’t know. That to me is a pretty dangerous predicament.”

The Tough Cop

The Tough Cop

While most states have adopted the Uniform Securities Act, New York is under the Martin Act, the state’s “blue sky” law designed to stop fraudulent schemes. While most states can conduct examinations unannounced, the New York attorney general, currently Eric T. Schneiderman, must obtain a preliminary injunction under Section 354 of the Martin Act. In other words, state regulators aren’t coming out to look at them unless there’s a complaint, a perception of fraud, or “trigger” of some kind.

The Martin Act was established in 1921 and mostly forgotten, that is, until dusted off and used by former New York Attorney General Eliot Spitzer to prosecute large financial services firms. The Martin Act gives the New York state AG wide discretion to investigate financial fraud and is considered to be stronger than any other financial-fighting state law. New York has a reputation for being the “bad” (as in lousy) cop on the beat, exercising its tough enforcement authority only after the fraud or scheme has been carried out, says Barbara Roper, director of investor protection at the Consumer Federation of America. While enforcement may work with large Wall Street firms, it may be too late to recover any money from small advisor firms that have wronged investors.

“New York has a great authority to go in and clean up the mess after the mess has been made,” Roper says. “Enforcement authority is important, but it’s not sufficient. Too often in these cases, there isn’t enough money left, by the time they go in, to make the investors whole.”

“If a guy has, let’s say 10 customers with $2 million each, that’s $20 million,” says Richard Roth, founder and partner of The Roth Law Firm. “I understand it’s a not a lot of money when it comes to the business, but there’s still 10 real people with $2 million each and there’s nothing that’s preventative for these people.”

Many say New York just doesn’t have the manpower to regulate these small advisors closely, given its workload of large financial institutions and private funds.

“New York is squarely focused on these global financial services firms, and they take a much less significant view of what they consider ‘mom and pop’ financial planning or investment advisory firms,” Hamburger says. “They really are relatively insignificant compared to the other firms that the attorney general needs to deal with within the securities industry.”

Stuart Meissner, a New York-based securities attorney who served under two New York attorneys general, has seen that lack of manpower firsthand. During his tenure at the attorney general’s office, there were only about 15 attorneys and 20 support personnel. They are more focused on the big Wall Street blow-ups than small RIA firms, he says.

That said, New York is not the only state with wacky regulations. Wyoming does not regulate RIAs at all, so they’re automatically licensed with the SEC. Minnesota also does not license investment advisor representatives. But these states also don’t serve as many advisors as New York, being the financial center that it is. According to Meridian-IQ, New York has 439 RIA firms with under $25 million in AUM registered in the state and a total of 2,684 operating in the state. In comparison, Minnesota has 389 RIA firms operating in the state, while Wyoming only has 33 firms operating. California has 3,372 RIAs operating in the state, while Texas has 1,376, Florida has 992, and Illinois has 984.

Prevention Goes a Long Way

To New York’s credit, IAs are not entirely unregulated. While individual advisors are not registered through the IARD system, the state does require that individuals fill out an Investment Advisor Qualification form, a one-page questionnaire asking about the individual’s Series 65 and Series 7 scores, designations, and any regulatory actions or arbitrations in the last five years. Diane Gatewood, chief of registration in New York’s investment protection bureau, says they are required to pass the exams. In addition, the RIA firm does have to apply through the IARD system, completing parts I and II of Form ADV, Gatewood says.

But there’s a lot to be said for preventative measures; examinations, especially, can go a long way.

“Routine exam programs are essential to keep firms compliant,” says Linda Cena, chairman of NASAA’s investment advisor section. “The goal is to not have to do enforcement actions. The goal is to keep them doing things right.”

There are things state regulators get out of being in the office of an advisor, conducting an exam, that they can’t get from a phone call or a document, says Cena, securities director for Michigan. Paperwork tells the regulators what advisors are going to do with their clients; exams go one step further.

“When we walk into the office, we see what they’re actually doing, Cena says. “And we want to see if what they’re actually doing matches what they told us they’re going to do.”

For example, being in the office allows examiners to pull client contracts, showing how the advisor is working with clients and what fees they’re actually charging.

In the Spring 2012, NASAA rolled out the IA version of the NASAA Examination Modules System (NEMO), an electronic database that walks examiners through the examination process.

Michael Huggs, director of the securities and charities division for the Mississippi Secretary of State’s office, and chairman of the investment advisor operations project group at NASAA, says a typical routine exam starts by reviewing the firm’s IARD filings. It’s then followed by an on-site interview where the examiner asks questions related to the firm’s custodians, their business practices, investment strategies, products, services and personnel. They will then look through areas of the advisor’s practice, such as books and records, financial issues, investment strategies, financial planning practices, the supervisory set-up, and advertising and marketing. There are 23 different practice areas within the NEMO system. Depending on the firm’s size, practice areas, number of accounts and strategies, the on-site examination could take anywhere from one day to a week, Huggs says.

Without seeing advisors through exams or investigations, the state is reliant on annual regulatory filings, tips, complaints and the advisor’s past history with the regulator, Huggs adds.

“There are just a lot of feelings you get walking into an office and seeing how people react, how you’re treated, their expressions,” says Dawn Bond, owner and executive vice president of Compliance Advisory Services, Inc.

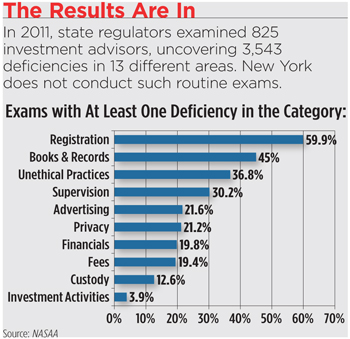

State securities regulators examined 825 investment advisors in 2011, resulting in 3,543 total deficiencies in 13 categories. About 60 percent had a deficiency in registration, while 36.8 percent had a deficiency in unethical practices and about a third had a deficiency in supervision.

According to a 2010 report NASAA submitted to the SEC, state regulators performed 2,378 on-site examinations of investment advisors in 2009. As a result, states issued 5,176 deficiency letters, and the exams led to 195 cease and desist orders in 32 states. Twenty-five jurisdictions issued a total of 219 denials, suspensions or revocations.

According to the SEC’s annual report, 82 percent of its fiscal year 2011 examinations conducted identified deficiencies, while 42 percent resulted in a “significant finding.”

The Black Hole

But when it comes to getting any hard data on New York and how it regulates investment advisors, it’s a bit of a black hole.

NASAA does not collect data comparing the sources of enforcement actions, such as what percentage come from examinations versus referrals from other agencies or other sources. The group does collect data from its members on a national level, but to separate it out by state and disclose that information, the group would have to get clearance from each state.

The New York Attorney General’s Office would not provide data on the number of complaints filed against investment advisors, the number of enforcement actions taken against advisors, the number of fraudulent activities, or a list of complaints filed against investment advisors in recent years. The office would not satisfy a freedom of information act request for this data, saying that REP. was asking for information, rather than records, and that the office does not maintain data in this way.

Gatewood says she does not even know how many investment advisor representatives are operating in the state.

When dealing with advisors who had regulatory problems in another jurisdiction, Hamburger says he recommends they pick up and move to New York, so that they can get back in business and start operating again.

“It’s a good haven for folks to go that have disqualifying regulatory events on their disclosures and their CRD records,” he says.

Compliance Advisory Services’ Bond works with one New York advisor who should be moving over to the SEC, but is trying to keep his asset count below the $25 million mark so he can stay under state regulation.

“He wants to stay with New York because he knows he’s not going to get an audit and he knows New York doesn’t regulate,” Bond says. “Therein lies the testament to probably what a lot of them are feeling. That’s scary.”

Kristen French, former features editor, contributed reporting to this article.