Launched 64 years ago by founder/chairman Gerald Hines, Houston-based Hines is among the top global commercial real estate investors/developers/owners, with a $160.9-billion portfolio that includes 622 properties totaling nearly 256.7 million sq. ft. under management in 27 countries.

Hines’ Pan-European Core Fund (HECF) currently has 30 assets under management, valued at more than €2 billion, in 15 cities across nine countries. This year, the company won the Pension Real Estate Association’s (PREA) Real Estate Investment Management Environmental, Social and Governance (ESG) award for HECF in the open-end fund category. The award recognizes PREA members for commitment to ESG principles and best practices within real estate investment.

The company also recently launched Hines Asia Property Partners (HAPP), the firm’s new flagship fund for the Asia Pacific region with a $400-million capital investment from Cadillac Fairview, the real estate investment arm of the Ontario Teachers’ Pension Plan. This fund, which has an initial investment capacity of approximately $900 million, will serve as an open-ended, diversified vehicle to invest across the Asia-Pacific region. It will target primary markets in Japan, Australia, South Korea, Singapore and China.

HAPP will pursue next-generation logistics, office, multifamily, retail and some alternative property sectors, targeting core plus returns. It will in certain cases, pursue new development.

For example, Hines recently announced plans for a new HAPP development project, a 460,0000-sq.-ft., five-story logistics center in Hwaseong, a greater Seoul location between the Incheon Airport, Incheon Port and Pyeongtaek Port, which provides access to over 20 million people within 30 miles. This represents the second cold storage and third logistics development for Hines in the Asia-Pacific region in the last six months.

David L. Steinbach, global chief investment officer and co-head of investment management at Hines, says there are three characteristics successful long-term investment firms like Hines possess: 1) the ability to recognize patterns and see trends as they emerge; 2) curiosity—asking questions about why things are the way they are and what will they become; and 3) a collaborative spirit—being open to other people’s ideas, rather than thinking that you have all the answers.

In the following Q&A, Steinbach talks with WMRE about the firm’s current investment activities and plans for the immediate future.

This Q&A has been edited for length, style and clarity.

WMRE: Which groups are Hines' biggest investors?

David Steinbach: We are raising money across the board globally. Funds are writing big checks, but the type of investor depends really on the mission and mandate. Last year we raised double the amount raised for the trailing five-year average.

David Steinbach: We are raising money across the board globally. Funds are writing big checks, but the type of investor depends really on the mission and mandate. Last year we raised double the amount raised for the trailing five-year average.

WMRE: How is Hines reaching new investors?

David Steinbach: Almost all of our fundraising was done virtually last year. Our team never left the country—no one could get in or out, so we got creative and leveraged all types of technology to reach investors globally. Our unique, open platform engaged investors across the world using a hybrid of virtual and on-site strategies. We hired a local videographer to walk investors through the streets of Copenhagen, for example, allowing investors to feel like they were doing a tour with our local team and used drones to capture site layouts and provide a bird’s eye view.

WMRE: How does Hines communicate with both existing and new investors?

David Steinbach: Last year we communicated with investors via video conferencing. But there are challenges to fundraising and communicating with investors virtually. It is incredibly transactional and works in the moment, but it’s tough to build relationships and culture when Zooming in and out. Without a relationship, it’s more difficult to service our investors. This took a lot of hard work on the part of our people to be successful.

WMRE: What kinds of returns are your investors looking for?

David Steinbach: Return expectations run the full spectrum, but depend on what and who, in general. For developers, the higher the risk, the higher the expected return. For core assets, not so much, but people’s expectations have gone up a bit. The market is proving to be surprisingly resilient.

WMRE: Has Hines seen a change in its investors’ attitudes toward commercial real estate pre- and post-COVID-19? If so, in what ways?

David Steinbach: Pre-COVID, investors were beginning to become cautious on the office sector, mainly driven by the length of the recovery post-Great Financial Crisis, but also due to a growing awareness of the capital being spent in the asset class. Industrial and multifamily required less continuous capital investment compared to office and were already preforming better than office pre-COVID, so office looked like less of a good place to go.

WMRE: How much money does Hines want to raise/deploy over the next several years?

David Steinbach: Our business is pretty diverse, with billions in equity deployed per year to do $10 to $20 billion in deals. Last year, about half of that was invested in U.S assets.

WMRE: Are there some project categories that are easier or harder to finance due to the pandemic and if so, which ones and why?

David Steinbach: Office and retail—office buildings are physically empty. Our view is there will be flight to quality on the other side of the pandemic, and there will be winners and losers. We believe in the future of the office and did a surprising amount of leasing over the last year—from tech to traditional office users, some companies made big leasing decisions during a pandemic year.

New real estate is viewed more favorably. If tenants are going to spend money, there will be greater scrutiny of assets. Tenants are focused on how space drives culture, so there will be greater demand for exceptional amenities. The best buildings will win the argument.

WMRE: Hines recently announced several office investment and development deals in both Europe and North America. How does your company view the future of office? What percentage of Hines’ investment capital do you expect to go to the office sector over the next few years?

David Steinbach: On the development side, we’re focused on complex projects, like mixed-use that create ecosystems within four walls. We’re currently active in 225 cities globally. We have major office and mixed-use projects planned or rising in cities around the world, including Los Angeles, New York, Milan, Miami, Chicago, Melbourne, Paris, Vancouver, Canada, Amsterdam, Toronto, and London. On the acquisition side, we are focused on New York, Paris, London, Tokyo, Hong Kong, and Sydney.

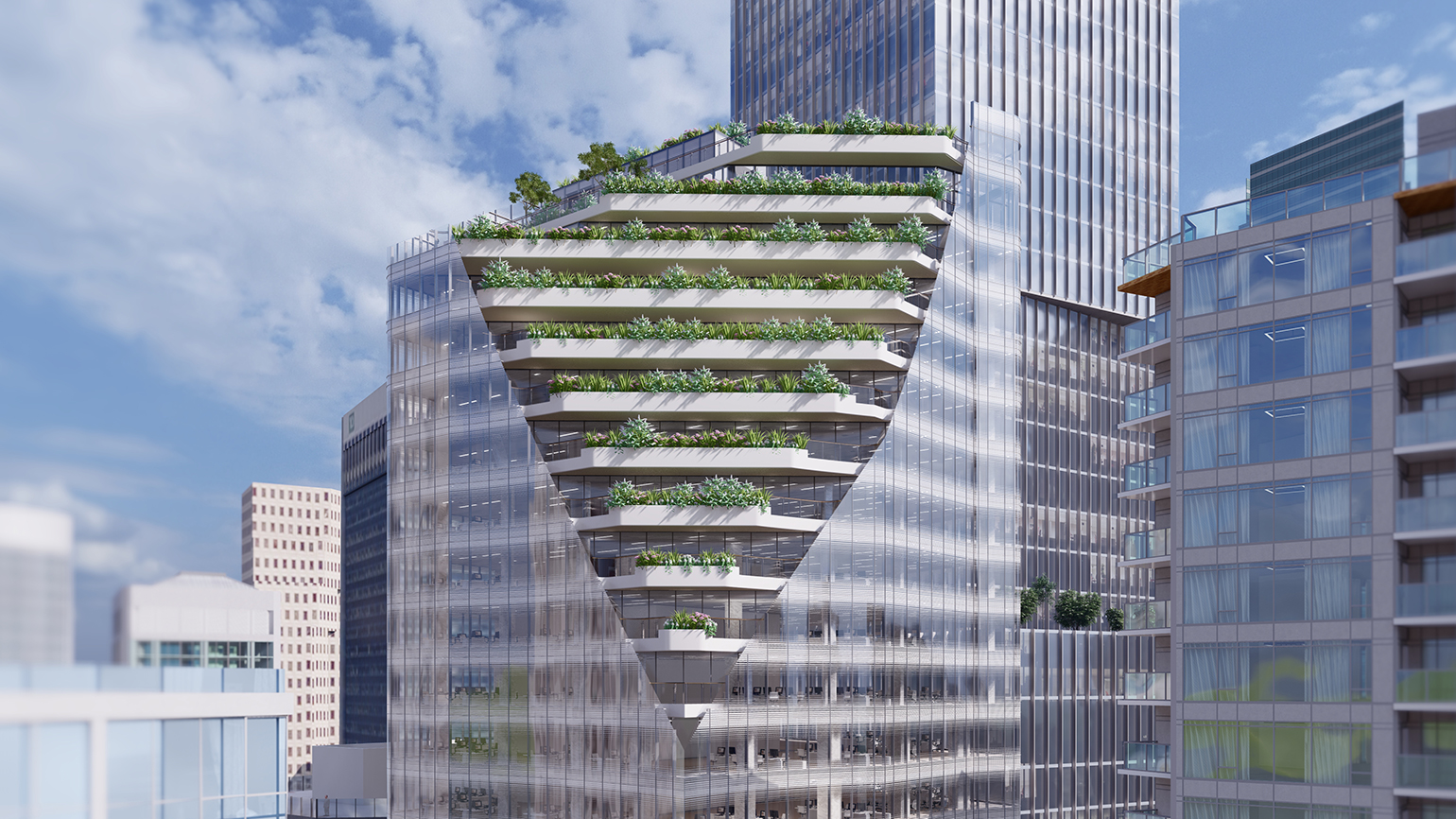

1166 West Pender, Vancouver, Canada

Office is a very large sector, and there’s no straightforward answer. Investment in office will depend on pricing and how the market moves.

It’s interesting, a year ago we thought there would be more distressed opportunities than we’re seeing now, and it’s taking hard work to uncover them. Assets in urban core markets were especially hard hit by the pandemic, but we believe they will make a comeback. The European market, however, is pretty strong, so there aren’t many distressed opportunities there like in ’08.

WMRE: Has there been a significant change in Hines investment strategy pre- and post-COVID-19? Is so, how has it changed?

David Steinbach: Our investment strategy hasn’t changed much from pre-COVID. We have always been focused on opportunities we think either represent good relative value for our investors or projects that we think we can uniquely create value [for]. Therefore, our overall strategy has not changed, but the types of things we are focused on have shifted based on market dynamics and where we see relative value.

WMRE: Recently, Hines has made a big push on industrial assets globally. Why does Hines feel industrial is such a good bet right now? How does Hines view and deal with the competition for assets and the high valuations?

David Steinbach: We share concerns about pricing and how competition for assets affects valuations. Our way of thinking about opportunities is where we can use our expertise to add unique value, like with zoning changes, environmental cleanup, and solving other complex issues.

WMRE: Your company recently launched a new fund with Cadillac Fairview to invest in core-plus real estate in Asia Pacific. Why does Hines feel right now is an opportune time to launch a fund for commercial real estate in the Asia Pacific? The press release mentions that in addition to the main property types, the fund will target niche real estate sectors. In which specific niche sectors does it see the most opportunity?

David Steinbach: We have been broadly focused on Asian markets for the last decade, but what’s changed is what investors are looking to make decisions. Previously, interest rates were so low in many developed Asian countries, the region’s capital moved to the U.S. and Europe. Now, interest rates are low everywhere, so investors are asking about population and rent growth. Asian growth stats point upward, so there will be a long tail of investor interest in Asia over the next five years if we can capture the demand.

Some niche investment areas include cold storage and last-mile logistics facilities in Asia and “build-to-rent,” or apartments, in Asia and Australia. Apartments in the U.S. are institutionally owned and feature lots of amenities. These are harder to find across Asia.

WMRE: What kind of returns will HAPP offer investors?

David Steinbach: We are focused on core-plus return for this fund strategy. By buying projects we think we can bring a unique perspective and vision to, [we think we can] outperform over the long run by leveraging our local teams to execute.

WMRE: Hines recently won an award from PREA for its ESG credentials. When communicating with investors, how important are ESG criteria to them? Are there some specific aspects of ESG that tend to be more in demand with investors than others?

David Steinbach: ESG is the future. There is a convergence happening right now between stakeholders. Our investors, our tenants, our own employees and now increasingly our cities are all asking for smarter and more bold approaches to ESG. We are taking on the E, the S, and the G in ESG. But to focus on one key element, the issue of embodied and operational carbon is something where we think we have a unique perspective and solutions, given our vertical integration and technical abilities that reside with our team.

WMRE: Hines is one of a handful of entities that truly invests in real estate all over the globe. What was running a global investment operation like that like during COVID-19?

David Steinbach: What a last 15 months we have all lived through! What was unique for us is that our local teams never left the cities they called home. This was a huge benefit given lockdowns and travel restrictions, as it has made our investors feel at ease because our teams never left their buildings. So it was interesting to have those embedded teams as the virus unfolded to get a sense what was coming early. But also, it was helpful to be able to share best practices across the globe in terms of a response once the virus came. At the end of the day, it was the power of technology, though, that really helped to bring our global team closer together.