Despite the economic impact of the COVID-19 pandemic and the ensuing lockdowns of the past year, the investment advisor industry continued to see steady growth in 2020, with both the number of advisors and assets under management per advisor increasing to record highs, according to the Investment Adviser Industry Snapshot 2021 report by the Investment Adviser Association (IAA).

Overall, the industry now has nearly 14,000 Securities and Exchange Commission–registered advisors employing more than 879,000 nonclerical employees, representing about $110 trillion in assets.

The number of clients seeking investment advice also grew, with advisors reporting they worked with about 60.8 million clients (including 49.7 million asset management clients), up 17.2% in 2020, according to the report.

In an interview with WealthManagement.com, IAA President Karen Barr said the demand for advice was fueled partly by the increase in the number (and popularity) of digital advice platforms, but she suggested the tumult of the past year had also contributed to the surge.

“A large number of clients, anecdotally, took this year to reflect on their financial goals and retirement goals, and where they were in their financial journeys,” Barr said. “They had those moments of reflection that the pandemic, in some ways, generated.”

Barr said the industry was able to retain and even recruit talent in the midst of the pandemic, which she largely attributed to the industry’s relative ease when transitioning into remote work environments. This remote setup also gave firms the ability to attract a broader range of talent less encumbered by the limits of looking in a specific geographic area.

Like 2019, the southern U.S. remained the top region for industry growth; the number of advisors in that area grew by 7.9% in 2020, compared with 8.4% from the previous year. The Midwest and West had lower increases, up 2.6% and 3.7%, respectively. By contrast, in the East, growth in the number of advisors dropped to 0.6% from 5.4% in 2019.

“There was talk in prior years of people moving to Florida and other states for tax reasons, and that was certainly discussed after the Tax Cuts and Jobs Act of 2017, but the pandemic certainly seems to have caused a lot of movement this year,” Barr said.

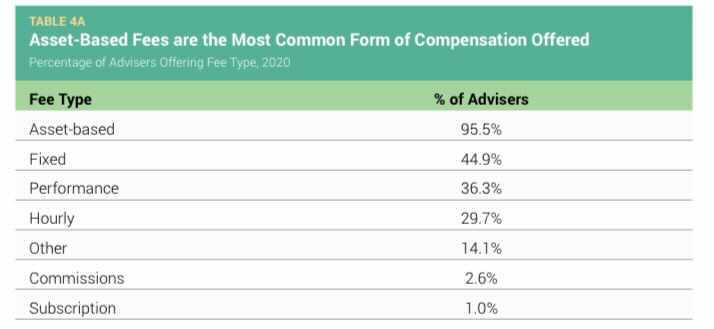

The data also showed the increasing use of asset-based fees, with nearly 96% of advisors charging this way, while only 3% of advisors charge commissions. That said, only 17% of advisors rely solely on the asset-based fee structure, with most offering it along with other fee structures. For instance, nearly 45% offer a fixed fee, 36% offer a performance-based fee, and nearly 30% offer an hourly fee.

Investment Adviser Association

The past two decades have seen the most growth in performance-based fees, which grew 16% over that time, followed by fixed fees, which grew by 12% over that time, the IAA found. Commission-based structures fell by 8.3% during that time. There was also a slight drop in the use of subscription-based fees over that period, surprising given that structure’s growing popularity. Only 1% of advisors charge that way.

“I was surprised that more advisors were not charging subscription fees, but I think we’ll see a move toward more subscription fees in the future,” Barr said.