Mergers and acquisitions activity in the registered investment advisor space has already surpassed 2020 volume in the first three quarters of this year, according to DeVoe & Company’s third quarter 2021 RIA Deal Book. That record pace was driven by large sellers and repeat buyers, said David DeVoe, founder and CEO of the consulting firm.

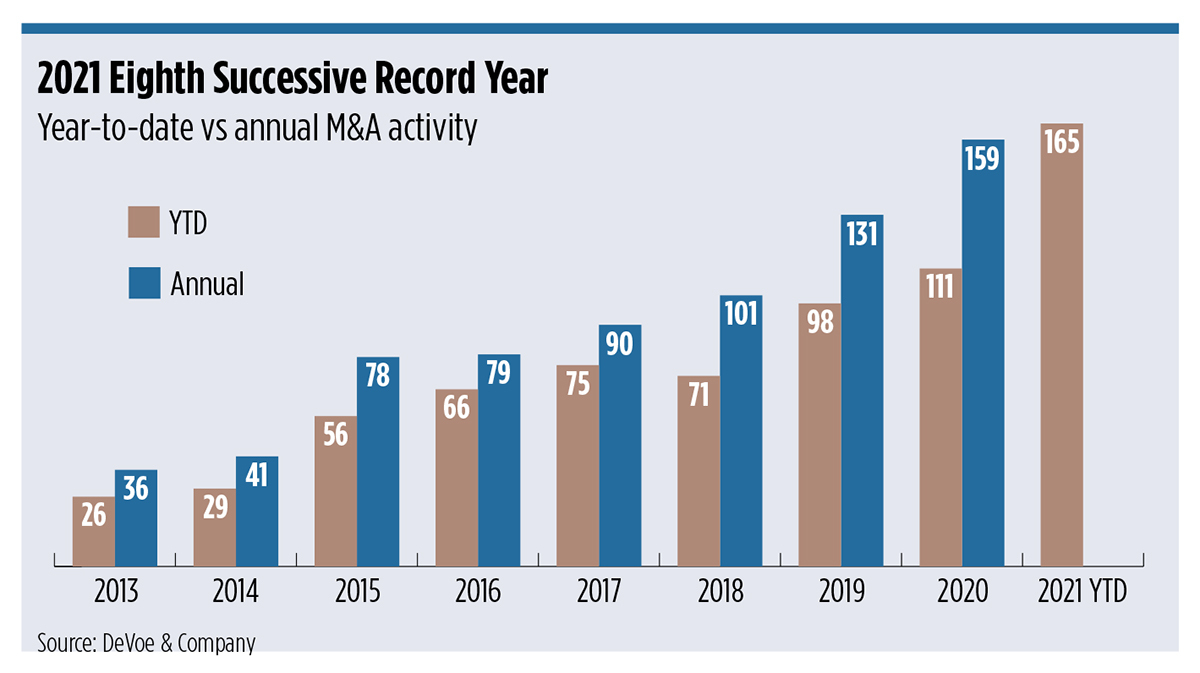

The industry saw 165 RIA transactions during the first three quarters of 2021, up from 2020’s annual record of 159 transactions set last year, making 2021 the eighth successive year of record RIA M&A activity. There were 64 total deals during the third quarter, a new quarterly record.

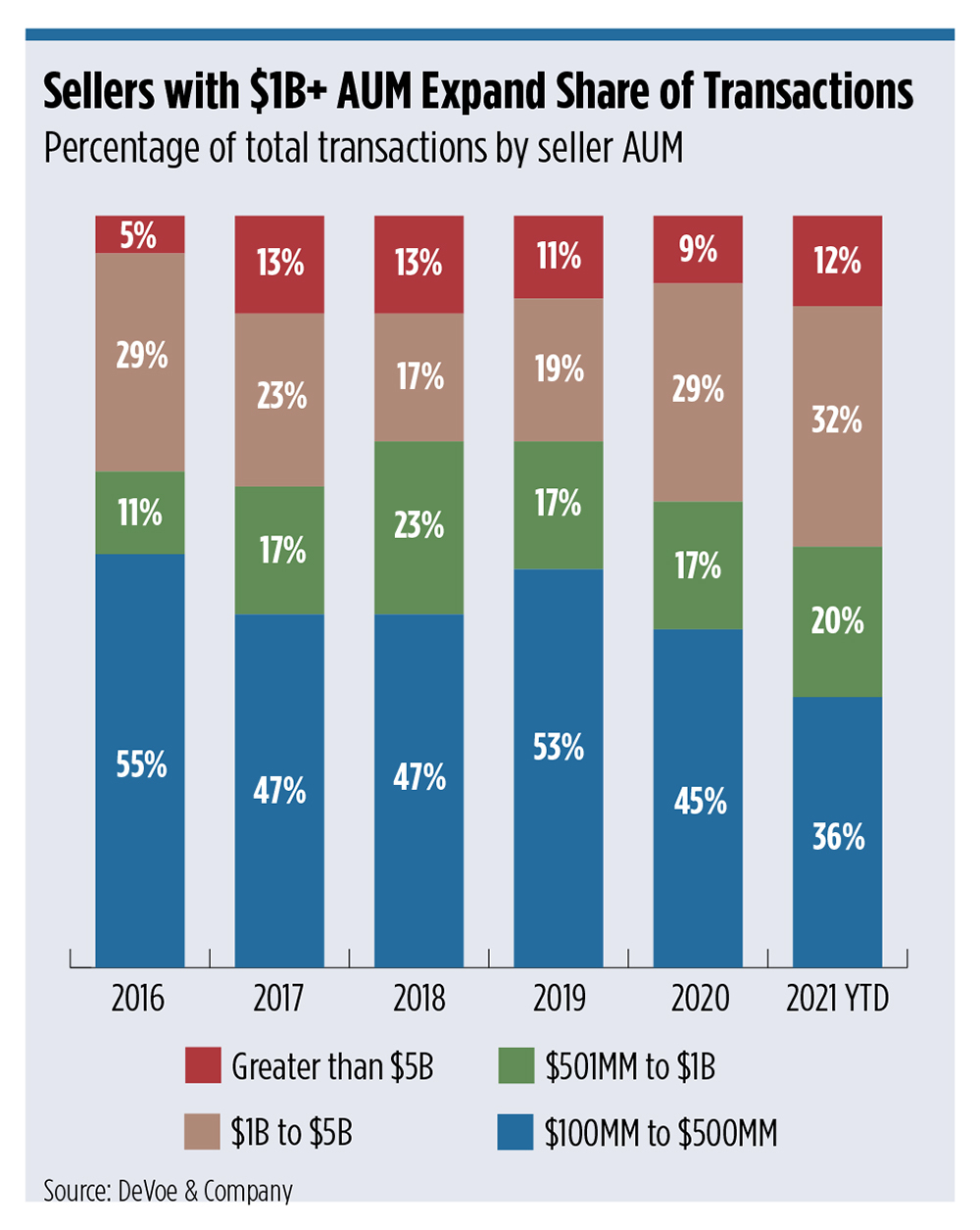

DeVoe said over half of those deals involved selling firms with $1 billion or more in assets under management, up from the historic average of 30%. The average AUM of sellers for transactions greater than $100 million and less than $5 billion increased to $1.18 billion, a record high, up from about $1 billion in 2020.

“Bigger firms have a greater propensity to sell today than they did, say, five years ago,” DeVoe said. “You could say it takes about the same amount of time and energy to do a $200 million versus a $2 billion deal, yet you increase your assets and revenue and profitability 10x.”

Take Captrust Financial Advisors’ acquisition this week of Covenant Family Offices, a Texas and Oklahoma-based RIA with $2.6 billion in assets, as an example.

“Captrust, Mercer, Wealth Enhancement Group, Hightower—all these firms used to focus to a degree on the $500 million or less [in AUM firms], and they’ve all continued to move upstream,” DeVoe said. “We’re starting to see some ‘blue ocean’ in the $100 million to $500 million space.”

Sellers with $5 billion or more in AUM are becoming unusually active, with 11 of these transactions during the quarter and 20 year-to-date, DeVoe added. That activity is driven by private equity firms and their interest in the RIA market.

“You have what historically has been called ‘smart money’ voting with a pocketbook, and oftentimes they either acquired firms that can now absorb multi-billion-dollar organizations, or they’re continuing to invest in large properties with the intention of growing those organizations,” DeVoe said.

Further, more M&A deals are involving minority investments, with those accounting for 16% of the transactions during the quarter, up from less than 1% in 2019, according to DeVoe’s report.

“In many situations, it supports the ability of next-gen advisors to buy into the firm,” DeVoe’s report reads. “In a growing number of cases, the economic value of RIAs is exceeding the grasp of the next generation. The gap can potentially be closed with the participation of a minority investor. But most often, selling firms typically take on minority investors to support an inorganic growth strategy. Most commonly, these are larger RIAs receiving capital from private equity firms.”

Despite the record M&A activity, DeVoe said deal volumes should be much higher.

“This industry should be seeing well over 300 transactions per year, and each year that doesn’t occur, there’s just a growing supply of sellers that are going to need to come on the market at some point,” DeVoe said. “Hopefully it’s a nice, methodical, accelerated progression.”

According to DeVoe, the market has been in a healthy environment for M&A, where the increase in sellers has been met with an increase in buyers and buyer capacity. But things could get ugly if there’s a disconnect between the two, DeVoe warns.

“If we had a given year, let’s say 2022, when we have two or three times the number of sellers, the buyers just couldn’t absorb them all. There’s capacity constraints amongst the buyer pool. If we have a big uptick, that does create a dis-equilibrium, and we would see some unhealthiness,” DeVoe said. “We’d see valuations potentially compress; we’d see some sellers that couldn’t find a buyer or couldn’t find a buyer that’s a good fit.”

There’s been a lot of talk over the last several years about how there are 50 buyers for every seller in the marketplace, but DeVoe says that is simply untrue.

“As a matter of fact, over the last five years, we’ve seen the number of sellers in a given year double, where the number of buyers has only increased 40%,” he said.