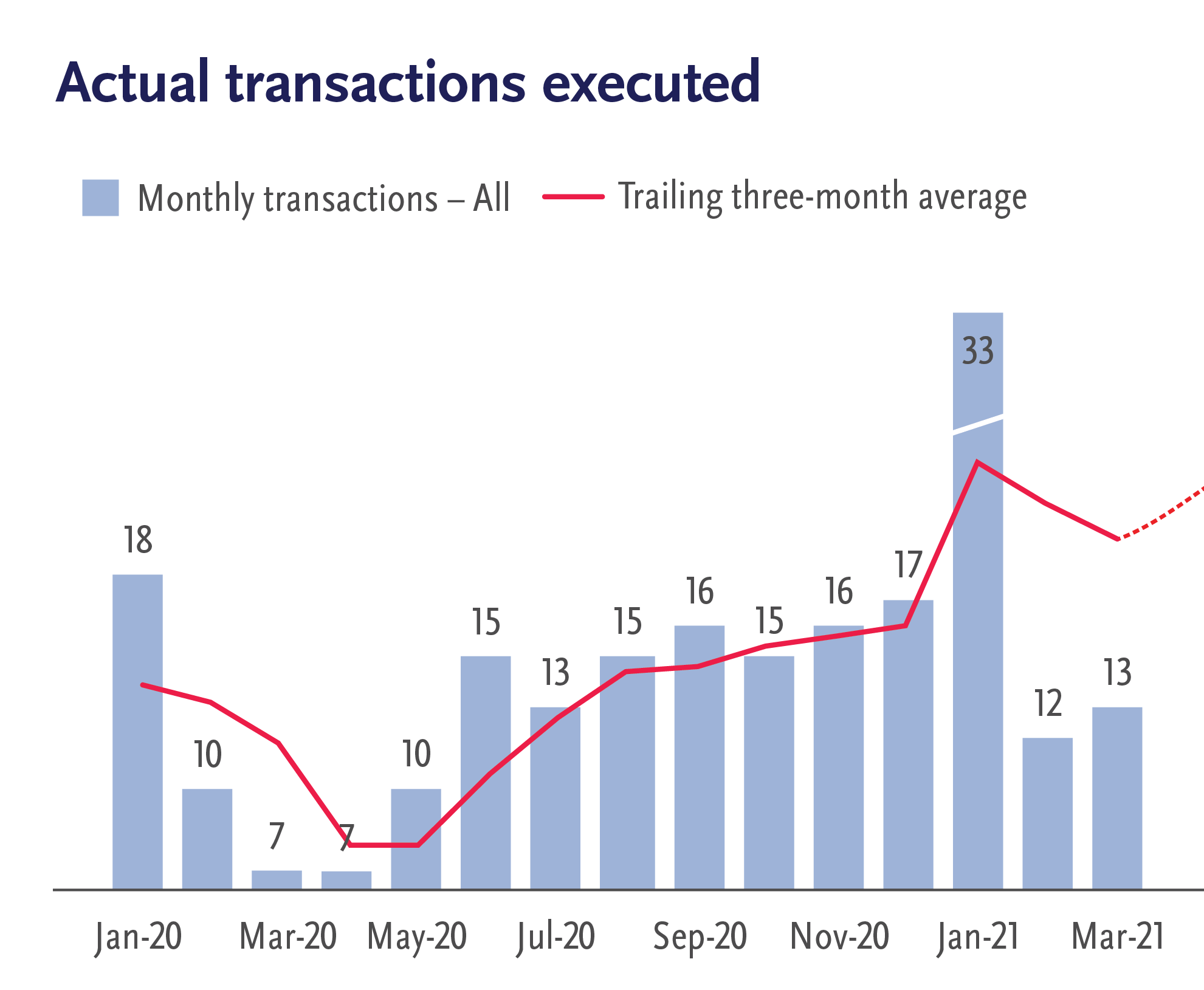

RIA merger-and-acquisition activity continued at a record pace in the first quarter, with a total 58 deals, up from 48 in the fourth quarter 2020, according to the DeVoe RIA Deal Book. In January alone, deals spiked to 33.

That compares with 35 deals recorded in the first three months of 2020, according to DeVoe & Company, an M&A consulting firm. The first quarter 2021 activity represents a 65% year-over-year uptick in M&A.

A total of $118 billion in assets under management was transacted last quarter. The average AUM of the sellers was $1.03 billion—up slightly from 2020 but getting close to the highest average of $1.06 billion, which was set in 2016.

The biggest deals last quarter included CI Financial’s acquisition of Chicago-based Segall Bryant & Hamill, an RIA with $23 billion in AUM. Hightower purchased Bel Air Investment Advisors, an $8 billion in AUM RIA located in Los Angeles. Last, DeVoe & Company counted Silicon Valley Bank’s agreement to buy Boston Private for $900 million, even though there’s an ongoing battle between Boston Private and its shareholder HoldCo over the sale price.

But the lion’s share of transactions occurred among midsize sellers who were looking to scale quickly. These sellers were the primary driver of the extended surge started in 2020. Sellers with AUM over $1 billion represented 39% of the deals, while those with $751 million to $1 billion had doubled their activity from 6% in 2020 to 12% last quarter. The group with $501 million to $750 million ticked up from 11% to 14% over that period.

DeVoe & Company expects midsize firms to make up a significant portion of sellers in the next several quarters. Activity among the smaller firms, those with $251 million to $500 million in client assets, slowed down. That cohort was 27% of transactions in 2019 and has gradually fallen to 12%.

While more sellers entered the market, nearly doubling in numbers from 79 in 2016 to 159 in 2020, the quantity of buyers has slightly increased from 61 in 2016 to 85 in 2020. Many observers have said the ratio of buyers to sellers is something like 50-to-1, but DeVoe argues it’s more like one buyer for every two sellers, making it a great time to be a buyer.

“By many metrics, there has never been a better time to be a buyer of RIAs,” the report said.

“At no point in history have RIA principals been so willing to sell their firms. The record number of external sales represents empirical evidence and should be music to any aspirational buyer’s ears. Similarly, the openness among principals to meet with buyers and explore the concept of selling their firm has never been so high.”

Buyers who were RIAs and consolidators accounted for the most deals. Consolidators, including Mercer Advisors, Focus Financial, Captrust and Wealth Enhancement Group, made up 40% of the transactions. RIAs accounted for 38%, rising slightly from 34% in the fourth quarter 2020. Non-RIAs, such as private equity firms and asset managers, made up 21% of transactions. Banks represented just 2% of transactions.

Despite setting a new record, the first quarter also showed a reduction in the rate of transactions. The first month brought in 33 transactions, which set a new record for January. But in February, the number of transactions dropped to 12, and March saw only 13 deals.

“The engine was out of gas after eight straight months of redlining to get as many deals in before the tax filing deadline,” the report said.

Last year, DeVoe & Company founder and CEO David DeVoe predicted that there would be a flurry of activity until the end of the first quarter. But the consulting firm is also anticipating another yet more stable rise in activity—the fourth phase of its post-COVID RIA M&A forecast where the industry returns to normal, or a “new normal.”