Nearly 600 advisors attended XYPN’s annual conference in St. Louis this week, attesting to the growth of the advisor support group. Founders Michael Kitces and Alan Moore said they are reaping the rewards of practicing what they preach: finding a niche and sticking with it.

“We tell [our member advisors] to find a niche and focus. We found a niche and focus,” said Kitces. XYPN’s “hyper-specific” style of advisors is growing: “We're now averaging more than 50 new advisors a month joining the network and we don't pay recruiting bonuses,” he said. If the current growth rate continues, he expects to have more than 2,000 members in the organization in three years.

“The closest competitor to us is really an independent broker-dealer,” explained Moore. “The difference is: we can't and don't tell our advisors what to do. We don't say, ‘This is the only platform, this is the only CRM or here's the two that you can use.’ Our advisors are really free to pick and choose what they want. It allows them to really sort of build their own membership model and really build out what they want to use of ours without any restrictions.”

“If you take an independent broker-dealer and you strip out FINRA, if you strip out the products and the distribution, the crap from that—what you're left with is an advisor support network,” added Moore.

But the rapid growth of the network has produced its problems, too. “We made a lot of mistakes and decisions, early on, that hurt us in the long run,” said Moore. Operationally, the network tended to choose the wrong technology platform in its infancy, not anticipating the growth of the firm.

The rapid growth in XYPN’s ranks, and the bumps along the way, led Moore to caution advisors who pick their own client niches. “Really figure out what you want the business to be, because if you don't, you'll build the wrong business,” he said. “You'll build a business that you hate.”

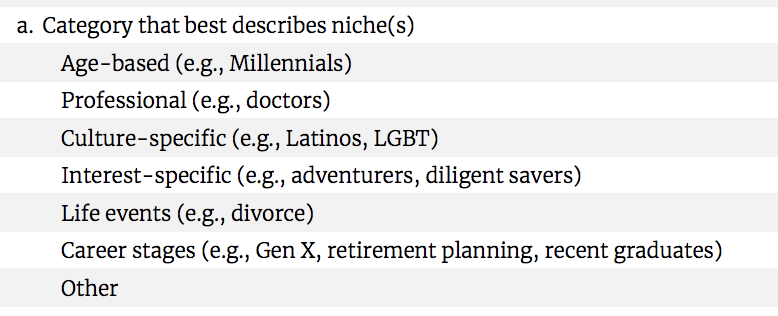

Still, XYPN’s research shows that focusing on a niche that requires some specialization—say, clients who own fast food franchises, medical doctors, or academic professionals, for example—acts as a rapid accelerant to revenue growth.

Benchmarking Update

According to the firm and the results of its XYPN Benchmarking Study, that focused approach of advisors has produced powerful growth and scale. Revenue growth last year for advisors with one to three years of XYPN membership stood at 40.8% for advisors who pursued a niche strategy, compared with 15.5% for those without.

For advisors with more than three years of membership, that difference was even more drastic: Revenue growth was 58.6% for advisors with niches compared with 9.7% for those without.

For advisors new to the network, however, the numbers reverse. Niche advisors with less than one year in XYPN saw revenue growth of just 1.9% last year, compared with growth of 25.0% for advisors without a niche, likely due to the more limited pool of potential clients an advisor will pull from to launch a practice.

Overall, firms in the XYPN benchmarking data grew revenue by an average of 17.8% in 2018.

“A niche strategy gives advisors a clear competitive differentiation that is easy for clients and referral sources to understand,” noted the study. “With a better understanding of the target client, referral sources appear to be referring higher quality prospects.”

Zeroing in on “higher quality prospects” has also produced a more profitable practice over the long run, according to the study. From 2016 to 2018, operating profit margins increased by 11.5 percentage points, from 21.0% to 32.5%. Conversion rates of prospects have also increased over the same time span, from 40% in 2016 to 50% in 2018.

At the end of the day, advisors with one year or more of membership in XYPN are paying themselves an average of a little more than $50,000 a year, according to the study. When added to the operating profit of owning one’s own practice, total owner income for that same group of advisors comes to $91,760 in 2018.