Shares of LPL Financial were 1.65 percent higher at Tuesday’s close on reports that the firm is in talks with private equity firms interested in buying the independent broker/dealer. Reuters reported earlier last month that LPL was exploring strategic alternatives and is working with Goldman Sachs to facilitate a sale. Analysts following LPL said that while the Department of Labor’s fiduciary rule could be the catalyst for current shareholders to look to sell LPL, it could equally turn off potential buyers.

T. Rowe's Longtime CIO Saying Goodbye

Brian Rogers, chairman and chief investment officer at T. Rowe Price, will retire after 35 years with the firm, the asset manager announced Tuesday. Rogers spent the last 12 years in his current role. He'll continue on as non-executive chair of the board of directors. As a result, the firm has appointed six executives to take his place and serve as CIOs, including Rob Sharps, group CIO; Henry Ellenbogen, CIO of U.S. equity growth; David Giroux, CIO of U.S. equity multi-discipline; John Linehan, CIO of U.S. equity value; Justin Thomson, CIO of international equity; and Mark Vaselkiv, CIO of fixed income. “[Brian’s] reminders to stay the course during extended periods of market volatility and economic turmoil reflected his patience as an investor and his belief in the resilience of the markets and in capitalism itself,” said Anne Marie Whittemore, lead independent director, in a statement.

Fidelity Launches Mystery Shopper Program

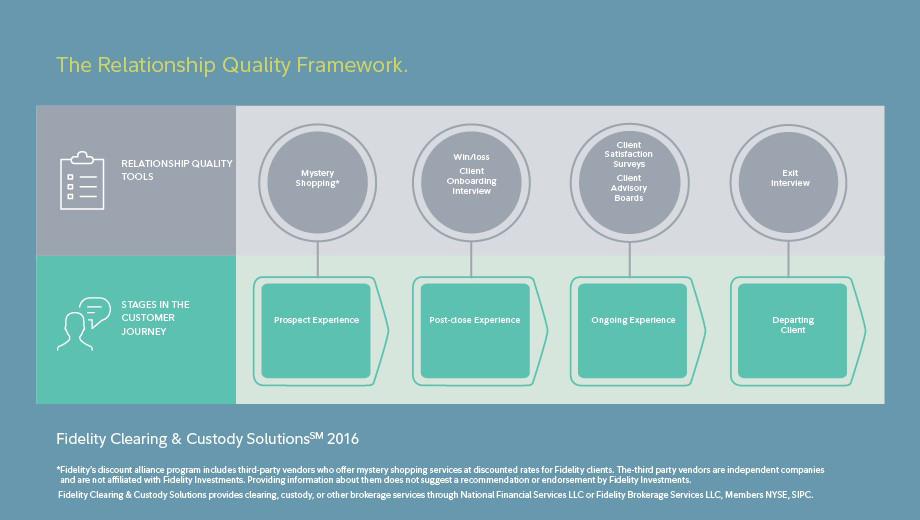

Fidelity wants its advisors to know what their potential clients want. And to find out, it has developed a mystery shopper program. The program, part of Fidelity's Relationship Quality Framework, connects Fidelity advisors with HawkPartners and GfK, who will supply real investors to pose as "shoppers" who meet the firm's client profile. The clients, without revealing their involvement in the program, will then interact with Fidelity advisory firm employees as if they were real prospects, reporting back on what their experience was like. The reason for all this: Cerulli research shows that clients don't care as much about a firm's high-end image or exclusivity; instead they focus on a warm, personable interaction and high-touch services. “You cannot underestimate the power of a first impression. It’s critical for firms to have a good grasp on how prospects feel about them from the first click on their websites or first steps into their offices,” said David Canter, executive vice president, practice management and consulting, Fidelity Clearing & Custody Solutions. “Once in the door, the power of listening to those prospective clients is critical. Investors have many options for financial advice, and advisors need to be keenly aware of how they may ‘fit’ with each prospect. Mystery Shopping can provide that outside perspective to firms so they improve their first interactions with clients—not only for an improved client experience, but also more complete discovery for the firm.”